-

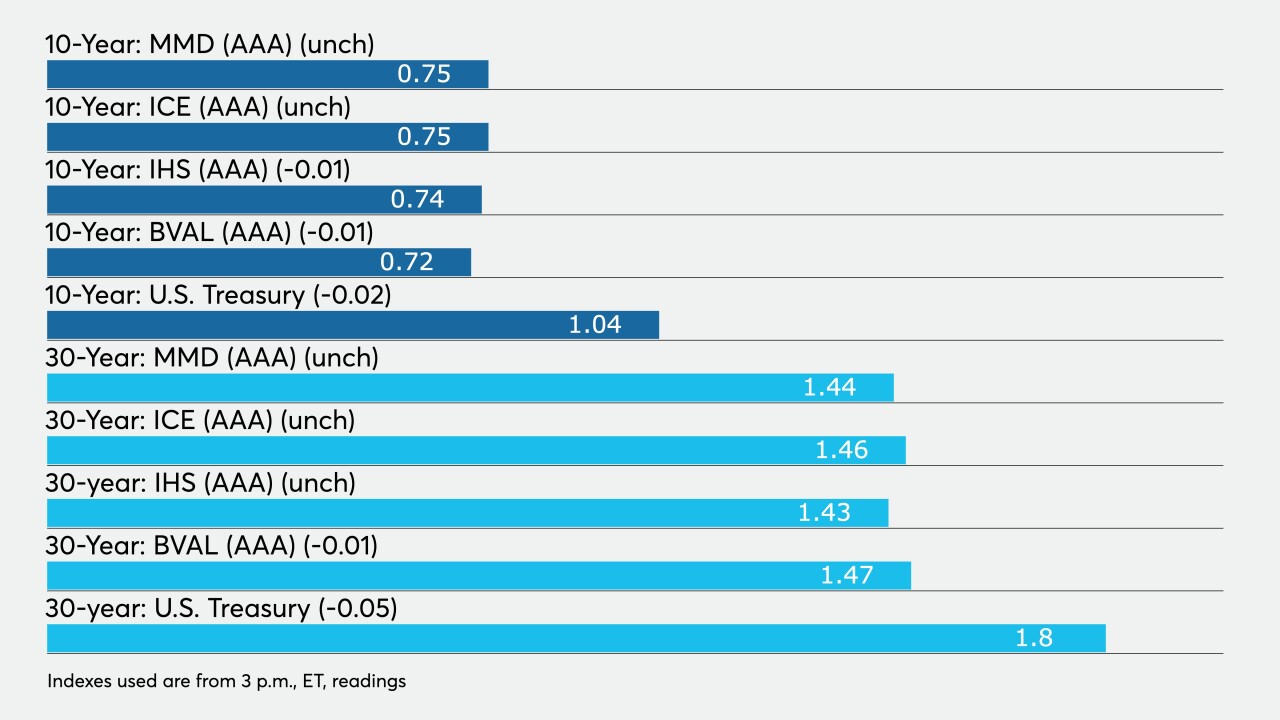

New issues priced with ease with high-grade issuers tight to triple-A benchmarks. It was the first time the municipal yield curve saw such noticeable movement, following little changed secondary activity for nearly the past two weeks.

January 26 -

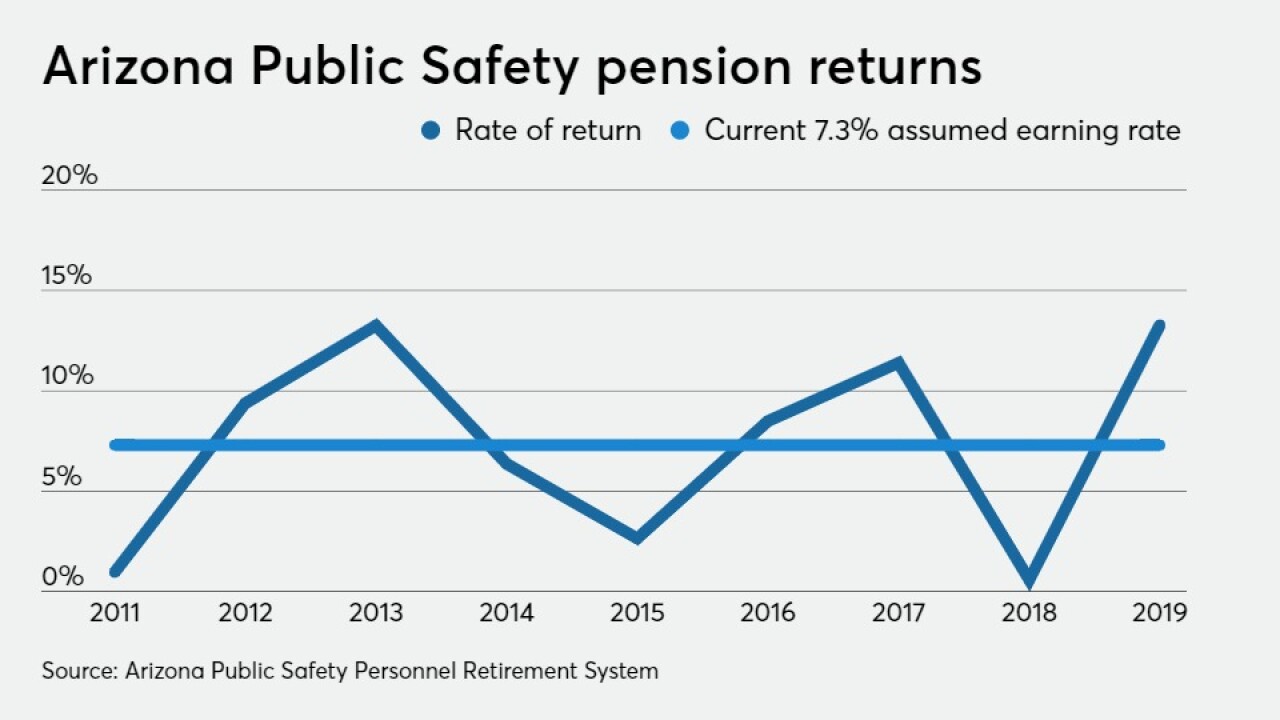

Federal COVID-19 relief aid cushions the district's balance sheet but labor, state budget, and pension woes remain.

January 25 -

Returns of all the investment grade options "pale in comparison to those for municipal high-yield," which should bolster Texas gas and Chicago public schools deals.

January 25 -

The $187 million deal is the largest yet to be hosted on the Clarity platform, which is approaching the half billion mark of resets every week.

January 25 -

With interest rates at historic lows and stock market returns at record highs, Tucson sees a ripe opportunity to issue pension debt.

January 25 -

A 'perpetual calm' continues to fall over the municipal market as inflows into municipal funds, combined with the shortage of traditional tax-exempt supply, is directing most aspects of daily market activity.

January 22 -

Refinitiv Lipper reports another multi-billion week of inflows, the domino effect from such strong flows is that secondary selling doesn’t need to be so active, creating fewer opportunities for new inquiry, analysts say.

January 21 -

Muni yields have been in a nine-basis point range since the beginning of the year while UST yields have fluctuated more than 20 basis points. With so little supply, muni credit spreads continue to compress.

January 20 -

Tax-exempt performance is dependent on what supply looks like versus taxables. The 30-day visible supply shows more than 30% taxables on tap, though some analysts say the taxable increase makes exempts more attractive.

January 19 -

Friday’s data showed economic weakness. Consumers, the drivers of the economy, pulled back during the holiday season and have exhibited weakening sentiment.

January 15