-

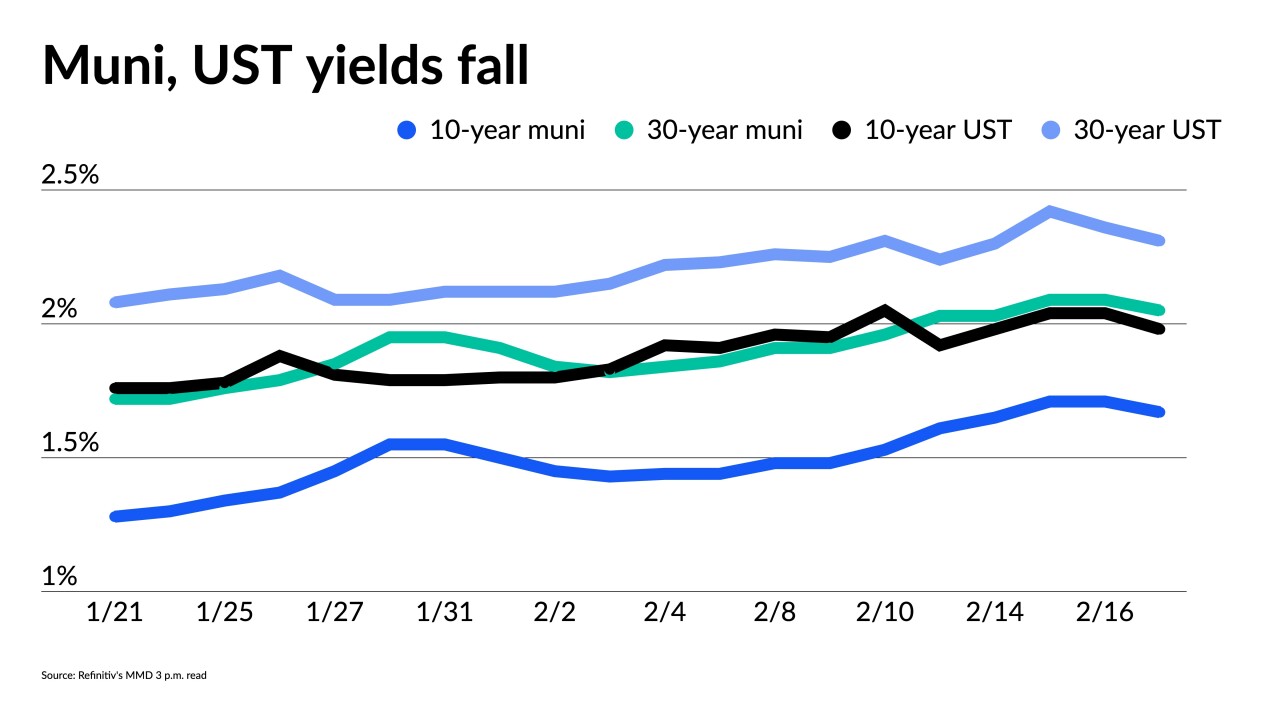

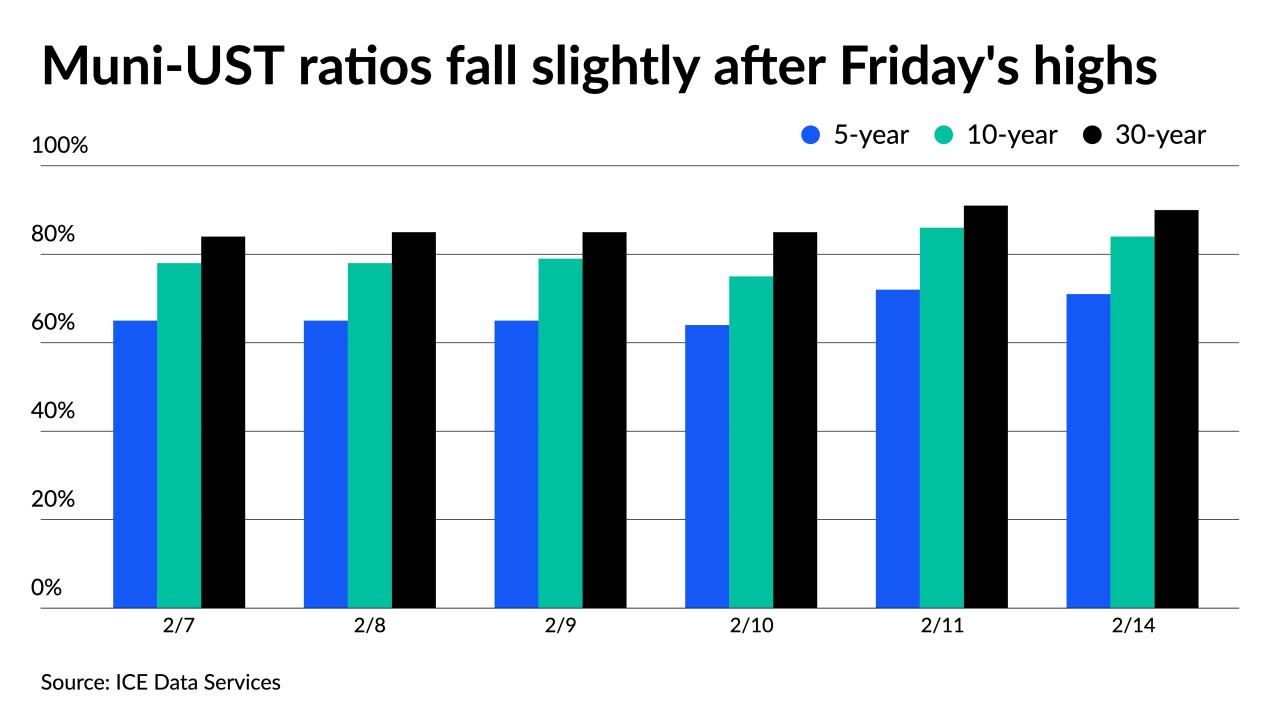

As municipals continue to underperform the moves in U.S. Treasuries, current ratios are attractive and present a buying opportunity.

March 7 -

Market volatility has risen significantly, particularly in the last several weeks, with daily Treasury yield swings of 10 basis points or more becoming the norm with municipals struggling to stabilize.

March 4 -

The University of Michigan follows Michigan State this month in joining the club of universities offering 100-year bond maturities.

March 3 -

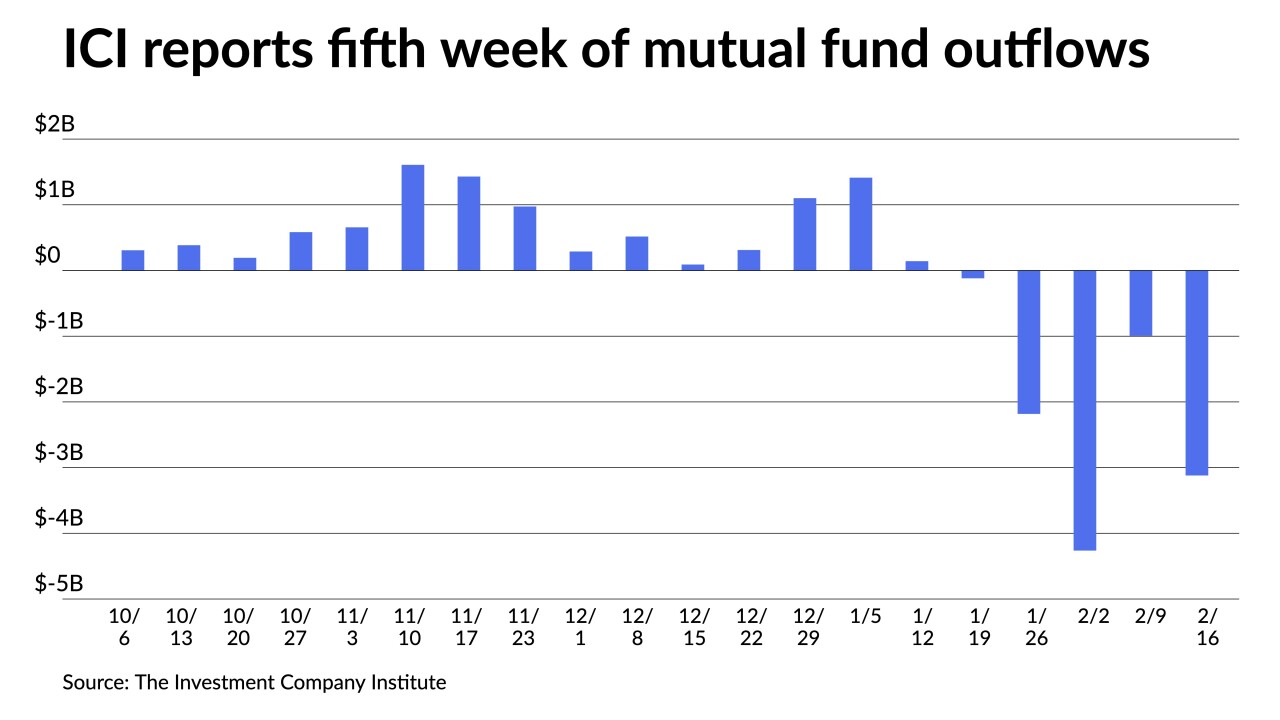

The Investment Company Institute on Wednesday reported $2.637 billion of outflows in the week ending Feb. 23, down from $3.120 billion of outflows in the previous week.

March 2 -

The Russian invasion of Ukraine could slow interest rate hikes and has led the market to pull back on the chances of a 50-basis-point liftoff.

March 1 -

North Carolina Treasurer Dale Folwell talks with The Bond Buyer's Chip Barnett about how the state's economy has remained in financially good health despite dealing with the COVID-19 pandemic as well how the state deals with troubled municipalities. As chair of the debt affordability commission, he chats about bond issuance. He also discusses the ways to reform healthcare and increase transparency. (15 minutes)

March 1 -

All markets, but particularly municipals, are in uncharted territory once again, with volatility amplified by the crisis in Ukraine and a still somewhat uncertain path for the Federal Reserve and inflation.

February 28 -

February volume was $26.481 billion in 594 deals versus $37.052 billion in 981 issues a year earlier, bringing total volume for the first two months of the year to $51.426 billion, or 20% less than 2021.

February 28 -

The new-issue calendar is $5.45 billion while 30-day visible supply sits at $11.14 billion. The largest deal of the week comes from the New York City Municipal Water Finance Authority with $793.83 million.

February 25 -

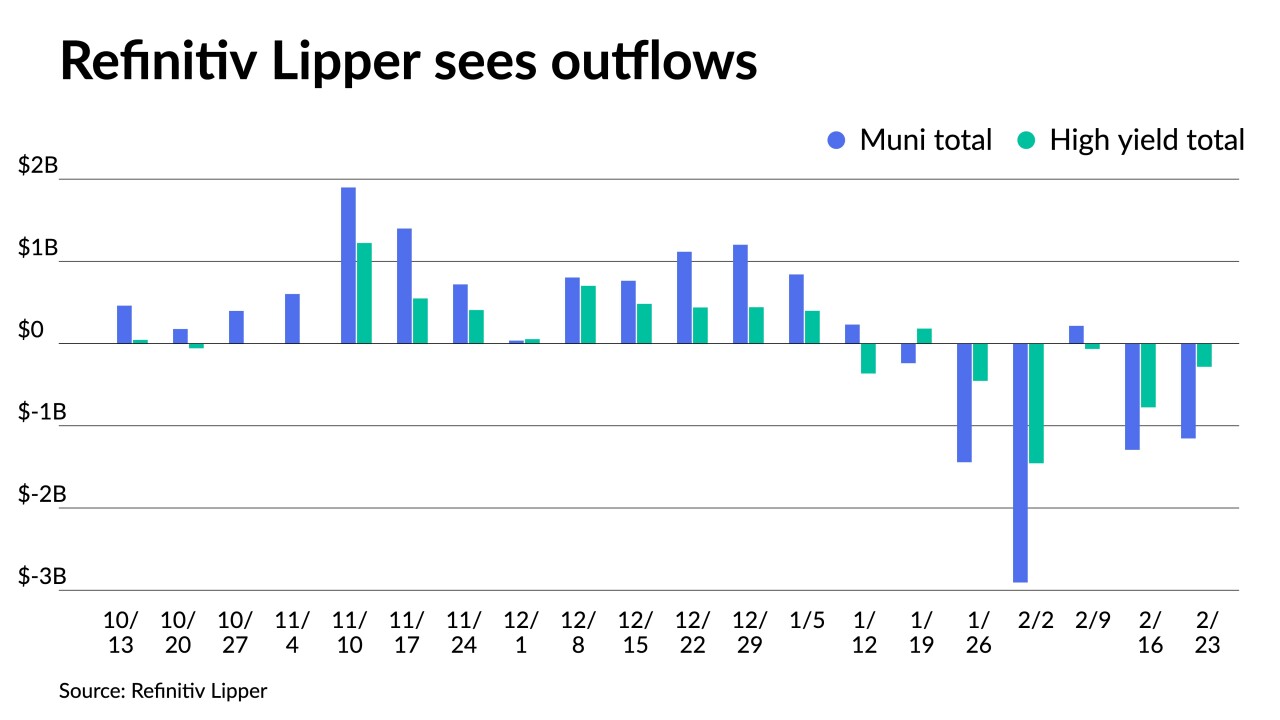

Investors yanked $1.154 billion out of municipal bond mutual funds in the latest week, Refinitiv Lipper reported.

February 24 -

The Investment Company Institute on Wednesday reported $3.120 billion of outflows in the week ending Feb. 16, up from $993 million of outflows in the previous week.

February 23 -

Between the long holiday weekend and investors trying to absorb the Russia-Ukraine developments, it was a slow start to the week in the municipal market.

February 22 -

Municipals have been resilient throughout the pandemic — with the help of federal aid — keeping the Golden Age for public finance alive.

February 22 -

The new-issue calendar for the holiday-shortened week is $4.98 billion, with $3.633 billion of negotiated deals and $1.347 billion of competitive loans.

February 18 -

Refinitiv Lipper reported outflows after inflows of $216 million the previous week.

February 17 -

Rates could go up faster than they did in 2015 if predictions for the economy hold, minutes from the FOMC said, but the release offered no hints as to whether a 50 basis point liftoff would be considered.

February 16 -

Issuance of ESG bonds is projected to grow 23% this year, while the entire market only expands by 2%, S&P Global Ratings analysts said.

February 16 -

Municipal bonds' relative value has increased dramatically as rates have risen and credit fundamentals have improved, with municipal-to-Treasury ratios now on par with their five-year averages.

February 15 -

Inflation remains under market scrutiny, with Monday’s data suggesting consumers expect price pressures to cool later this year.

February 14 -

Municipal yields rose up to 10 basis points on the short end, playing catch up to the volatility of Treasuries' moves on Thursday. Rising UST rates will inevitably be more significant for munis until they settle into more stable levels.

February 11