-

Municipal bonds were steady to stronger on Tuesday. Taxable issuance continues its record growth, putting overall issuance on pace to be the largest year on record.

October 27 -

Municipals were in a holding pattern ahead of this week's $15.8 billion new-issue slate as issuers pour debt into the market and investors remain cautious ahead of election results.

October 26 -

The deal is being wrapped with insurance and $300 million of the $434 million offering is supported with the state government's moral obligation backing.

October 26 -

The Central Texas Regional Mobility Authority will sell $333 million of bonds and notes.

October 26 -

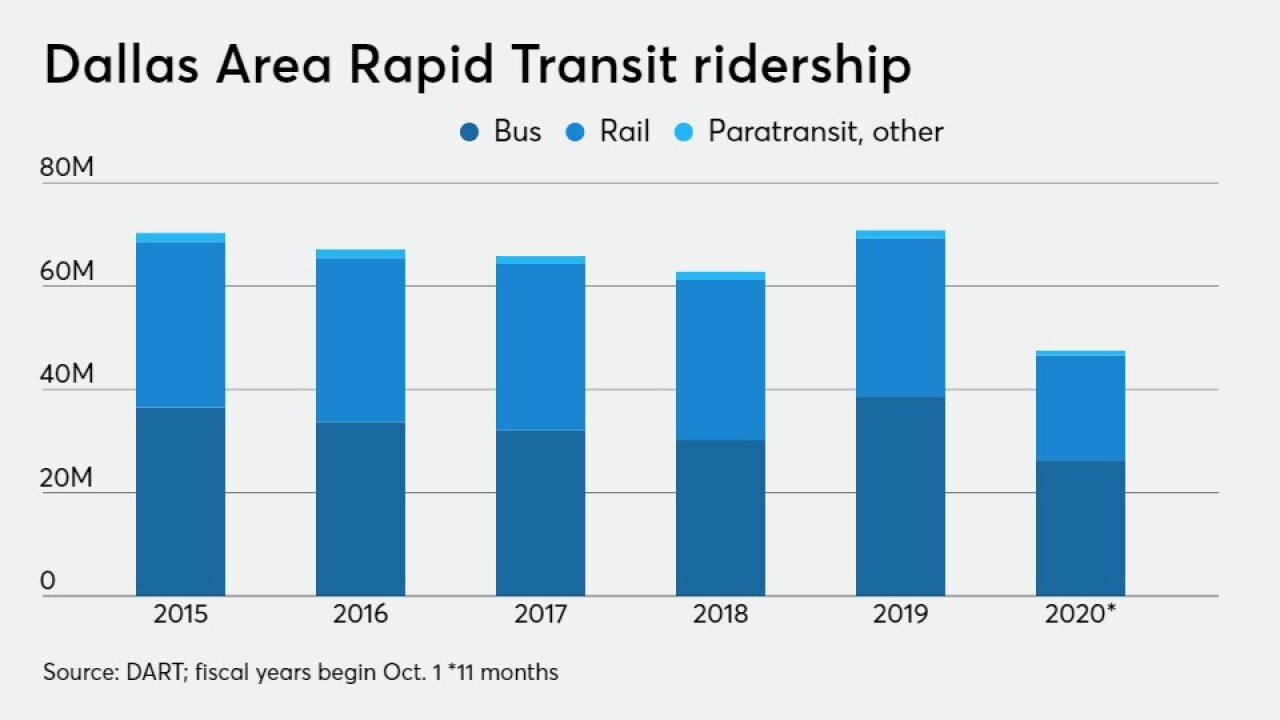

"We have no need for cash-flow relief or restructuring," said the treasurer of Dallas Area Rapid Transit, which continues to expand its rail services.

October 26 -

Municipals held firm Friday as the market gets set for another week of hefty supply. Citi anticipates $550 billion in 2021, led by surge in taxable issuance.

October 23 -

Municipals were little changed on Thursday as the supply surge continued ahead of the U.S. elections.

October 22 -

The No Place Like Home bonds, backed by a long-standing income tax surcharge, fund supportive housing for homeless people with mental health issues.

October 22 -

The current deal deluge is causing a minor yield pullback, but levels have been steadier than many probably thought, trader said.

October 21 -

Favorable sale results compared to recent secondary trading levels prompted MMD to narrow Illinois' spreads on average by 10-30 basis points across the curve with the short-end seeing the biggest improvement.

October 21