-

Oklahoma saw its economy steadily slowing through 2019, according to Treasurer Randy McDaniel.

January 9 -

Texas closed out a record year of sales tax collections with a strong kick in December, state Comptroller Glenn Hegar said.

January 6 -

With a new Texas Rangers venue opening in March, the city of Arlington, Texas, plans to add an adjacent hotel and convention center.

January 6 -

The Winona County Board of Commissioners approved the county's 2020 property tax levy Friday, though not without some disagreement about the increase.

December 24 -

Another round of tax legislation is not expected to emerge until the very end of the year after the presidential election or in 2021 after a new Congress is sworn in.

December 24 -

The legislation, which would make tax-exempt municipal bonds more attractive for high-income income retail customers, has no chance of becoming law.

December 19 -

Reports of a trade deal and an election that seems to cement Brexit don’t remove the uncertainties the Federal Reserve has been worrying about.

December 13 -

The additional revenue from permanently increasing the top individual tax rate to 39.6% from the current 37% would help pay for a temporary two-year suspension of the SALT cap.

December 11 -

For the fourth time since 1993, Oklahoma City voters have approved a 1-cent tax to build projects without the use of bonds.

December 11 -

John Hicks has left his position as executive director of NASBO to become Kentucky's budget director.

December 10 -

The Metropolitan Nashville Airport Authority prices $807.7 million in subordinate bonds Thursday for the capital plan.

December 4 -

The $10,000 limit on the SALT deduction caused an estimated 10.88 million individual taxpayers to lose $323.1 billion in tax deductions for the 2018 tax year.

December 3 -

Proposition CC, which would have repealed the revenue cap built into Colorado's Taxpayer Bill of Rights, promised to help fund three of the state's most notably underfunded buckets: K-12 education, higher education and transportation infrastructure.

November 22 -

Most observers were skeptical, even as markets rallied after President Trump said a trade deal with China is close.

November 22 -

Richard Taormina, head of Tax Aware Strategies at JPMorgan Asset Management, talks about the value of municipal bonds and focuses on performance, foreign demand and the effect of the tax reform legislation on the market. Chip Barnett hosts this podcast, which was recorded in early October.

November 21 -

Next week's $500 million taxable revenue bond deal is backed by a 1% surcharge on annual incomes higher than $1 million.

November 14 -

The Chicago Civic Federation supports the proposed budget despite worries

November 13 -

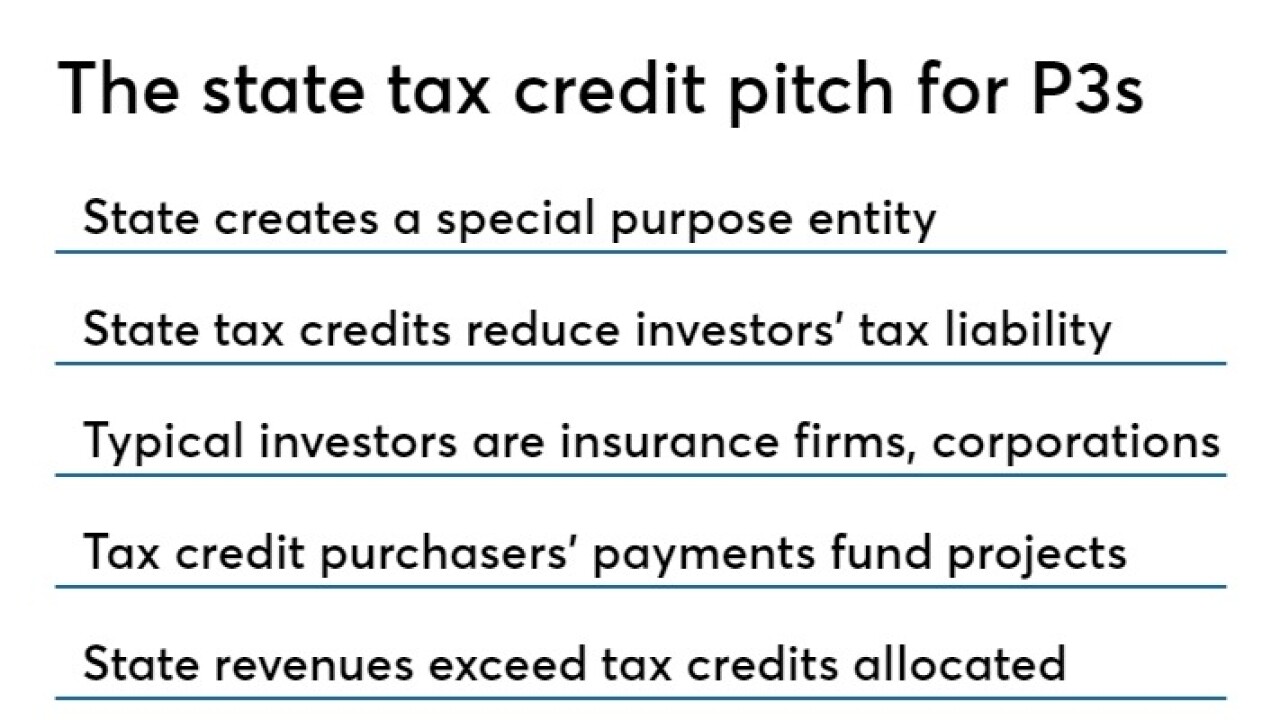

NDH founder Scott Haber told Louisiana officials that state tax credits can provide seed funding for public-private partnership projects.

November 13 -

Gov. Brian Kemp asked state agencies to reduce spending by 4% in the current budget and by 6% in fiscal 2021.

November 11 -

The port saw a 19.1% year-over-year drop in port container traffic in October amid the trade war with China.

November 8