-

Market attention turns to the taxable sector as some the week’s biggest deals are set to hit the screens.

November 4 -

Taxables in full force once again; yield seekers have Illinois.

November 4 -

New York State's fifth-largest city will sell $152 million of general obligation bonds.

November 1 -

Wisconsin will refund $622 million of taxable 2008 bonds in a sale that sheds swaps tied to Libor.

October 22 -

Most of the proceeds will refinance direct placement debt with bonds sold in the public markets.

October 22 -

Spectrum Health System will consolidate its administrative offices into a central location.

October 21 -

Taxable bonds will replace interim financing that funded land acquisition for the plant, which may not match the vision that drew state and local subsidies.

October 21 -

The Idaho audit involved $1.485 million general obligation bonds issued with a taxable direct-pay federal subsidy under the Qualified School Construction Bonds program.

October 18 -

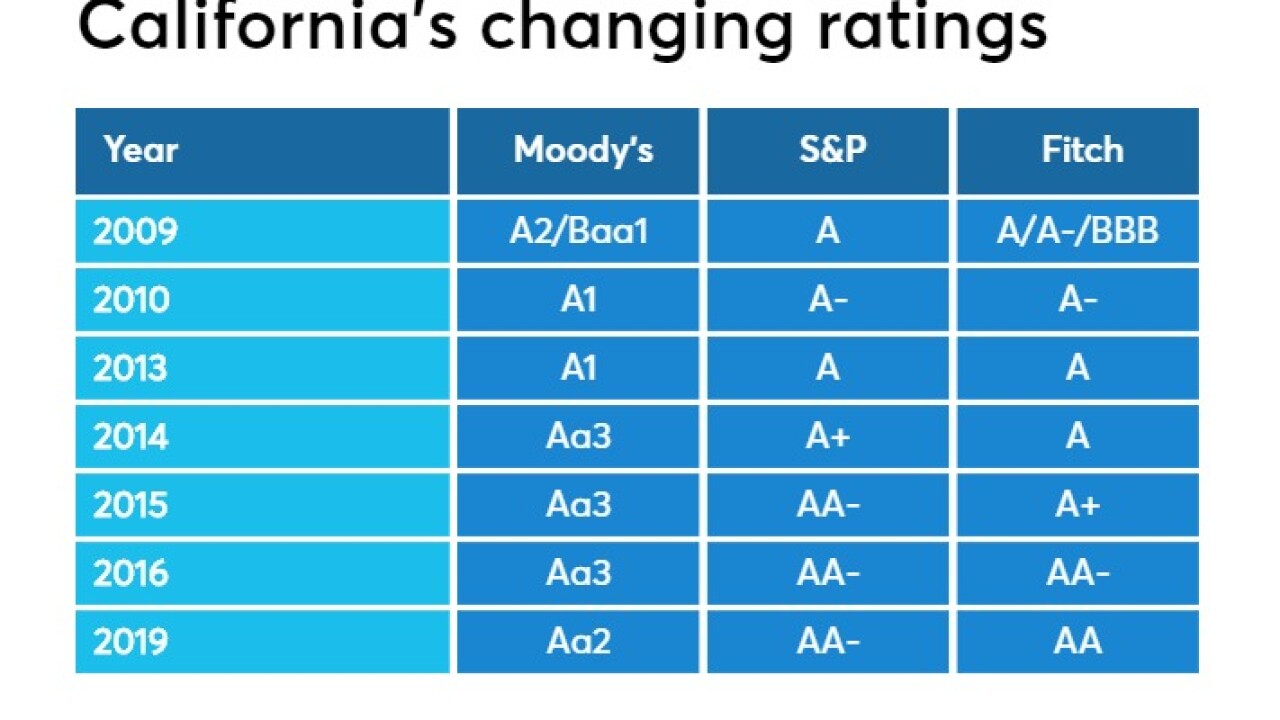

California's largest-ever competitive taxable deal, which followed two upgrades, drew 10 or more bidders for each tranche.

October 17 -

St. Louis-based Ascension Health Alliance will price up to $856 million through the Wisconsin Health and Educational Facilities Authority.

October 11 -

The authority is bringing $950 million of taxable bonds and $1.7 billion of tax-exempts.

October 10 -

Green bonds and taxables dominate the Massachusetts Water Resources Authority's $620 million sale.

October 9 -

The deal allows the university to shed a master trust indenture and concentrate its debt under the University of Nebraska Facilities Corp.

October 8 -

Most of the deal from Connecticut's largest city will be taxable, with the lion's share going to a pension fund.

October 8 -

The municipal market continues to flex its muscles even as the U.S. economy seems to be slowing, which could lead to an even flatter yield curve.

October 4 -

Municipal bond volume continues to accelerate, closing out the month of September 39.1% higher and the quarter 17.8% higher than a year earlier, as issuers flocked to market with taxable deals.

September 30 -

Low taxable rates will allow the state to reap 10% present value savings while advance refunding $285 million of tax-exempt GO debt.

September 26 -

Downtown Dallas has seen a revival in recent years with residential conversions and more pedestrian-friendly design paid for with tax-increment financing.

September 23 -

Texas A&M University System will price $430 million of taxable bonds, including $230 million to advance refund tax-exempt debt.

July 22 -

CommonSpirit Health will sell $2.7 billion of taxable bonds and $3.1 billion of tax-exempt debt, with BBB-plus ratings, into a supply-starved market.

July 18