-

With the third quarter officially under way, municipal bond experts say the tax-exempt market is poised for better performance and stronger market technicals ahead in the second half.

July 11 -

Nick Venditti of Allspring Global Investments talks about evolving demand components, compelling yields and expectations for second half performance. Jessica Lerner hosts. (24 minutes)

July 11 -

This week should see a return to more normal supply, which might be a little higher than average for the year so far, said Daniel Solender, partner and director of tax-free fixed income at Lord Abbett & Co.

July 10 -

BofA Securities remained at the top of the list, with $22.948 billion, accounting for 13.4% of the market, but the rest of the top 10 saw some shuffling.

July 10 -

For the coming week, investors will be greeted with a new-issue calendar estimated at $7.282 billion.

July 7 -

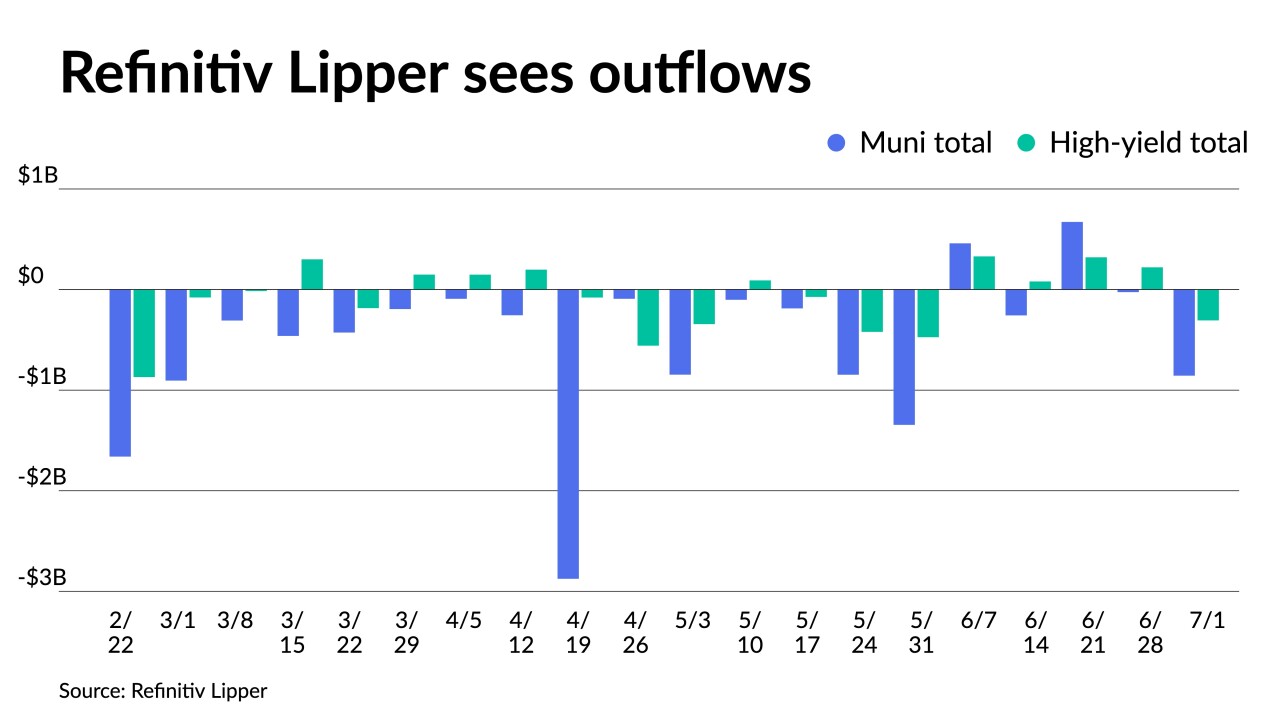

Municipal bond mutual fund outflows intensified as Refinitiv Lipper reported investors pulled $855.719 million from the funds for the week ending Wednesday following $25.331 million of outflows the week prior.

July 6 -

The Investment Company Institute reported investors pulled $136 million from municipal bond mutual funds in the week ending June 28, after $338 million of inflows the previous week.

July 5 -

"Lower volumes, lighter primary issuance, and heavier reinvestment cash flows are likely going to contribute to a continued bout of muni relative performance," said Birch Creek Capital strategists.

July 3 -

For the coming week, investors will be greeted with a new-issue calendar estimated at $304.5 million. This marks the lowest week of issuance in 2023.

June 30 -

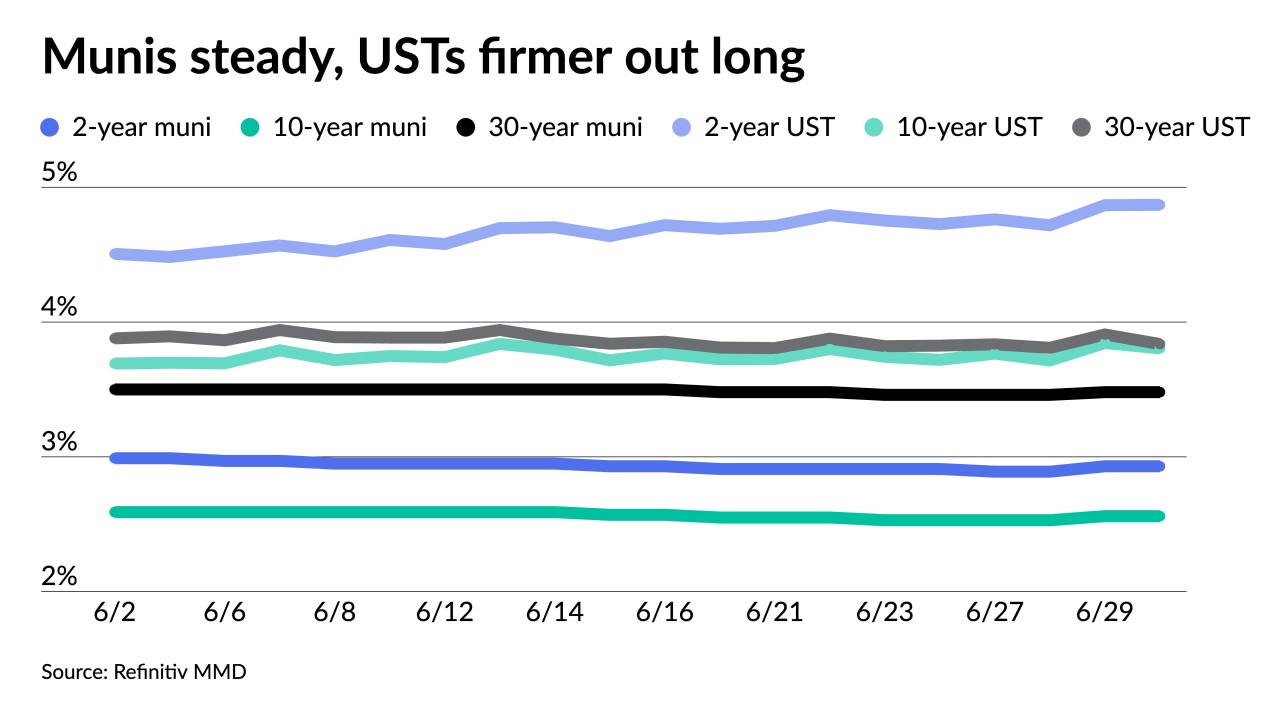

Total volume for the month was $34.436 billion in 744 issues, down from $37.775 billion in 984 issues a year earlier, according to Refinitiv data.

June 30