-

The muni market improvement has the asset class seeing gains of 1.08% so far in May, as year-to-date returns inch closer to "positive territory," said Jason Wong, vice president of municipals at AmeriVet Securities.

May 13 -

The New York City Transitional Finance Authority leads the new-issue calendar with a total of $1.8 billion of future tax-secured subordinate bonds in the negotiated and competitive markets.

May 10 -

Municipal bond mutual funds saw another week of inflows as investors added $1.053 billion in the week ending Wednesday, the second-largest figure this year.

May 9 -

The University repriced to lower yields up to 15 basis points Wednesday while Illinois accellerated its pricing of its tax-exempt GOs and were repriced yesterday afternoon with bumps of 10 to 13 basis points and saw $1.5 billion of retail orders alone.

May 8 -

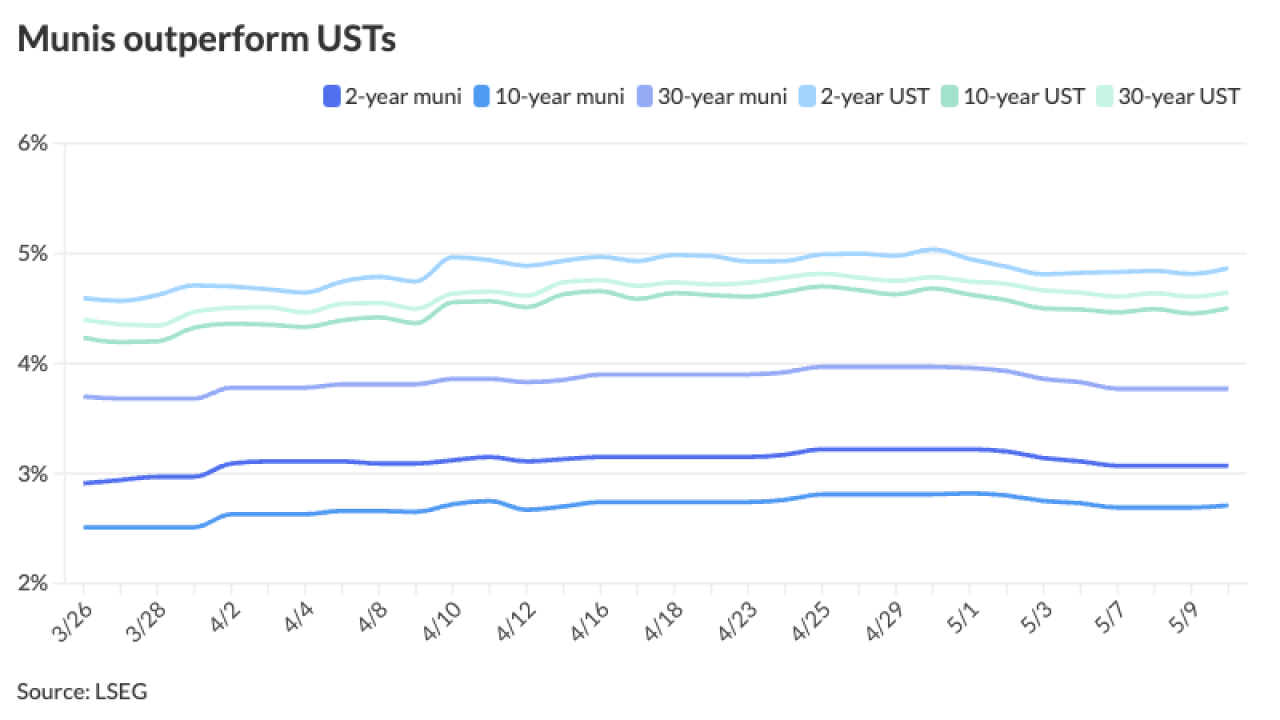

April's "poor performance" pushed munis further into negative territory, but "despite the poor start to the year, they may still end the year positive," said Cooper Howard, a fixed-income strategist at Charles Schwab.

May 7 -

The driving force behind the trend is the overall strength of the economy, according to Fitch Ratings' Michael Rinaldi. Revenue sources for municipalities, such as sales and property taxes, are doing very well.

May 7 -

"It'll be very interesting to see when an event happens or the market get sloppy, what the secondary market does," said a sellside panelist at a Bond Buyer market outlook panel in Florida.

May 7 -

"We remain cautious with respect to duration given the uncertain macro and geopolitical environment though optically, yields seem attractive in the current range," said Wells Fargo's Vikram Rai.

May 6 -

This week's deal will fund accelerated pension payments and Rebuild Illinois expenditures. A $250 million piece will be taxable.

May 6 -

A supply surge hits the market as The Bond Buyer 30-day visible bond volume ticks in at $17.67 billion, $10 billion of which will come the first full week of May, just as macroeconomic data moves all markets to rally.

May 3