California competitively sold bonds while several large healthcare deals hit the market as the week's supply surge continued unabated.

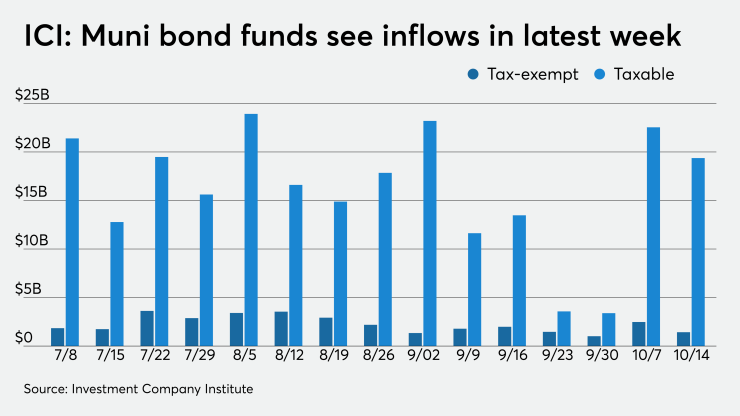

ICI reported muni bond funds and exchange-traded funds saw combined inflows of $1.4 billion, the 24th week in a row of positive results.

In secondary trading, municipals were mostly steady, with yields on the AAA scales rising by as much as one basis point on some longer-dated maturities.

The market tone on Wednesday was mostly stable, but mixed, according a Florida trader, who noted a slight cheapening on secondary issues as well as some firmness on some of the new issues dominating the market this week.

“The market is in reasonable shape,” he said. “It’s a large issuance week and it has customers’ attention,” according to the trader, who said heavy issuance may become a trend over the next two weeks leading up to the election.

The current deal deluge is causing a minor yield pullback, but levels have been steadier than many probably thought, according to Kim Olsan, senior vice president at FHN Financial.

“This is the third week of outsized supply and while some balances exist across most deals, attractive spreads and slightly higher yields should help distribution,” she said.

Even with the pandemic’s effects hitting issuers’ revenue flows, buyers know that when certain sectors widen out — such as AAA-backed, state-guaranteed school and mid-AA essential service names — the entry point is in their favor.

As the calendar continues to grow, it may attract those ready to take advantage of better buying conditions, according to Olsan.

“In fact, the 10-year AAA spot is inching its way back toward 1.00% — a range it hasn’t traded through since mid-May,” Olsan said. “While AA-rated and lower credits have moved behind 1%, it’s the optics of the AAA spot widening out that will pique interest (as will the approach of a long 2% AAA). November’s supply scenario could be very fluid depending on conditions post-election, potentially creating a smaller window of opportunity.”

Primary market

Morgan Stanley priced CommonSpirit's (Baa1/BBB+/BBB+/NR) $1.5 billion of Series 2020 taxable corporate CUSIP bonds.

With some cheapening outside of the primary market, the Florida trader said his firm was “losing some of the focus of clients to the secondary” on Wednesday afternoon — but large deals were still demanding attention.

The CommonSpirit Health deal, for instance, was priced between 10 and 30 basis points firmer than usual and well inside of early expectations — despite its triple-B ratings, according to the trader.

"That’s good for the issuer since it priced firmer than usual — especially for a triple-B hospital — and the marketplace supported it,” he said.

“We didn't see any slippage from what quality type spreads are,” he said, adding that “we did see some weakness in smaller, less than investment-grade bid wanteds in the secondary market.”

He attributed the weakness to the upcoming election and investors dialing back risk and credit paper.

Morgan Stanley also priced the California Health Facilities Financing Authority’s (Baa1/BBB+/BBB+/NR) $586.17 million of Series 2020A tax-exempt revenue bonds for

BofA Securities priced the state of

The $600 million of Series 2020GB taxables were priced at par to yield 0.429%, 28 basis points over the comparable U.S. Treasury security, in 2022 to 0.852%, 50 basis points over the Treasury security, in 2025. The $400 million of Series 2020GC taxables were priced at par to yield from 0.852%, 50 basis points over Treasuries in 2025, to 2.782%, 115 basis points over Treasuries in 2040.

The $146.905 million of Series 2020GA tax-exempts were priced to yield 0.25% with a 5% coupon in 2021.

In the competitive arena, the state of California (Aa2/AA-/AA/NR) sold $1.1 billion of various purpose general obligation bonds in three offerings.

BofA Securities won the $590.265 million of tax-exempt Bid Group B GO and GO refunding bonds with a true interest cost of 1.693%. The GOs were priced as 5s to yield 1.33% in 2031, 1.41% in 2032, 1.54% in 2034, 1.59% in 2035, 1.64% in 2036 and as 2.25s to yield 2.50% in 2043. The refunding GO were priced as 5s to yield 0.44% in 2025, 0.83% in 2027, 0.98% in 2028, 1.14% in 2029 and 1.54% in 2034.

JPMorgan Securities won the $321.625 million of taxable Bid Group A GO construction bonds with a TIC of 1.656%.

Wells Fargo Securities won the $198.89 million of taxable Bid Group C GO refunding bonds with a TIC of 1.3949%. The taxables were priced as 3s to yield 0.25% in 2022, 0.35% in 2023, 0.70% in 2025, 1% in 2026, 1.60% in 2030, 1.70% in 2031, 1.80% in 2032, 1.86% in 2034 and 1.90% in 2035.

Public Resources Advisory Group was the financial advisor. Orrick Herrington and the State Attorney General acted as the bond counsel.

Citigroup priced West Virginia’s Tobacco Settlement Finance Authority which is issuing $703.83 million of taxable Series 2020A&B Class 1 & 2 senior current interest tobacco settlement asset-backed refunding bonds.

Morgan Stanley priced Banner Health of Arizona’s (NR/AA-/AA-/NR) $607.655 million of Series 2020C taxable corporate CUSIP bonds.

Morgan Stanley also took indications of interest on Sutter Health’s (A1/A+/A+/NR) $1.99 billion of Series 2020A corporate CUSIP taxable bonds. The deal is set to be priced Thursday. The deal was indicated to be priced to yield 115 basis points above the comparable U.S. Treasury security in 2025, 162.5 basis points above the comparable Treasury in 2030, 170 basis points above Treasuries in 2040 and 187.5 basis points above Treasuries in 2050.

BofA priced Mid-Michigan Health’s (NR/A+/AA-/NR) $318 million of Series 2020 corporate CUSIP taxable bonds. The bonds were priced at par to yield 3.409% in 2050.

Siebert Williams Shank & Co. priced Philadelphia, Pa.’s (A2/AA/BBB+/NR) $254.02 million of 16th Series 1998 general ordinance gas works revenue bonds. The deal is insured by Assured Guaranty Municipal Corp. The bonds were priced to yield from 0.43% with a 5% coupon in 2022 to 2.12% with a 5% coupon in 2040. A 2045 maturity was priced as 4s to yield 2.54% and a 2050 maturity was priced as 5s to yield 2.39%.

Raymond James & Associates priced the Comal Independent School District, Texas’ (Aaa/NR/NR/NR) $107.885 million of unlimited tax refunding bonds. The deal is backed by the Permanent School Fund guarantee program. The bonds were priced to yield from 0.28% with a 5% coupon in 2021 to 1.75% at par in 2033.

RBC Capital Markets received the written award on San Antonio, Texas’ (Aa1/AA/AA+/NR) $418.255 million of New Series 2020 taxable electric and gas systems revenue refunding bonds.

Barclays Capital received the official award on the Harris County, Texas, Cultural Education Facilities Finance Corp.’s (NR/A/NR/NR) $208.02 million of Series 2020 taxable medical facilities mortgage revenue refunding bonds issued for the Baylor College of Medicine.

JPMorgan received the written award on the Oklahoma Capitol Improvement Authority’s (NR/AA-/AA-/NR) $191.6 million of state highway capital improvement revenue bonds consisting of Series 2020B tax-exempts and Series 2020C taxables.

Looking at Illinois sales

On Tuesday, the state of

“The state of Illinois is pleased to have received a strong response from the municipal bond market in one of the busiest weeks in nearly 20 years through its competitive sale of $850 million of general obligation bonds,” said Paul Chatalas, the state’s director of capital markets. “We appreciate the ongoing support of our investors, who recognize the solid fundamentals and bondholder security of the state’s bonds, and we appreciate the bids from the banks who represented them.”

Yvette Shields of The Bond Buyer

"The competitive sales attracted good interest from investors drawn to the state’s relatively high yields," ICE said. "In May, Illinois turned to the Fed’s Municipal Lending Facility to borrow money for one year, the only state to do so. Yesterday’s deal narrowed the state’s secondary market yield curve."

ICI: Muni bond funds see $1.4B inflow

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $1.428 billion in the week ended Nov. 14, the Investment Company Institute reported Wednesday.

It marked the 24th straight week that the funds saw inflows. In the previous week, muni funds saw an inflow of $2.479 billion, ICI said.

Long-term muni funds alone had an inflow of $1.065 billion in the latest reporting week after an inflow of $2.086 billion in the prior week.

ETF muni funds alone saw an inflow of $363 million after an inflow of $393 million in the prior week.

Taxable bond funds saw combined inflows of $19.372 billion in the latest reporting week after an inflow of $22.542 billion in the prior week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $3.037 billion after an inflow of $7.568 billion in the previous week.

Secondary market

Some notable trades on Wednesday:

Dallas Texas ISD 5s of 2022 traded at 0.26%-0.25%. Brookhaven, NY 5s of 2022 traded at 0.23%. Charles County Maryland GOs, 4s of 2023, at 0.25%, originally at 0.24%. St. Louis, Missouri 4s of 2028 at 0.84%-0.83%, originally at 0.70%. Montgomery County, Maryland GO 4s of 2030 at 1.07%. Miracosta, California community college district 4s of 2032 at 1.16%-1.15%.

Forsythe County Georgia 4s of 2036 at 1.37% versus 1.39%-1.28% Tuesday.

Washington GOs, 4s of 2040 traded at 1.60% verus Thursday at 1.69%-1.65%. Conroe Texas ISD 2.25s of 2046 traded at 2.33%, the same as Tuesday.

High-grade municipals were unchanged on Wednesday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields in 2021 and 2022 were flat at 0.17% and 0.18%, respectively. The yield on the 10-year muni was steady at 0.96% while the yield on the 30-year remained at 1.74%.

The 10-year muni-to-Treasury ratio was calculated at 118.8% while the 30-year muni-to-Treasury ratio stood at 107.7%, according to MMD

The ICE AAA municipal yield curve showed short maturities weakened as the 2021 maturity rose one basis point to 0.18% in 2021 and rose one basis point 0.19% in 2022. The 10-year maturity remained at 0.93% and the 30-year was flat at 1.75%.

The 10-year muni-to-Treasury ratio was calculated at 114% while the 30-year muni-to-Treasury ratio stood at 107%, according to ICE.

The IHS Markit municipal analytics AAA curve showed short yields steady at 0.15% and 0.16% in 2021 and 2022, respectively, with the 10-year yielding 0.97% and the 30-year at 1.74%.

The BVAL AAA curve showed the yield on the 2021 maturity unchanged at 0.13%, the 2022 maturity steady at 0.15% while the 10-year rose one basis point to 0.94% and the 30-year gained one basis points to 1.75%.

Treasuries were weaker as stock prices traded higher.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 0.82% and the 30-year Treasury was yielding 1.62%.

The Dow rose 0.15%, the S&P 500 increased 0.40% and the Nasdaq gained 0.48%.