-

Bonds backed by hotel and restaurant bill taxes will pay for upgrades to the home of the Carolina Panthers. The team agreed to commit to the city for 15 more years.

June 27 -

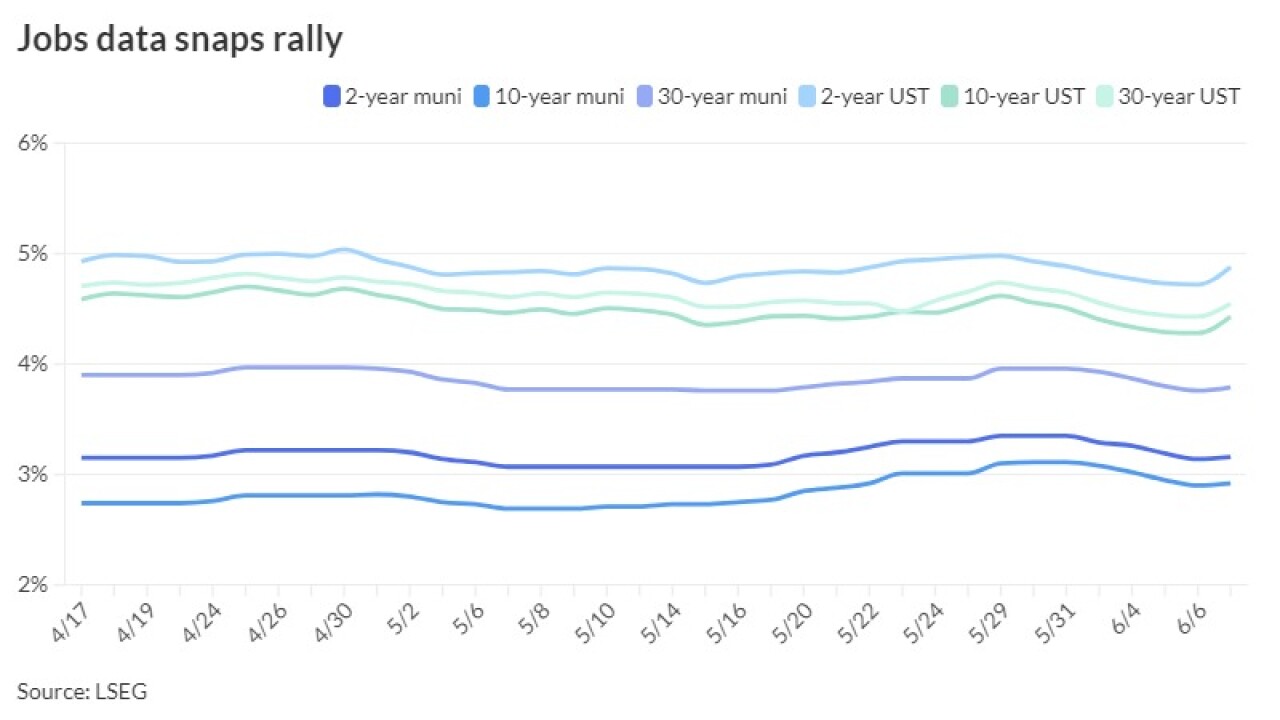

USTs spiked 17 basis points on the short end and 15 to 12 10-years and out following the release, while triple-A curves saw yields rise two to five basis points, depending on the yield curve, in a more muted and typical reaction for the asset class.

June 7 -

A $345 million taxable bond deal will support the public-private partnership arrangement that will upgrade the College Park campus district energy system.

June 7 -

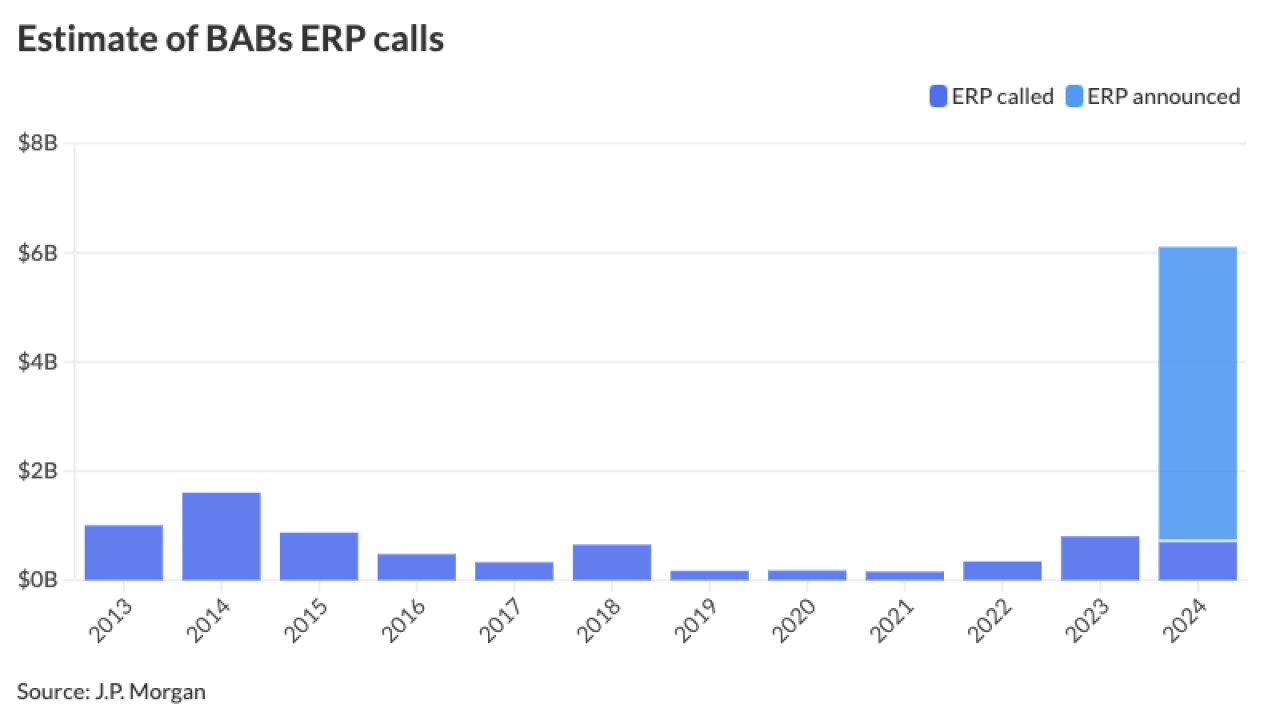

More than two dozen issuers have announced plans to refund their BABs this year, despite objections from investors.

May 22 -

The debt was approved for Greensboro and Raleigh.

May 20 -

The Turnpike Authority of Kentucky expects to sell the bonds on June 6.

May 14 -

Jeffrey Scruggs, Managing Director and Head of Public Sector and Infrastructure Group at Goldman Sachs, sits down with Bond Buyer Executive Editor Lynne Funk on the state of the muni industry.

April 18 -

With a dearth of taxable muni supply and Build America Bond refundings, the university should see strong demand for this week's $500 million taxable corporate CUSIP bonds.

April 2 -

The Washington refunding deal is built on an extraordinary optional redemption of Build America Bonds despite criticism from investors who hold them.

March 22 -

Taxable munis have returned 1.48% month to date and 0.29% year-to-date while investment-grade munis have seen 0.44% returns so far in March and 0.05% year-to-date. USTs are in the black at 1.43% so far this month but returning -1.76% year-to-date while corporate bonds are returning 1.24% in March but -0.46% year-to-date.

March 12 -

Market participants said it is yet to be seen whether issuers will pull back their BABs refundings due to concerns after several bondholders sent a letter to the trustee on a Regents of the University of California deal, saying it was "prohibited" from executing the redemption.

March 11 -

High-yield and taxable munis continue to outperform, supply grows but concentrates in larger deals led by $3 billion of state personal income tax revenue bonds from the Dormitory Authority of the State of New York next week.

March 8 -

With a recent court ruling and higher interest rates in their favor, more issuers are likely call back their outstanding BABs using the extraordinary redemption provision.

February 26 -

This decision will accelerate foreign buyers' reduced presence in the muni market, said Vikram Rai, head of municipal markets strategy at Wells Fargo.

February 16 -

The Chicago Park District Board of Commissioners unanimously approved three ordinances laying the groundwork for up to $37 million new money bonds and a tender.

February 15 -

Most tax-exempt tenders saw low participation, which is good news to the taxpayers. The poorer the participation in the tender, the less is the waste from these premature refundings prior to the call date.

February 8 Kalotay Advisors LLC

Kalotay Advisors LLC -

The city of Aurora, Illinois, is issuing an upfront loan to developer Penn Entertainment using bonds backed by tax increment financing district revenue.

February 7 -

Growing new-issue supply is "adding to bidders' 'wait-and-see' mentality with a variety of credits coming to market at favorable spreads," said FHN Financial's Kim Olsan. Next week's calendar hits $8.4 billion.

January 19 -

Participants are mixed on whether there will be continued growth in 2024, but some still see a universe of taxable bonds that still can be tendered.

December 28 -

With a high of $450 billion and a low of $330 billion, no firms currently see issuance surpassing the records hit in 2020 and 2021.

December 5