-

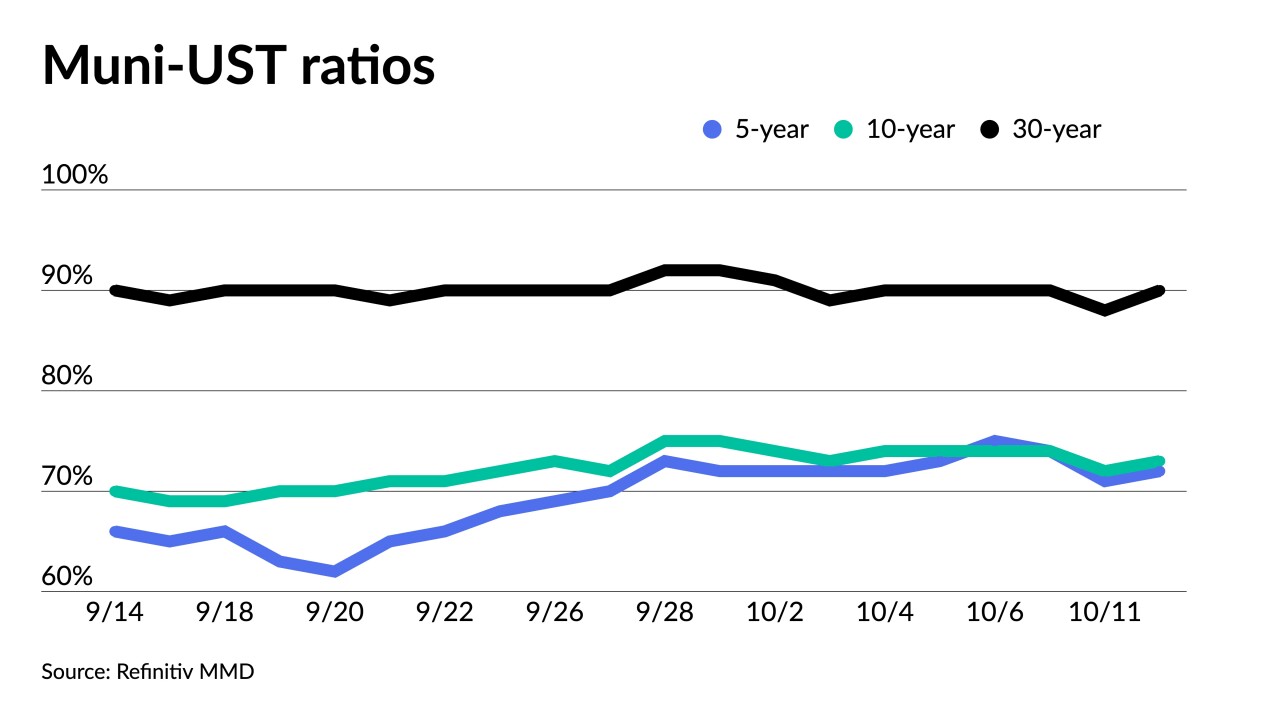

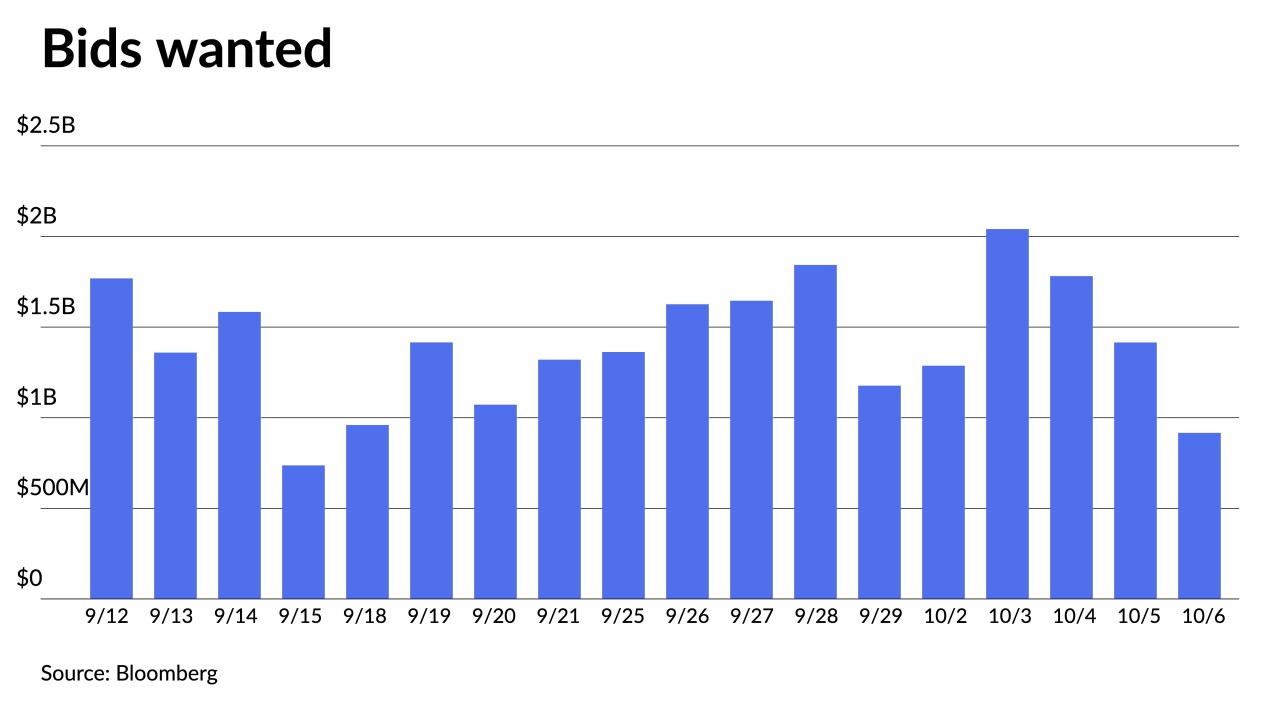

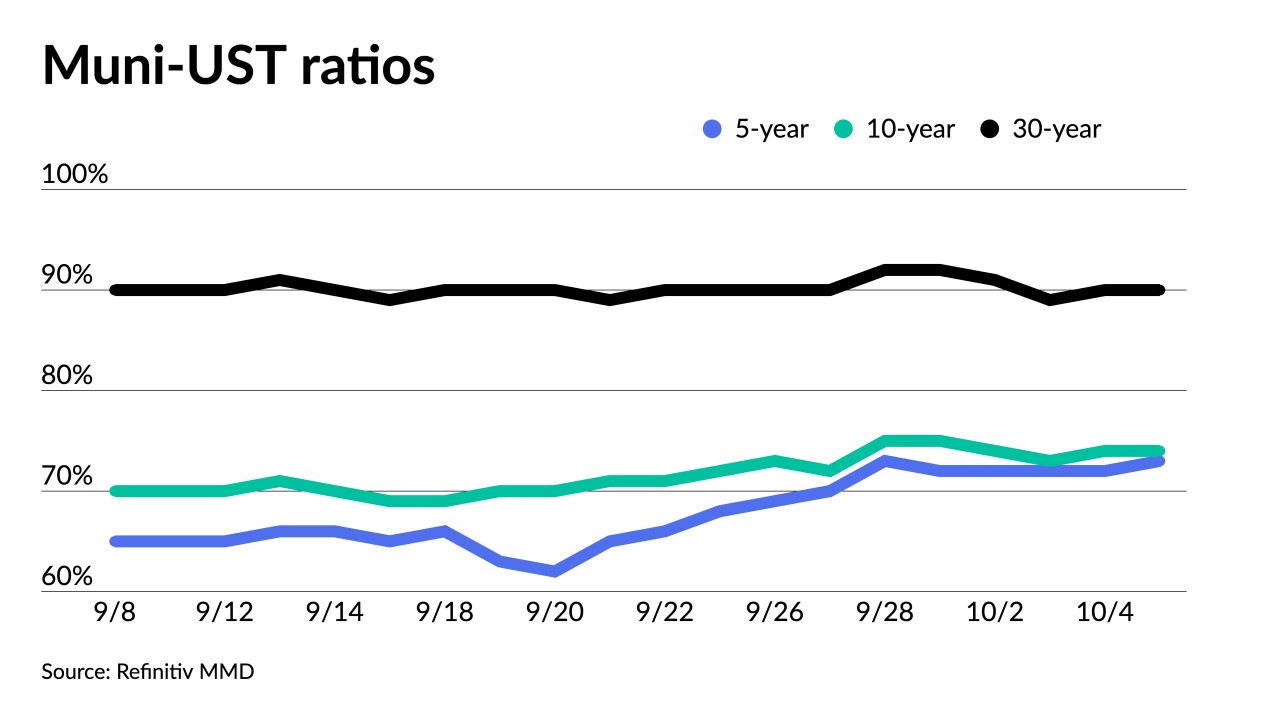

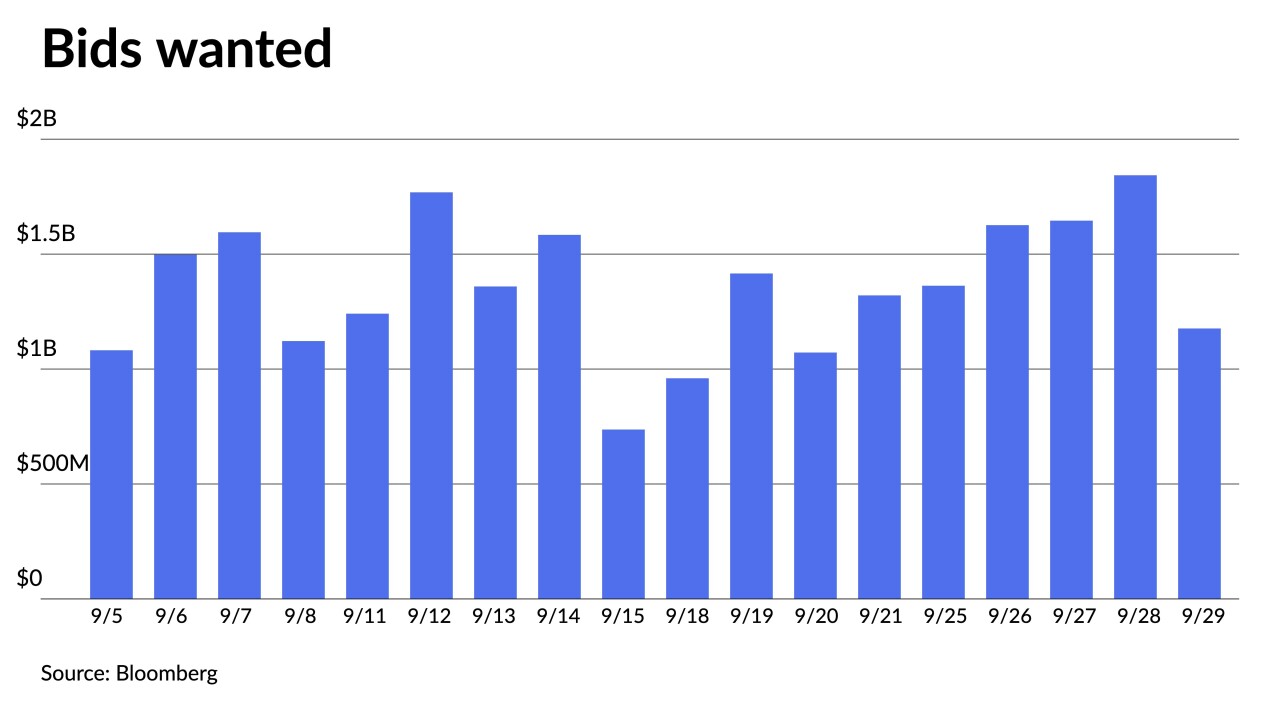

As valuations got richer after muni outperformance this week, Barclays strategists expect munis to be "truly tested in the next several weeks, with supply picking up."

October 13 -

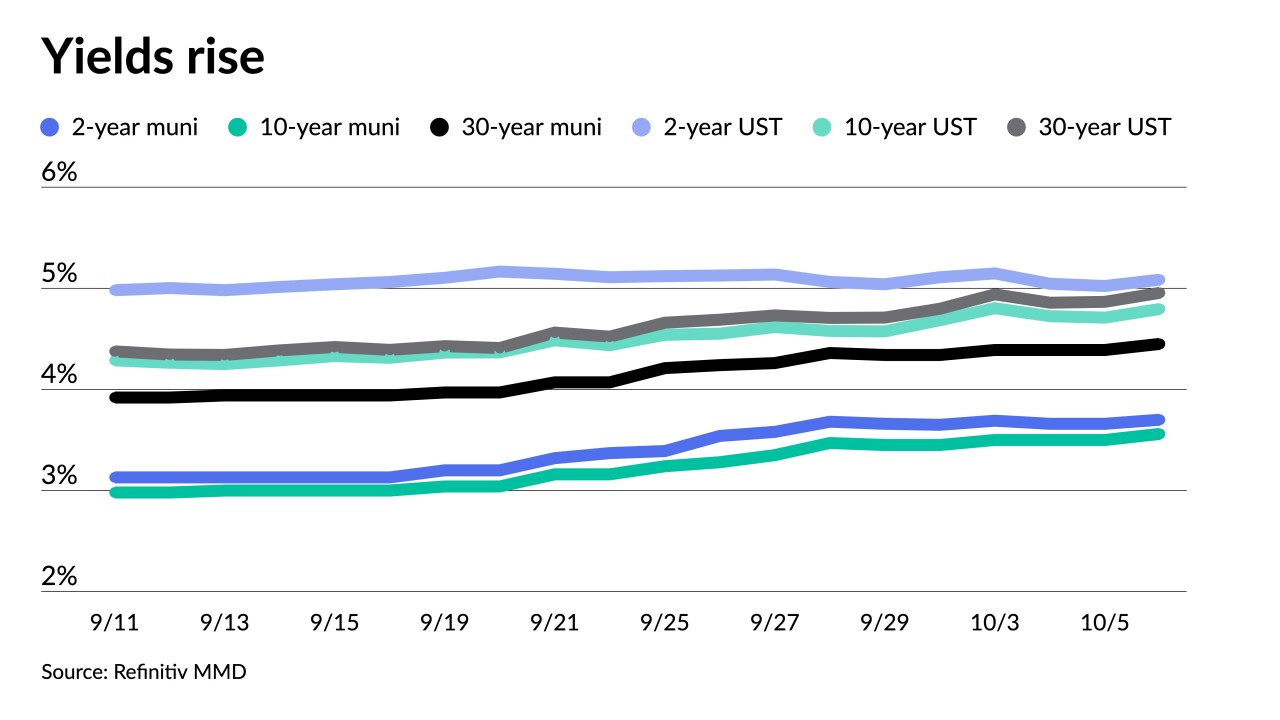

The recent rise in yields has created an opportunity for those investors waiting to "jump into the market," said Roberto Roffo, portfolio manager at SWBC Investment Company.

October 13 -

Despite the sticker shock of rising rates, yields in fact are at average levels for over the last 30 years, panelists said at the GFOA's MiniMuni conference.

October 13 -

A higher inflation figure sent UST yields higher, complicating Central Bank policymaking and reversing a flight-to-safety bid amid ongoing geopolitical turmoil in Israel.

October 12 -

Minutes from the September Federal Open Market Committee meeting were "not much of a market mover" Wednesday, said Scott Anderson, chief U.S. economist and managing director at BMO Economics.

October 11 -

However, "a long-lasting bond market rally seems unlikely given major structural shifts of higher bond supply and on uncertainty with demand," said Edward Moya, senior market analyst at OANDA.

October 10 -

"Despite the breathtaking selloff in longer rates, Barclays' macro strategists see no clear catalyst to stem the bleeding," Barclays strategists said. "Data are unlikely to weaken quickly or enough to help bonds."

October 6 -

The nature of municipal bonds is to help people, says Peter Hayes, "I really like that it's public purpose."

October 6 -

All eyes will be on Friday's report, though "it seems most leading indicators suggest job growth will remain healthy, which should keep the bond market selloff going strong," said OANDA's Edward Moya.

October 5 -

Municipal yields fell up to three basis points, depending on the scale, but underperform a better UST market.

October 4 -

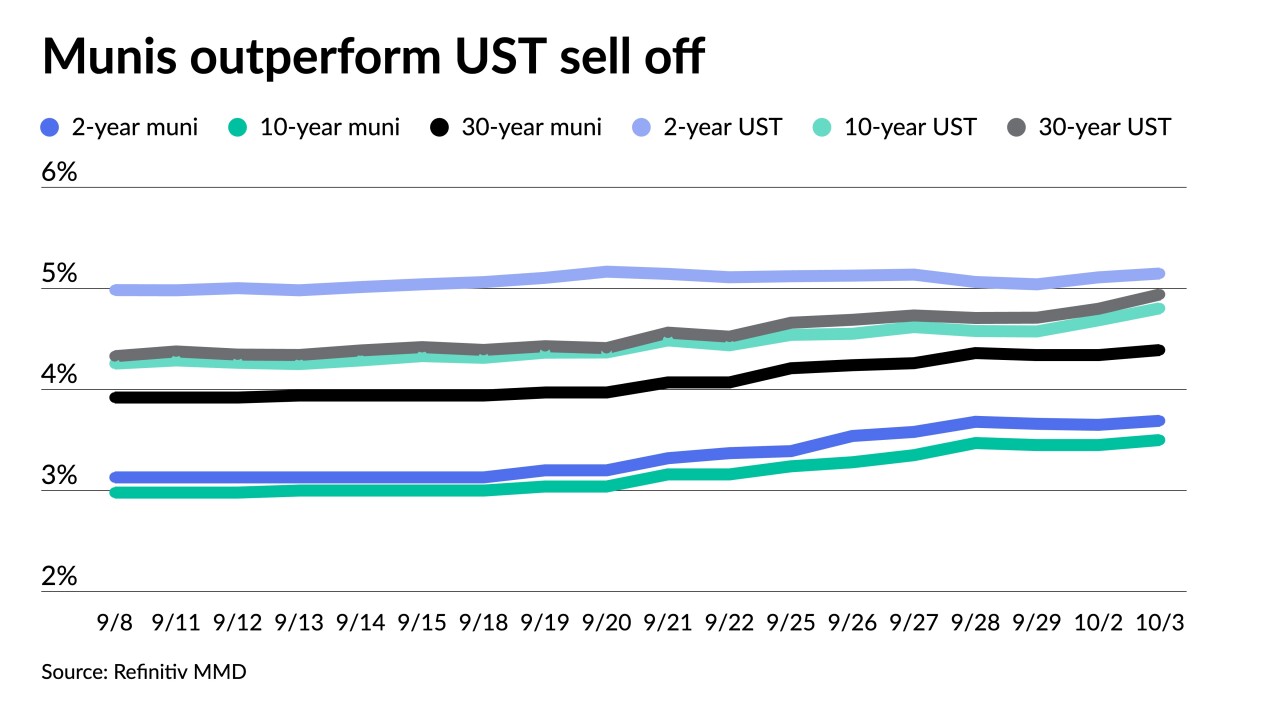

UST rates are driving all things in the muni market, said Jon Mondillo, head of North American Fixed Income at abrdn.

October 3 -

There will be "choppiness in the municipal bond market through the end of the year," said Anders S. Persson, Nuveen's chief investment officer for Global Fixed Income, and Daniel J. Close, Nuveen's head of municipals.

October 2 -

The Bloomberg Municipal Index and High-Yield Index lost 3.3% and 3.9%, respectively, in September.

September 29 -

The last time muni mutual funds saw outflows top $1 billion was the week ending May 31 when they were $1.345 billion.

September 28 -

"The market has taken to heart the [Federal Open Market Committee] actions from last week," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

September 27 -

Yields have "risen substantially over the last week as the market seeks to find at least a minor level of balance or equilibrium," said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

September 26 -

"People are just kind of sitting on their hands and being careful because MMD is raising yields every day and people don't know which way this is heading," said John Farawell of Roosevelt & Cross.

September 25 -

The Texas Water Development Board leads the new-issue calendar with $1 billion of revenue bonds.

September 22 -

The general bias toward muni rates is that they would be a bit higher with technicals "being a little less supportive than they were in August, plus what we heard with from the Fed 'higher for longer,' and potentially another hike," said Jeff MacDonald, head of Fixed Income Strategies at Fiduciary Trust International.

September 21 -

As was expected, the FOMC held rates in a range between 5.25% and 5.50%, but the dot plot in the Summary of Economic Projections showed 12 of 19 members expect another 25-basis-point rate hike this year.

September 20