-

A $345 million taxable bond deal will support the public-private partnership arrangement that will upgrade the College Park campus district energy system.

June 7 -

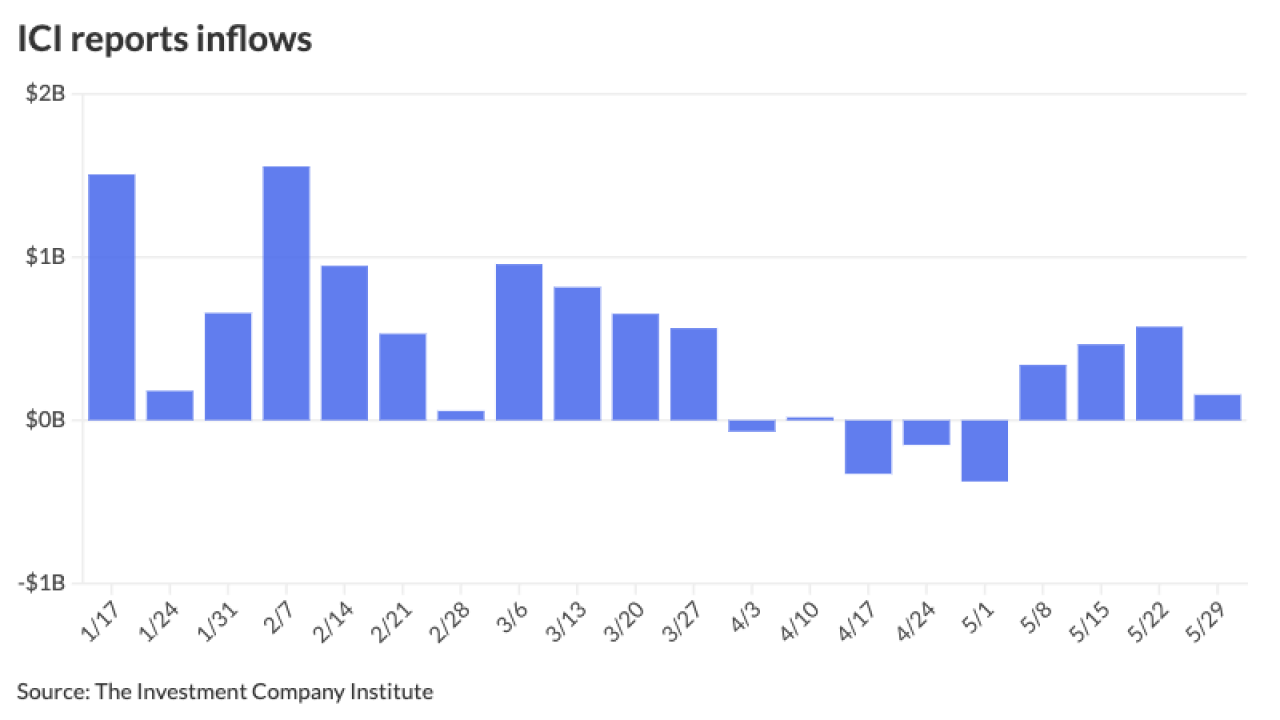

Municipal bond mutual funds saw inflows as investors added $549.2 million after $94.9 million of outflows the week prior, according to LSEG Lipper.

June 6 -

Issuance remains robust Wednesday with an estimated $5.9 billion, said J.P. Morgan strategists led by Peter DeGroot.

June 5 -

New-issue volume has topped $50 billion over the past few weeks, said AllianceBernstein in a weekly report.

June 4 -

This week's surge in issuance, which tops $14 billion, is "likely going to keep a lid on any enthusiasm," Birch Creek strategists said in a weekly report.

June 3 -

While particpants expect some pressure in the near-term with more than $16 billion on tap, they also say the current yield and ratio levels offer investors opportunity.

May 31 -

May volume "surprised on the high end and it has been one of the fastest starts to the year historically," said James Pruskowski, chief investment officer at 16Rock Asset Management.

May 31 -

Despite losses, munis are "being set up nicely" as the summer season approaches, said Jeff Lipton, a research analyst and market strategist.

May 30 -

The Metropolitan Washington Airports Authority plans to refund about $400 million and sell $429 million of new money for its capital construction program.

May 30 -

Muni yields rose up to 13 basis points Wednesday, depending on the curve, coming on the tailwind of a market correction, said Brad Libby, a fixed-income portfolio manager and credit analyst at Hartford Funds.

May 29 -

Orrick, Herrington & Sutcliffe take the top spot with a 10.29% market share.

May 29 -

Overall education issuance, including higher ed, K-12 and student loan debt, in 2023 totaled $94.9619 billion, or 3.6% more than 2022's totals.

May 29 -

The California Community Choice Financing Authority was the leader in the public power sector, issuing nearly $5 billion or 28% market share in 2023. It was also one of the top 10 overall issuers of 2023.

May 29 -

Munis sold off last week "as the anticipated market correction may have finally started ahead of the summer reinvestment period," said Jason Wong, vice president of municipals at AmeriVet Securities.

May 28 -

A pair of muni market experts propose cities and towns borrow through state-based, credit-enhanced bond banks to make the market more efficient.

May 28 -

"For each May dating to 2021, the average 30-year MMD was 2.74% — or 122 basis points below the current yield," FHN Financial's Kim Olsan said. "The recent adjustment offers better investor value."

May 24 -

Municipal bond mutual funds saw the second week of outflows as investors pulled $217.6 million from the funds after $546.2 million of outflows the week prior, according to LSEG Lipper. High-yield saw inflows again.

May 23 -

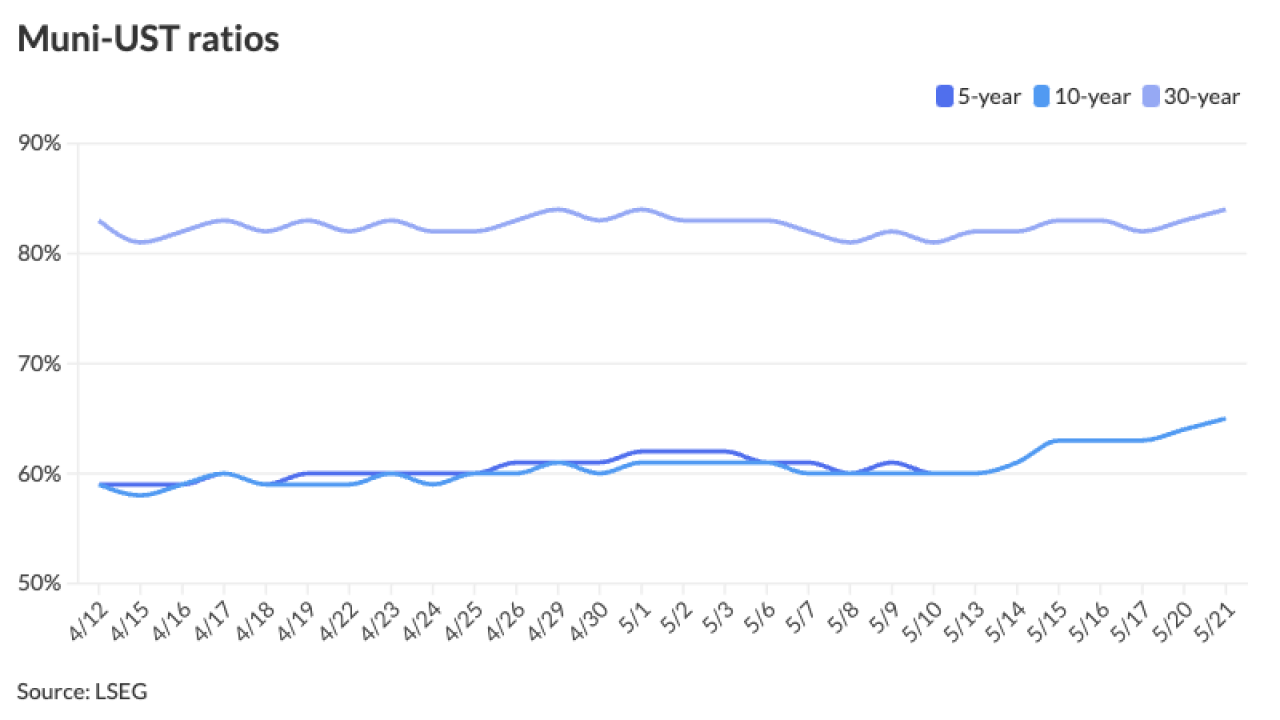

The ongoing influx of new-issue supply has pushed muni-UST ratios to at or near year-to-date highs, J.P. Morgan strategists said.

May 22 -

More than two dozen issuers have announced plans to refund their BABs this year, despite objections from investors.

May 22 -

Several weeks of elevated supply should theoretically be "weighing more on performance, but the market is now just ahead of its largest reinvestment season, which so far in 2024 has become even more pronounced, with an additional $19.5 billion scheduled for call/redemption between [June 1 and August 30]," said Matt Fabian, a partner at Municipal Market Analytics.

May 21