-

Market participants said it is yet to be seen whether issuers will pull back their BABs refundings due to concerns after several bondholders sent a letter to the trustee on a Regents of the University of California deal, saying it was "prohibited" from executing the redemption.

March 11 -

High-yield and taxable munis continue to outperform, supply grows but concentrates in larger deals led by $3 billion of state personal income tax revenue bonds from the Dormitory Authority of the State of New York next week.

March 8 -

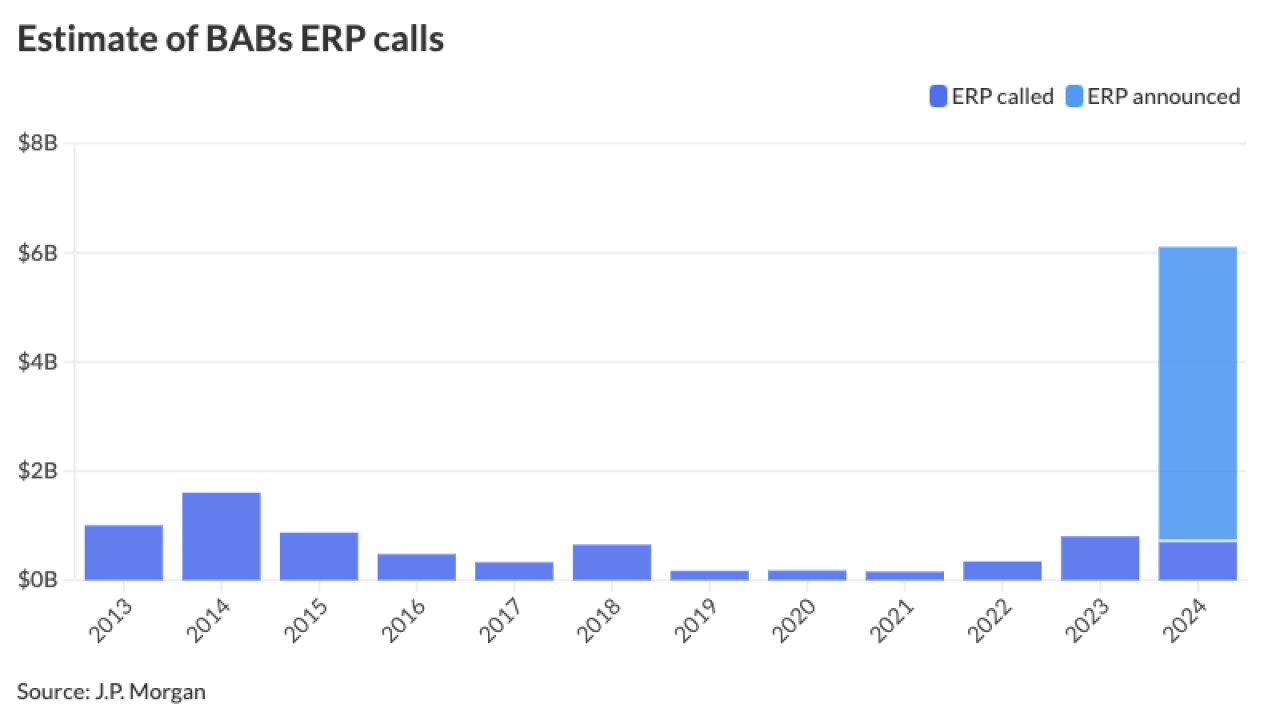

With a recent court ruling and higher interest rates in their favor, more issuers are likely call back their outstanding BABs using the extraordinary redemption provision.

February 26 -

This decision will accelerate foreign buyers' reduced presence in the muni market, said Vikram Rai, head of municipal markets strategy at Wells Fargo.

February 16 -

The Chicago Park District Board of Commissioners unanimously approved three ordinances laying the groundwork for up to $37 million new money bonds and a tender.

February 15 -

Most tax-exempt tenders saw low participation, which is good news to the taxpayers. The poorer the participation in the tender, the less is the waste from these premature refundings prior to the call date.

February 8 Kalotay Advisors LLC

Kalotay Advisors LLC -

The city of Aurora, Illinois, is issuing an upfront loan to developer Penn Entertainment using bonds backed by tax increment financing district revenue.

February 7 -

Growing new-issue supply is "adding to bidders' 'wait-and-see' mentality with a variety of credits coming to market at favorable spreads," said FHN Financial's Kim Olsan. Next week's calendar hits $8.4 billion.

January 19 -

Participants are mixed on whether there will be continued growth in 2024, but some still see a universe of taxable bonds that still can be tendered.

December 28 -

With a high of $450 billion and a low of $330 billion, no firms currently see issuance surpassing the records hit in 2020 and 2021.

December 5