-

The Los Angeles Unified School District bonds carry a sustainability label with a third party opinion from Kestrel.

September 23 -

"Active ETFs are becoming an integral part of investor portfolios around the world, with financial advisors increasingly incorporating them into their models-based practice," a BlackRock spokesperson said.

September 23 -

As Erie County sells general obligation bonds to fund its new stadium for the Buffalo Bills, the deal team is targeting a new market: fans of the NFL team.

September 23 -

"Should September's positive returns hold as we expect, it would mark the fourth consecutive month of positive total returns — the first such period since the five-month period spanning from March through July 2021," BofA strategists Yingchen Li and Ian Rogow said.

September 20 -

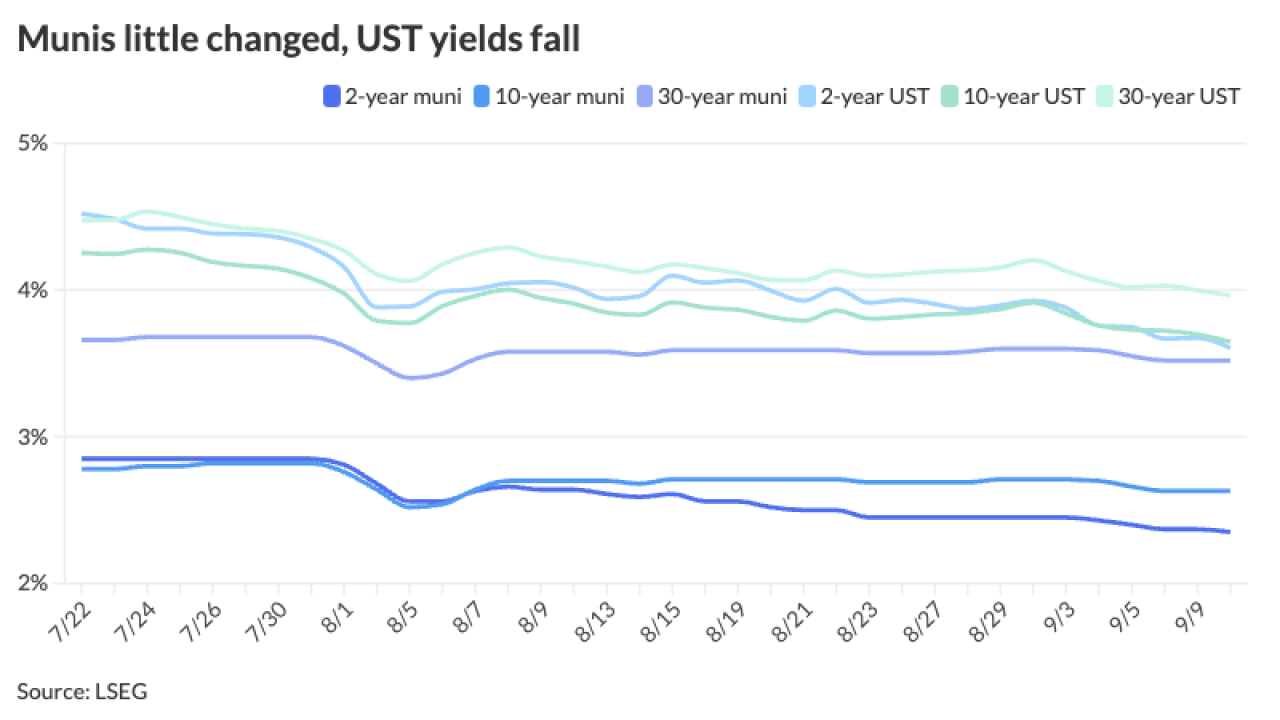

While the municipal market barely budged following the Fed's decision to cut rates 50 basis points, Thursday saw muni yields rise up to two basis points, depending on the scale, but still lagged the weakness in USTs. LSEG Lipper reported $716 million of inflows into municipal bond mutual funds.

September 19 -

The record pace of municipal bond supply this year is driven in part by cities and states realizing projects won't get any cheaper if they wait.

September 19 -

The ratio of local government municipal debt to GDP in aggregate has fallen to around 10% from 20% in 2010.

September 19 -

For municipals, Wednesday "marks a crucial step forward, perfectly aligned with the current risk landscape," said James Pruskowski, chief investment officer for 16Rock Asset Management.

September 18 -

Fed rate cuts "should lead to positive price action for both taxable and tax-exempt bonds, and current nominal yields remain well above where they were when the Fed was more dovish, implying generous room to rally from here," said Matt Fabian, a partner at Municipal Market Analytics, Inc.

September 17 -

"Given increasing student demand for charter schools, we anticipate continued strong supply issued into the municipal market," according to Nuveen.

September 17 -

Despite the underperformance to USTs, munis saw positive momentum during the first two weeks of September with the asset class returning 0.68% so far this month and 1.99% year-to-date.

September 16 -

While supply falls next week as investors await their first Fed rate cut in four years, it should pick up after the FOMC, Barclays PLC said, adding the 30-day visible pipeline "is at relatively manageable levels at the moment." Bond Buyer 30-day visible supply is at $10.09 billion.

September 13 -

Municipal bond mutual funds saw inflows as investors added $1.258 billion to funds — the second-largest inflow figure year-to-date after $1.413 billion of inflows for the week ending Jan. 31.

September 12 -

The agencies are overstepping their statutory authority in trying to force the market to adopt a new securities identifier, says the American Bankers Association.

September 12 -

The August consumer price index showed inflation remains above the Federal Reserve's target level and makes a 50-basis-point rate cut next week unlikely, economists said. Further, many expect the market will be disappointed going forward, as future cuts will likely be shallower than expected.

September 11 -

Issuance as of Wednesday is at $345.327 billion, a 32.7% increase over 2023. The Bond Buyer 30-day visible calendar on Monday was at $20.02 billion, the largest in nearly four years.

September 11 -

Municipals lagged the UST moves again, cheapening ratios and creating a valuable entry point for investors looking for compelling taxable equivalent yields, particularly 10-years and out.

September 10 -

"Despite the underperformance of tax-exempt yields last week, we could see some more pressure on both spreads and ratios due to the heavy supply calendar," said Vikram Rai, head of municipal markets strategy at Wells Fargo.

September 9 -

Municipal supply continues to grow as Bond Buyer 30-day visible supply sits at $20.02 billion and the municipal market will see one of the largest weeks of new-issuance at an estimated $13.35 billion, led by three billion-plus deals from Washington, D.C. ($1.6 billion), the New York City Transitional Finance Authority ($1.5 billion) and Illinois ($1 billion).

September 6 -

Municipal bond mutual funds saw inflows as investors added $956 million to funds after $1.047 billion of inflows the week prior, according to LSEG Lipper.

September 5