-

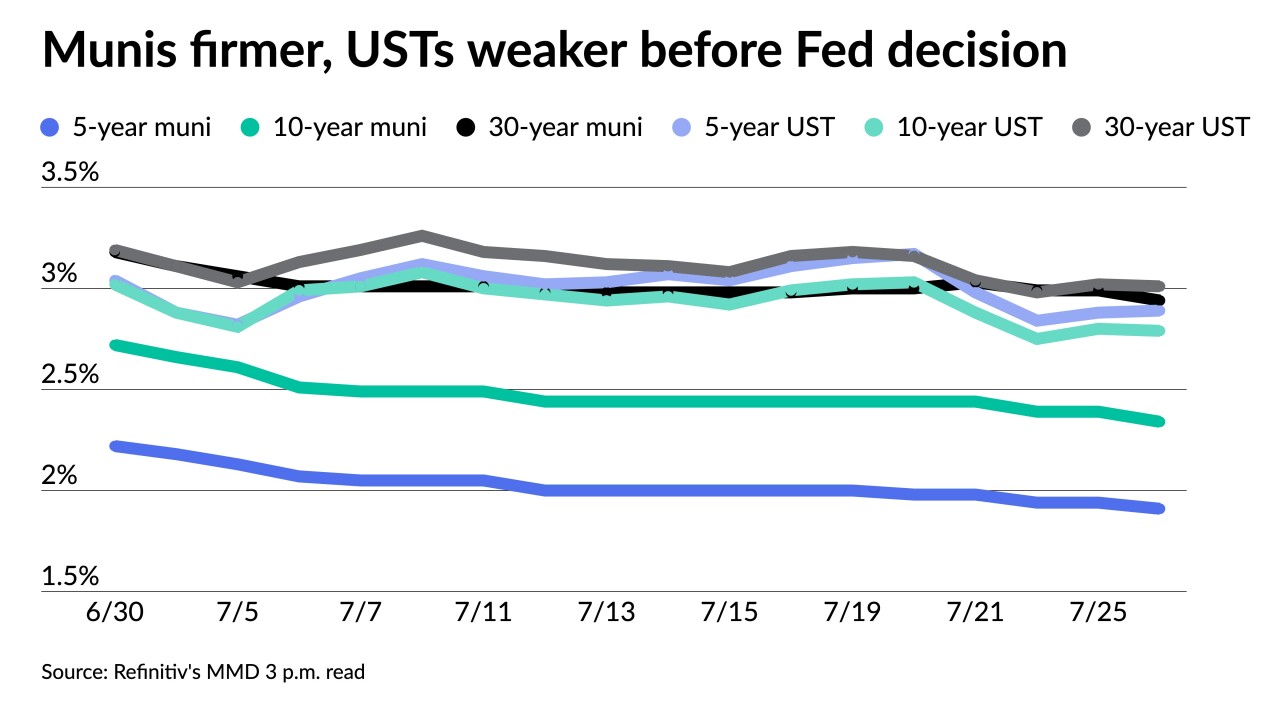

Investors sit on the sidelines, waiting to see how much the Fed will hike rates. The consensus appears to be another 75 basis point rate hike, though a full point hike could be on the table.

July 26 -

With the Fed rate decision coming this week, issuers are sitting on the sidelines in both primary and secondary Monday with little changed yield curves.

July 25 -

Munis were firmer to end the week but underperformed U.S. Treasuries.

July 22 -

As passengers return and revenues climb toward pre-pandemic norms, the Port Authority of New York and New Jersey has billions of capital construction on tap at the region's largest airports.

July 22 -

The bank in recent months shuttered its muni proprietary trading unit — which used the firm’s own cash to trade and invest — as part of a push to focus on providing more of its balance sheet to larger, institutional clients, according to people familiar with the matter.

July 22 -

Investors pulled $698.782 million out of municipal bond mutual funds, per Refinitiv Lipper data, versus the $206.127 million of inflows the week prior. High-yield saw small inflows.

July 21 -

The Investment Company Institute reported investors added $543 million to muni bond mutual funds in the week ending July 13 compared to the $1.061 billion of outflows in the previous week.

July 20 -

Looking forward, a myriad of factors, including spiking fuel prices, fallout from the Russian invasion of Ukraine and the heat wave, “will facilitate recessionary(ish) economic outcomes by year end," noted an MMA report.

July 19 -

Issuers come to market more often and with larger deals when muni bond funds are enjoying inflows, a new paper contends. But not all market participants agree.

July 19 -

Munis are improving, but positive second-half municipal returns likely won’t be enough to offset the major losses of the first half of the year.

July 18