Want unlimited access to top ideas and insights?

In the first half of the year, the top 10 bond counsel firms accounted for 45% of the industry total of bond counsels.

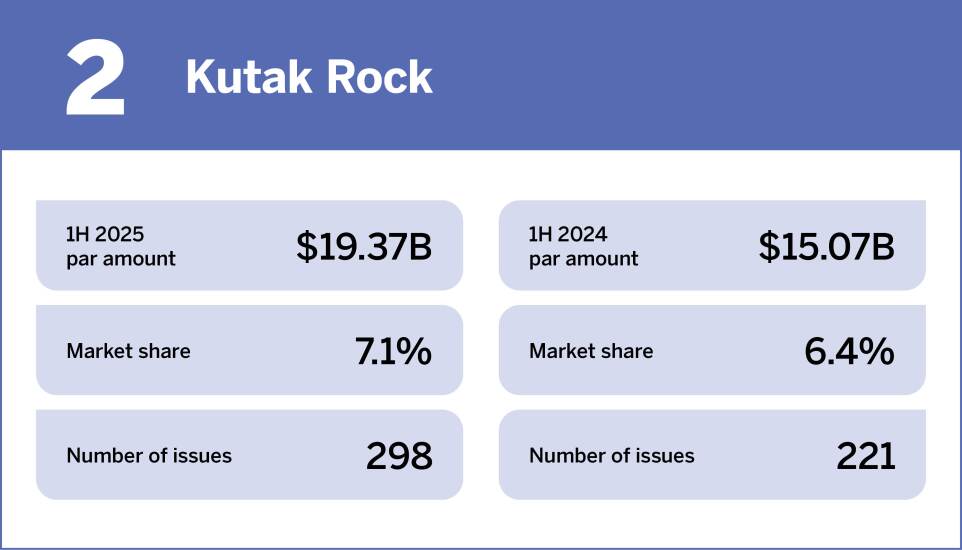

Orrick Herrington & Sutcliffe remained in first as the top bond counsel for the first half of 2025.

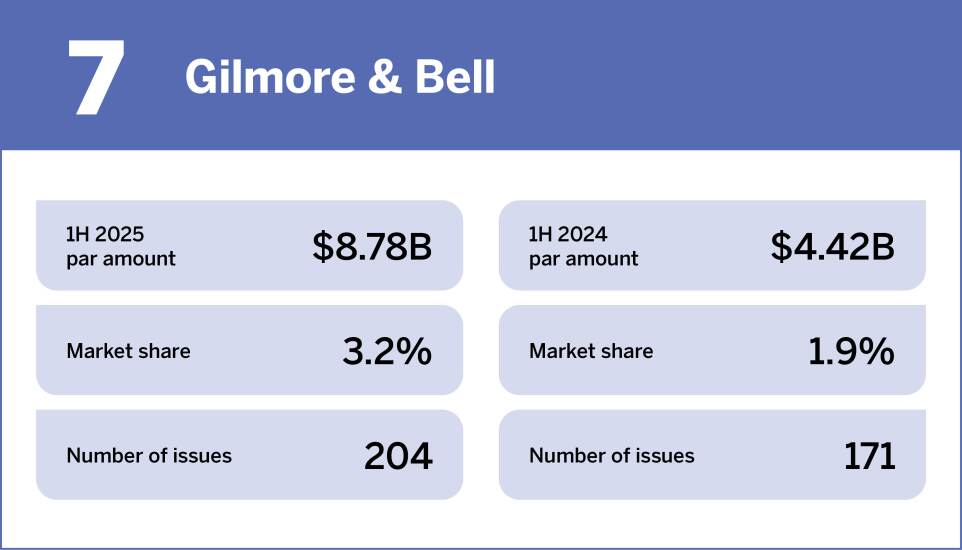

The top 10 saw few changes, with Gilmore & Bell entering the top 10, while Greenberg Traurig was bumped to the top 15.

| Rank | Bond Counsel | 1H 2025 par amount (USD millions) | Market share | Number of issues |

|---|---|---|---|---|

| 1 | Orrick Herrington & Sutcliffe | $27,008.92 | 9.83% | 183 |

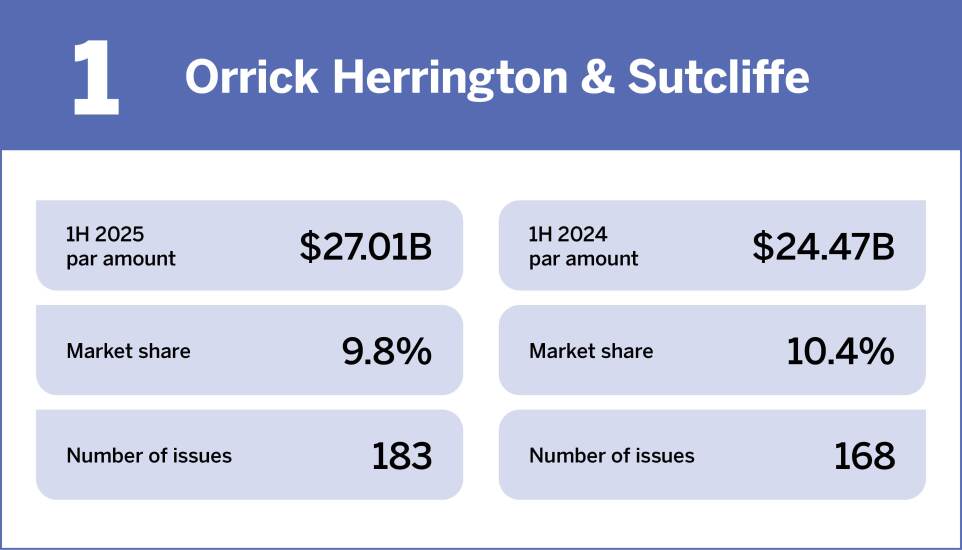

| 2 | Kutak Rock | $19,374.33 | 7.05% | 298 |

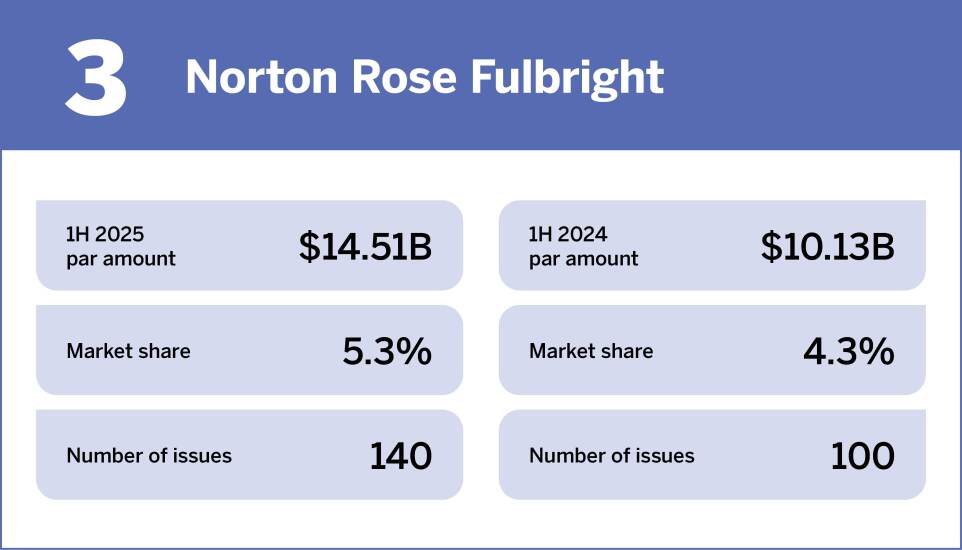

| 3 | Norton Rose Fulbright | $14,513.72 | 5.28% | 140 |

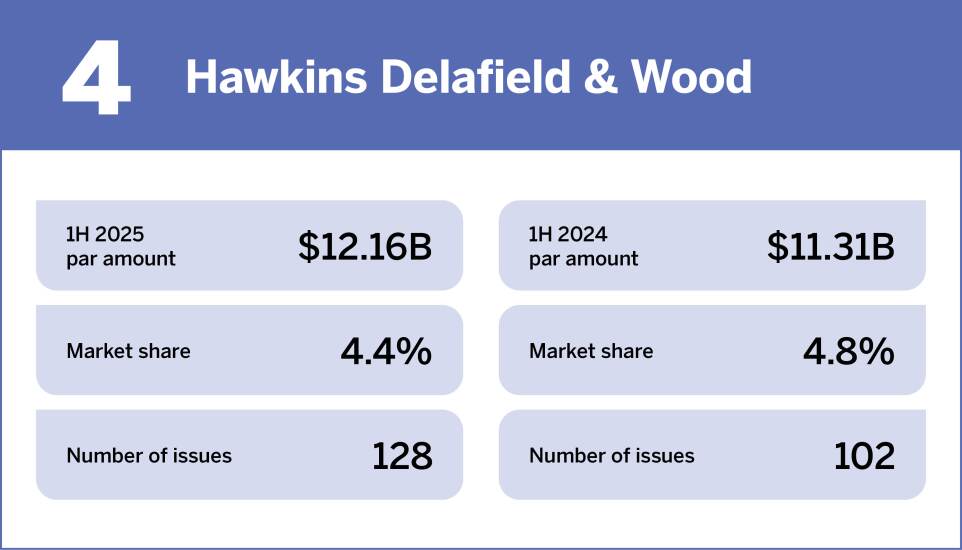

| 4 | Hawkins Delafield & Wood | $12,156.22 | 4.42% | 128 |

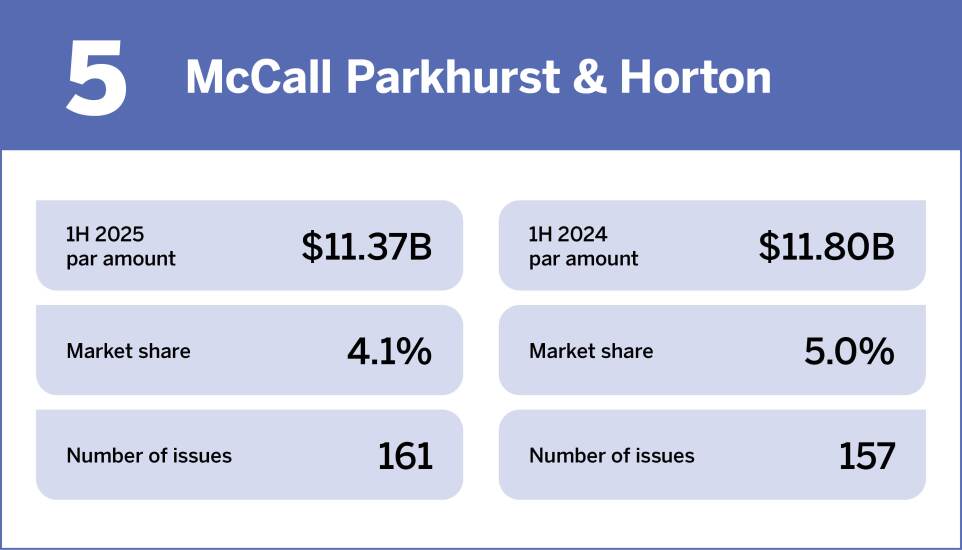

| 5 | McCall Parkhurst & Horton | $11,371.96 | 4.14% | 161 |

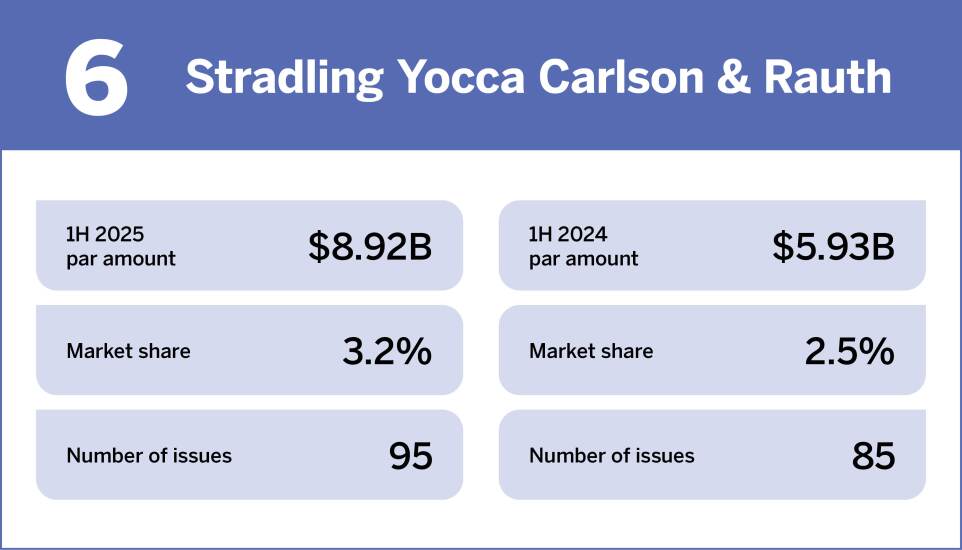

| 6 | Stradling Yocca Carlson & Rauth | $8,916.68 | 3.24% | 95 |

| 7 | Gilmore & Bell | $8,780.09 | 3.19% | 204 |

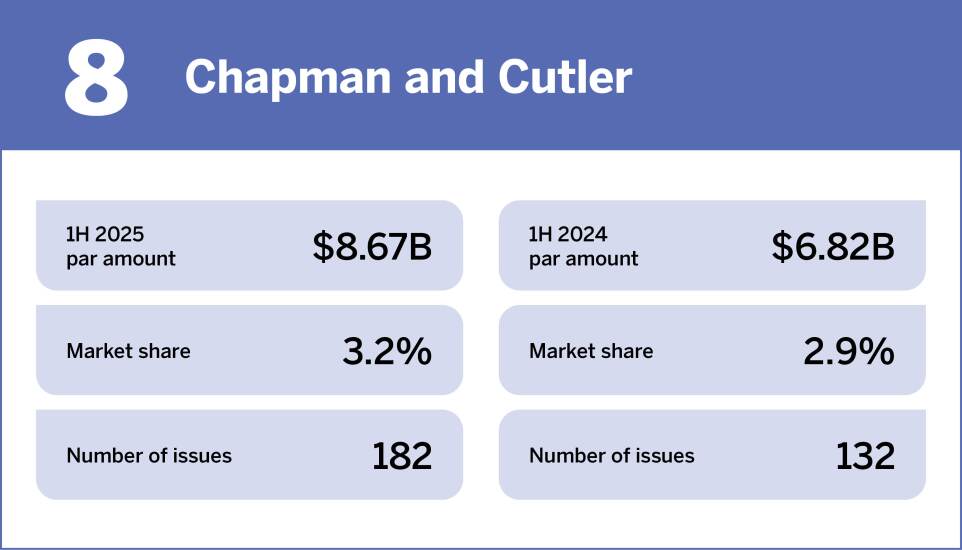

| 8 | Chapman and Cutler | $8,673.84 | 3.16% | 182 |

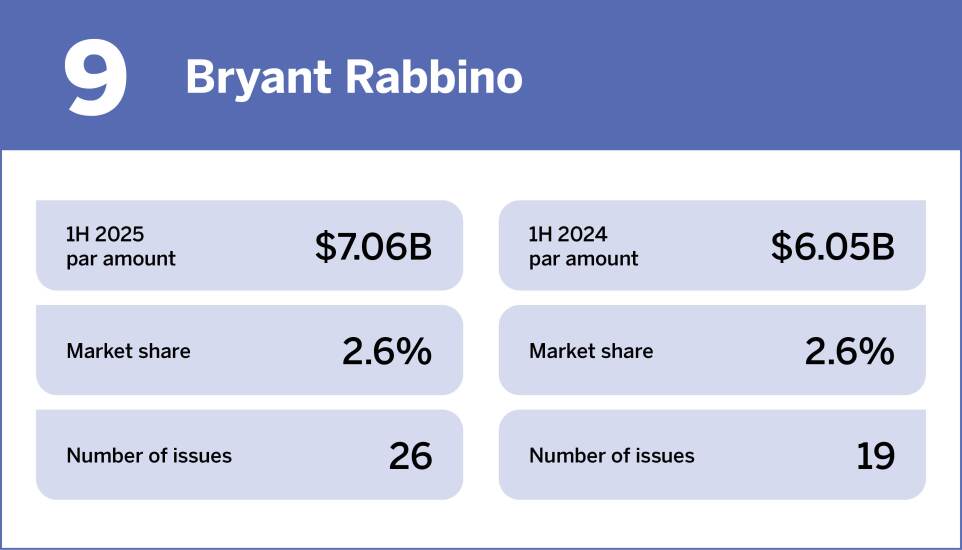

| 9 | Bryant Rabbino | $7,058.01 | 2.57% | 26 |

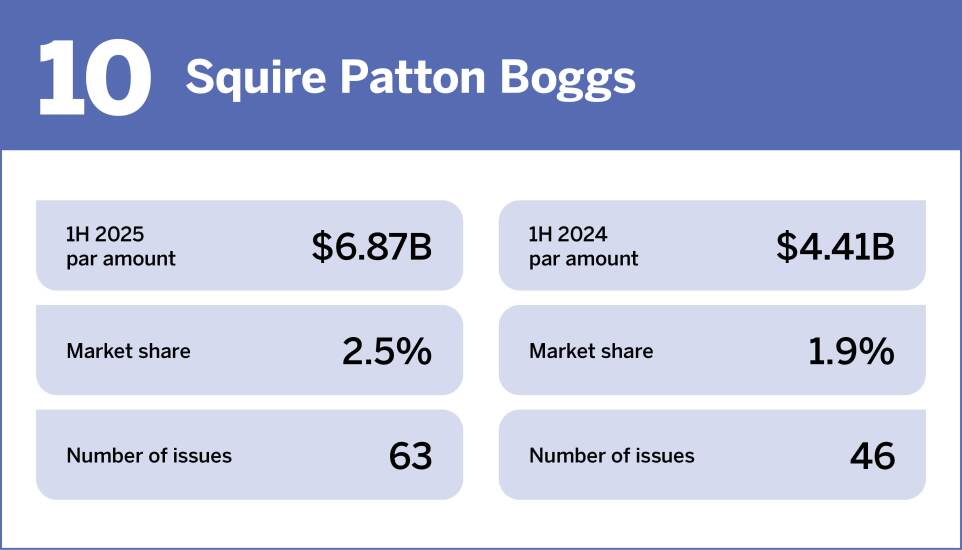

| 10 | Squire Patton Boggs | $6,872.52 | 2.50% | 63 |

-

Over the past five years, January has seen a relatively stable market tone, said Jeff Timlin, managing partner and head of municipal bond investing at Sage Advisory.

January 29 -

Campbellsville University "shares many of the characteristics of schools that are struggling" in higher education, said Lisa Washburn of Municipal Market Analytics.

January 29 -

Market Intelligence analyst Jeff Lipton uses the Federal Reserve's latest Flow of Funds data to show how households still dominate municipal bond ownership even as ETFs surge and banks and insurance companies trim exposure, reshaping muni demand heading into 2026.

January 29 -

The move comes after Janney shuttered its public finance business in December.

January 29 -

The governor, in the final year of his term, asked lawmakers to approve reforms that would fix the Virgin Islands Water and Power Authority's balance sheet.

January 29 -

The Bond Buyer has launched a new AI-powered research experience designed to give subscribers an easy way to access our latest news and research while also offering a deep, comprehensive dive into our archives.

January 29