-

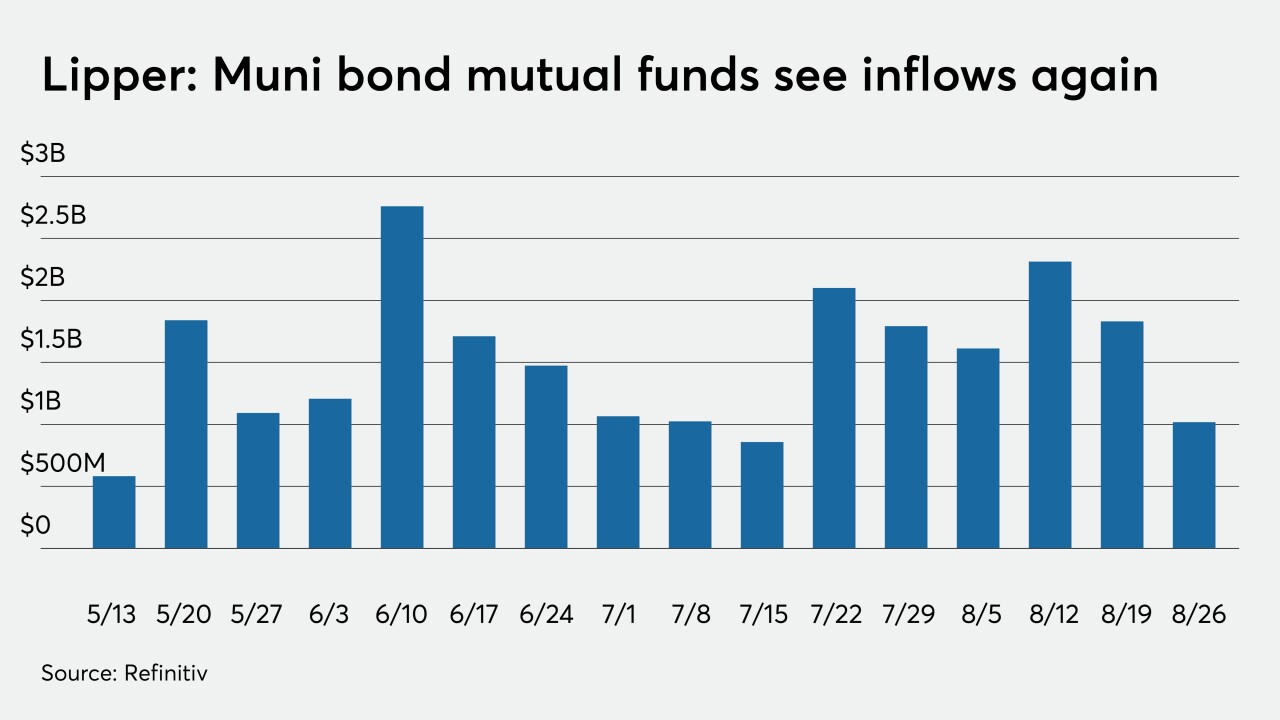

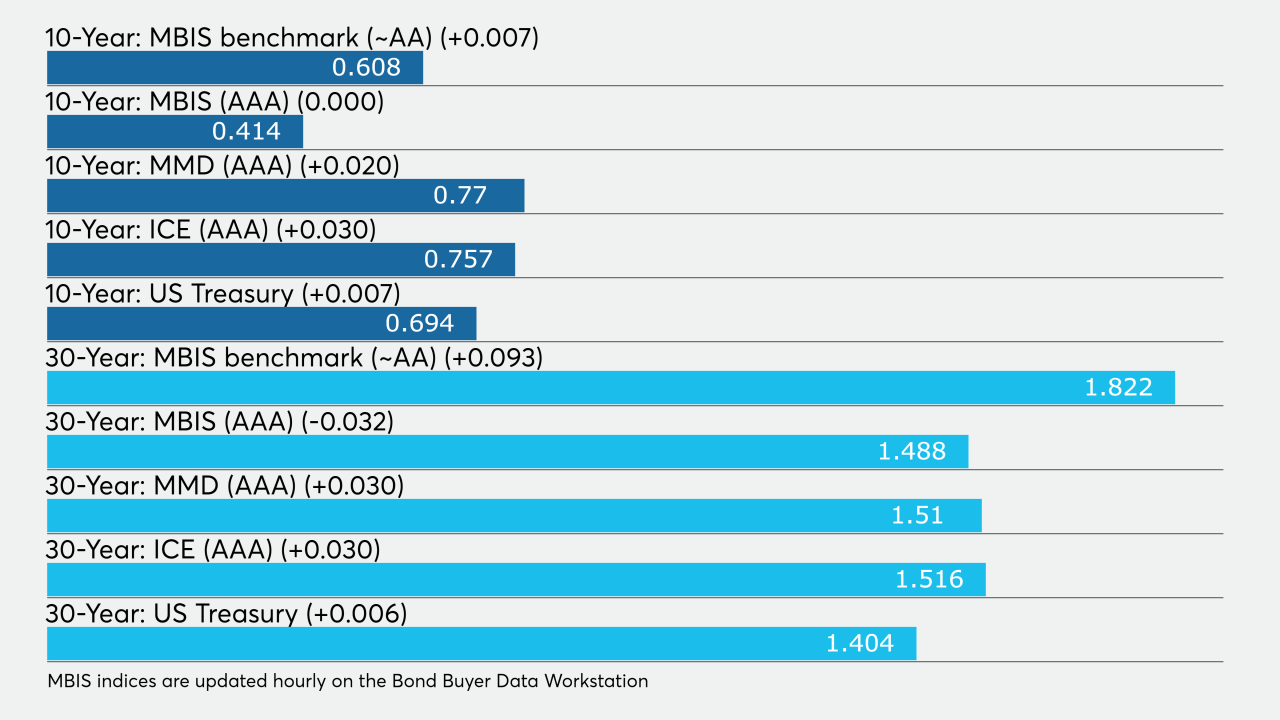

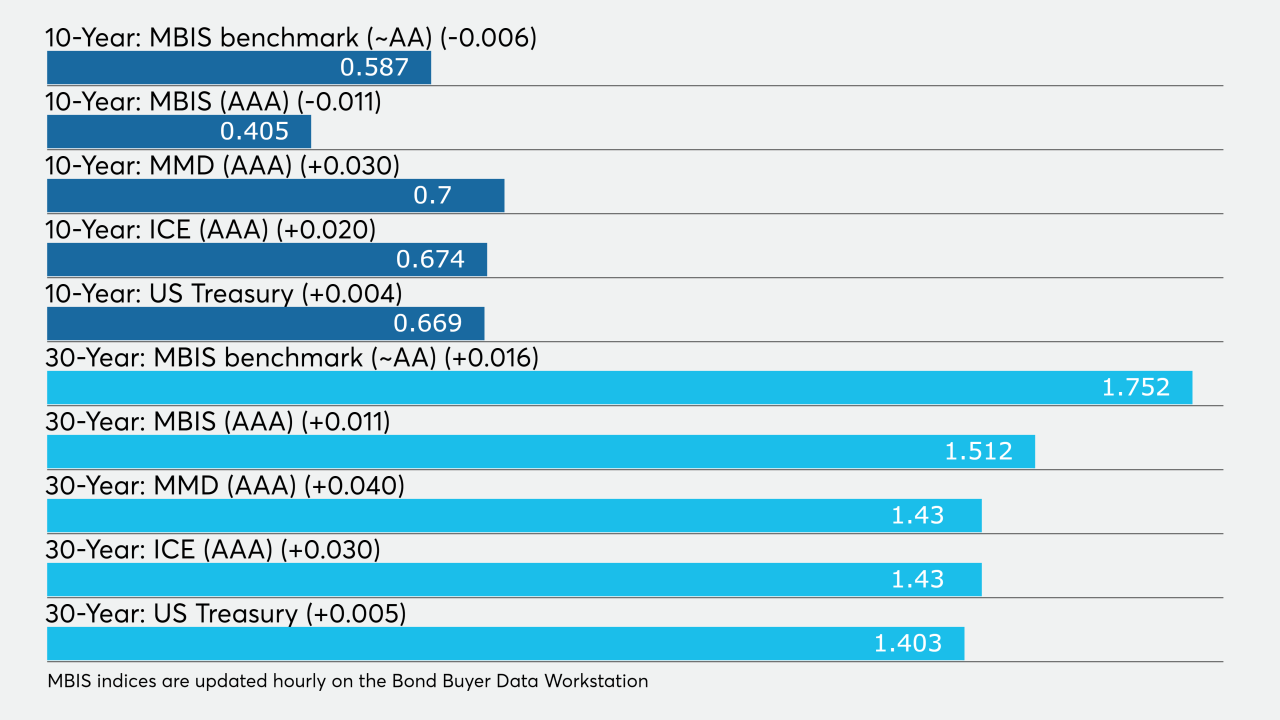

Municipals were weaker on Friday, with yields on the long end finishing out the day up one basis point. Since Aug. 12, when the muni market correction began and yields moved off record low levels, the yield on 10-year muni has risen by 23 basis points while the 30-year yield is up 29 basis points, according to Refinitiv MMD.

August 28 -

More supply sold Thursday as the Chicago Transit Authority, the Austin ISD, Texas and Kern HSD, Calif., all came to market.

August 27 -

Ashton Goodfield, head of municipal bonds at DWS Group, talks with Chip Barnett about how the municipal bond market has been coping with the effects of the COVID-19 pandemic and what's in store for the rest of the year. (22 minutes)

August 27 -

Munis continued to weaken with yields on the AAA scales rising by as much as three basis points.

August 26 -

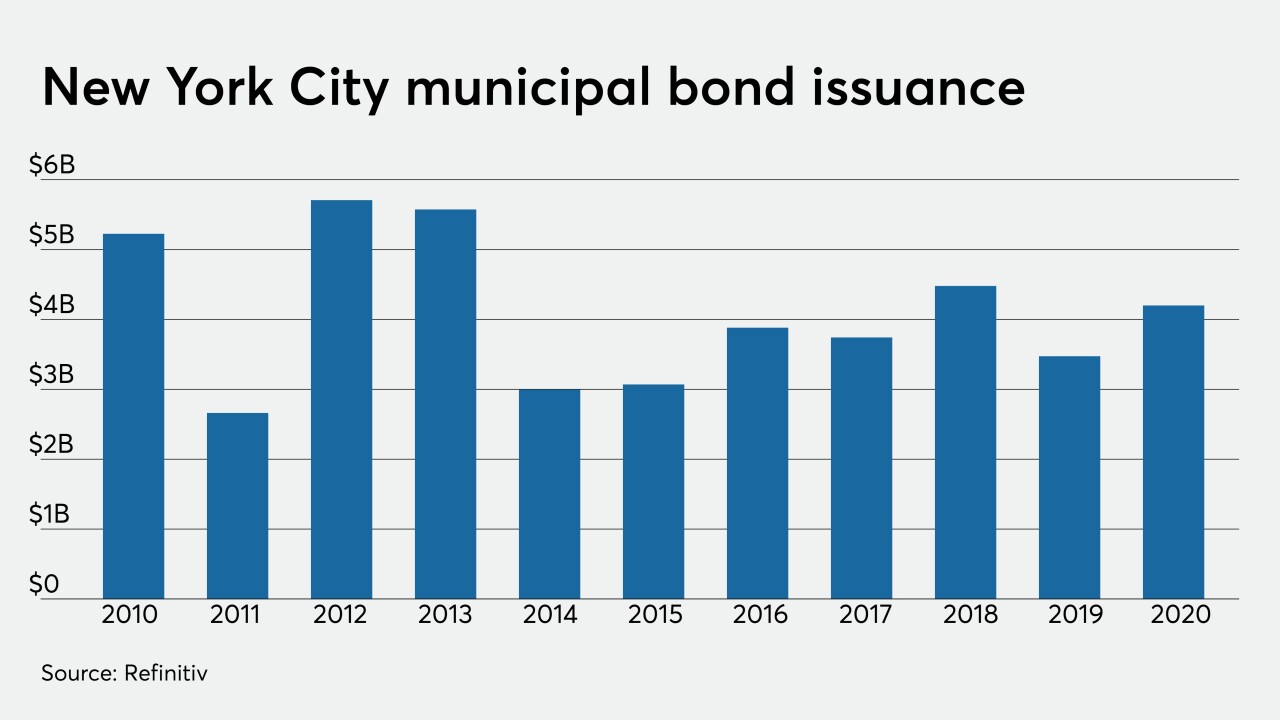

Municipals turned weaker on the long end Tuesday as NYC's tax-exempt GOs were priced for retail investors.

August 25 -

Municipal bonds ended unchanged on Monday ahead of this week $8 billion of new issuance.

August 24 -

Municipals were little changed on Friday after a market moved that took long yields up by as much as 15 basis points since mid-month.

August 21 -

Municipals were steady to weaker, with yields up by as much as three basis points on the long end Thursday.

August 20 -

The muni market steadied Wednesday as a strong dose of supply hit the screens.

August 19 -

Municipals were slightly weaker on Tuesday as investors take stock of inventories and exceedingly low yields for a market that might be ripe for a correction.

August 18