-

PABs represented 25.4% of all tax-exempt bonds issued in 2017, up from 21.5% in 2016.

June 8 -

Indian River County petitioned the court to overturn its unsuccessful appeal against the U.S. Department of Transportation and the passenger train operator.

May 20 -

IRS General Counsel Michael Desmond said Wednesday his office has received “a number of requests” for extending deadlines.

May 8 -

The IRS also announced temporary guidance providing relief for the calendar year 2020 regarding the reacquisition of qualified tender bonds and commercial paper.

May 5 -

Virgin Trains USA hopes to sell tax-exempt bonds from its $600 million California allocation this summer.

April 14 -

"Like all businesses, we are operating in a period of uncertainty which may last several months," Virgin Trains/Brightline President Patrick Goddard said.

March 26 -

The IRS has informally responded to a letter from NABL asking for a reduction in the high fee it charged for private letter rulings.

February 28 -

More private money would be invested in infrastructure if Congress expands the use of PABs and P3s.

February 25 -

Some muni market members don’t see hope for an infrastructure bill passing in 2020, even though Trump called for it in his address.

February 5 -

The $760 billion, 5-year plan also calls for expanding qualified private activity bonds, reinstating tax credit bonds, and more bond-friendly provisions.

January 29 -

The California Debt Limit Allocation Committee wants more information on the request for $600 million of private activity bond allocation.

January 16 -

Indian River County won’t pursue the federal litigation further, but it will proceed with a lawsuit in state court over the use of its railroad crossings.

January 15 -

The challenge this year will be biggest in the three states that were found by the Council of Development Finance Agencies to be closest to using their 2018 limits — California, New York and Massachusetts.

January 6 -

The U.S. Department of Transportation reasonably determined the Florida’s passenger train owners were qualified to receive private activity bond financing.

December 24 -

Another round of tax legislation is not expected to emerge until the very end of the year after the presidential election or in 2021 after a new Congress is sworn in.

December 24 -

The issuance limit on tax-exempt private activity bonds for Industrial Development Bonds would be raised to $30 million from the current $10 million while the limitation for first-time farmers using so-called Aggie Bonds would be raised to $552,500 from $450,000.

December 19 -

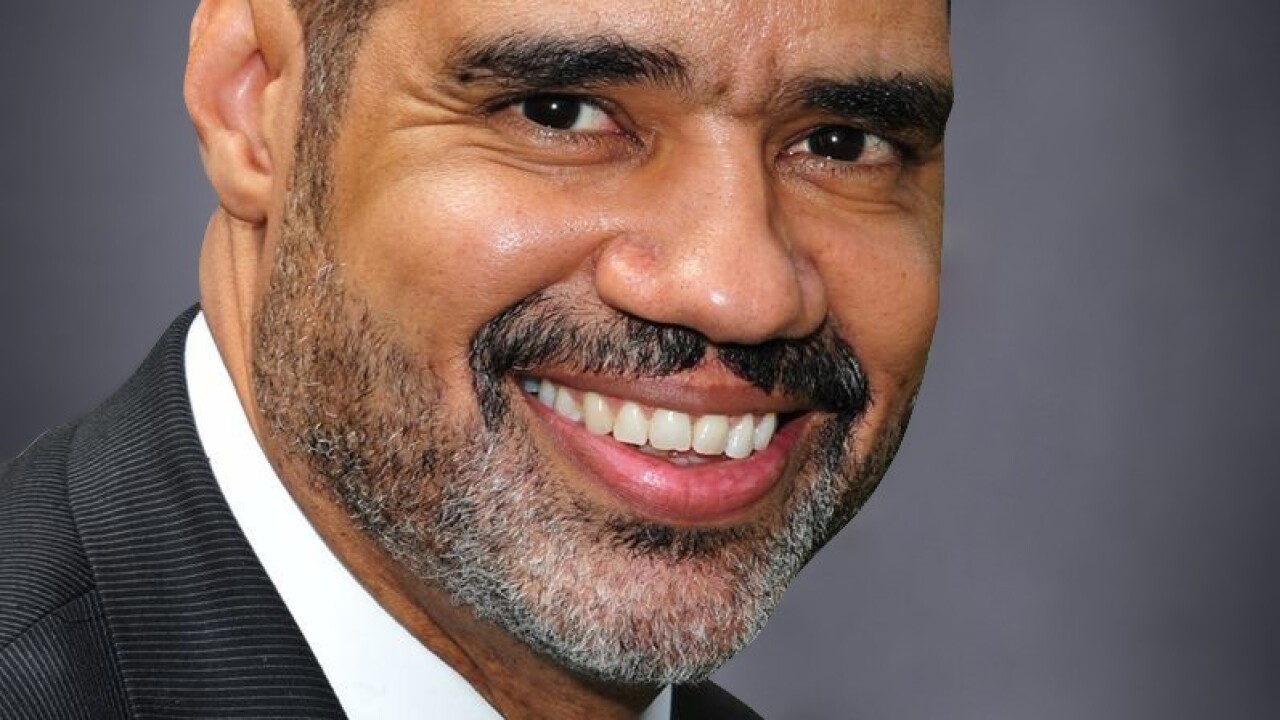

Reuben R. McDaniel III will head the Dormitory Authority of the State of New York.

December 16 -

Denver International Airport expects to pay up to $210 million in termination costs to exit a public private partnership for renovation of its main concourse.

December 16 -

A not-for-profit chosen by Bloomington would borrow about $300 million to finance the Mall of America indoor water park through an Arizona conduit.

December 13 -

Ron DeSantis appointed new Florida Development Finance Corp. board members; a bill has been introduced to place the issuer under the auspices of another state agency.

December 10