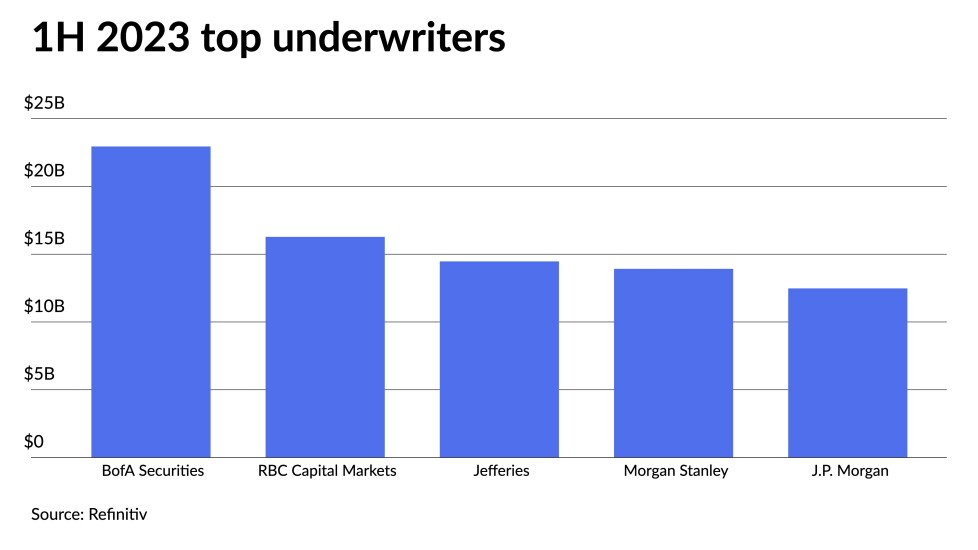

Municipal underwriters handled $171.714 billion in 3,501 issues in the first half of 2023. The total par amount and issues continued to decline, down from $201.119 billion in 4,688 deals in 2022.

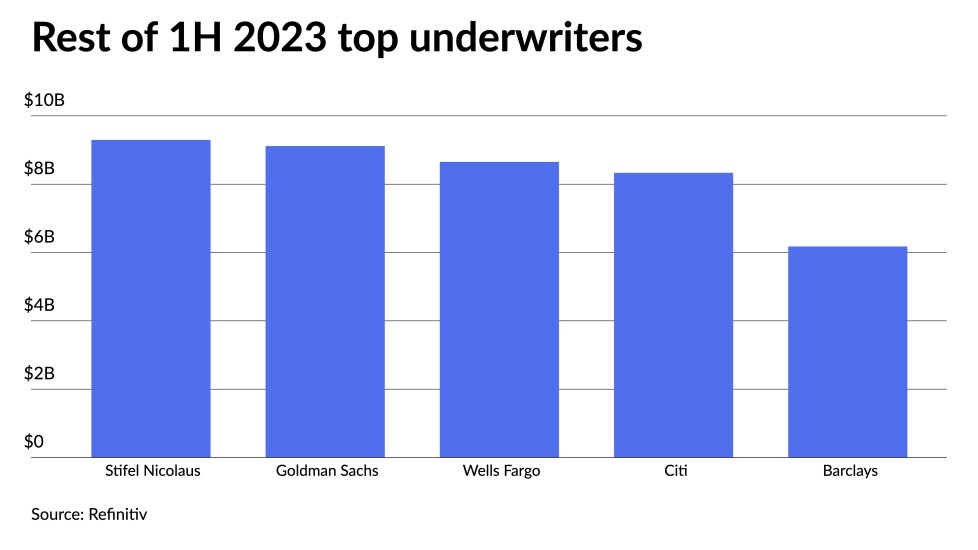

BofA Securities remained at the top of the list, with $22.948 billion, accounting for 13.4% of the market, but the rest of the top 10 saw some shuffling. Barclays was the only new entrant into the top 10 after narrowly missing out last year, while Piper Sandler & Co. was ousted.