-

"If the narrative takes hold that the Fed is behind the eight ball and will need to cut rates several times in the coming months to catch up to the realities of a weaker economy, we expect muni yields will drift lower alongside treasuries," Birch Creek strategists said.

August 4 -

Municipal yields fell four to seven basis points, depending on the curve, while UST yields rallied nine to 30 basis points, with the largest gains on the front end.

August 1 -

Tax-exempt munis have underperformed year-to-date, said David Hammer, a managing director and portfolio manager at PIMCO.

July 31 -

The FOMC held rates steady at the conclusion of its meeting Wednesday and offered no hints regarding a September move.

July 30 -

The muni market has "cheapened and steepened," which is a great opportunity for people still on the sidelines to get into the market again, said Jennifer Johnston, director of municipal bonds research at Franklin Templeton.

July 29 -

The asset class got a "much-needed boost" from inflows into muni mutual funds last week, said Birch Creek strategists.

July 28 -

Issuance for the week of July 28 is estimated at $11.035 billion, with $9.018 billion of negotiated deals and $2.017 billion of competitive deals on tap, according to LSEG.

July 25 -

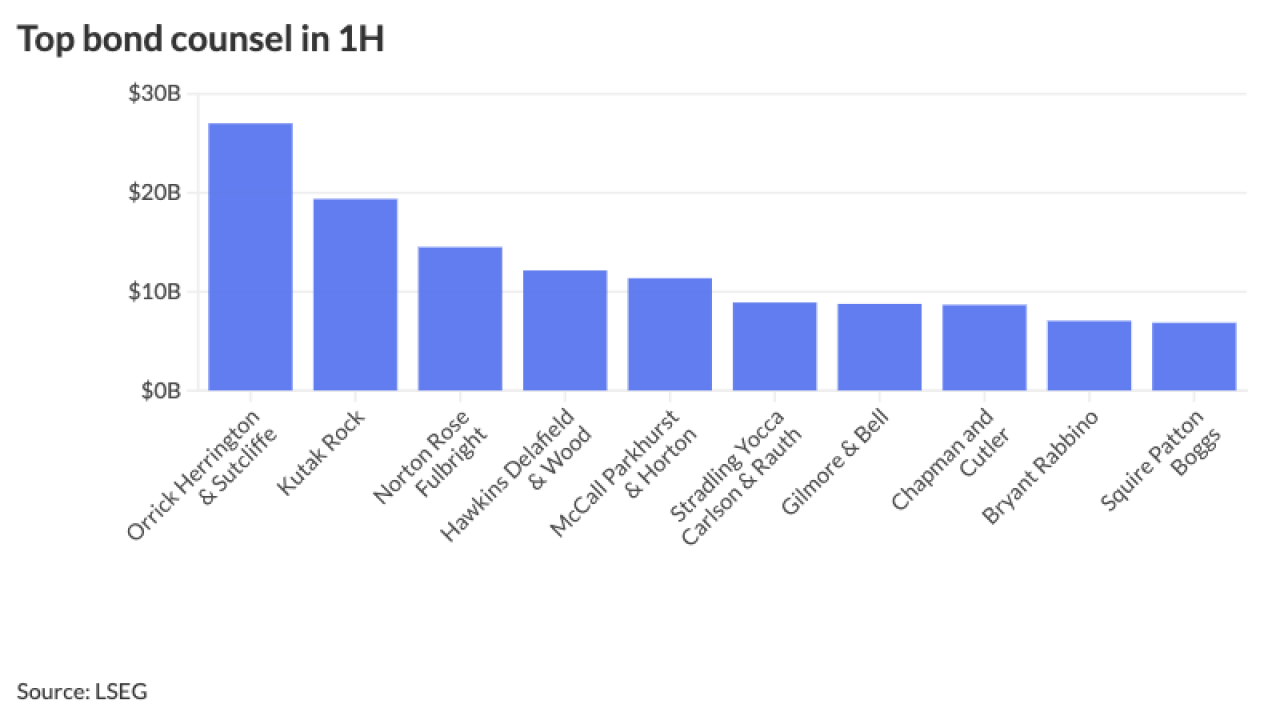

The top five featured in the ranking handled deals totalling more than $84 billion in par value.

July 25 -

Investors added $571.5 million from municipal bond mutual funds in the week ended Wednesday, following $224.6 million of outflows the prior week, according to LSEG Lipper data.

July 24 -

The fund's sell-off in June shows the challenges of accurate pricing in the high-yield muni market.

July 24 -

Larger dealer networks lead to lower markups, but smaller networks show evidence of potential collusion and market manipulation, the paper said.

July 24 -

Longer-term munis have become more attractive, said Cooper Howard, a fixed income strategist at Charles Schwab.

July 23 -

There is a buyer base that is a little bit "skeptical" of longer maturities, but it's more of a retail response, said Adam Congdon, a director at Payden & Rygel.

July 22 -

While the cost of small trades is higher than institutional trades across all fixed-income markets, the gap is more pronounced in the municipal bond market.

July 22 -

The primary market saw "decent subscriptions" last week, but the entire primary calendar came at "healthy concessions to where evals had been marked on existing bonds," Birch Creek strategists said.

July 21 -

First Southern LLC failed to timely and accurately report on trades executed for an affiliated hedge fund, FINRA said.

July 21 -

The week was a long-awaited reckoning with record supply, said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

July 18 -

Munis are "under pressure as elevated primary supply collides with lackluster seasonal reinvestment flows, leaving dealers heavy and buyers selective," said James Pruskowski, an investor and market strategist.

July 17 -

As the market continues to contend with the surge in issuance, investors still have a significant amount of cash that can be put to work, said Jeremy Holtz, a portfolio manager at Income Research + Management.

July 16 -

As always, economists had disparate interpretations of the consumer price index, with none expecting a July rate cut. And tariff questions remain unanswered.

July 15