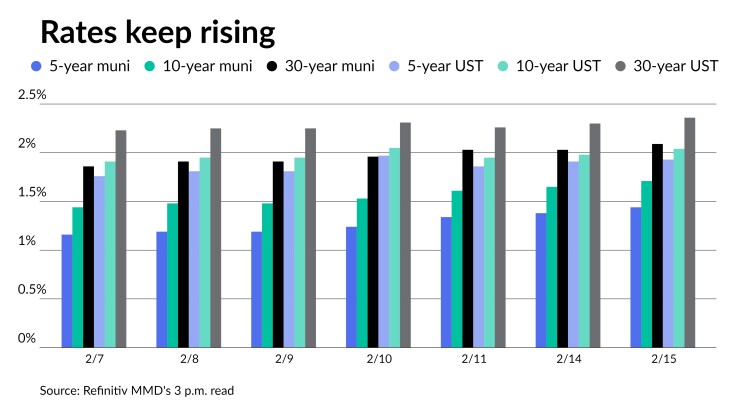

Municipal triple-A yield curves were cut up to six basis points Tuesday in another day of selling pressure exacerbated by losses in U.S. Treasuries while equities rallied on easing Russian/Ukraine tensions.

The municipal to UST ratio five-year was at 74%, 84% in 10 and 89% in 30, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 72%, the 10 at 84% and the 30 at 89% at a 4 p.m. read.

Municipal bonds' relative value has increased dramatically as rates have risen and credit fundamentals have improved. While the market is expected to experience more volatility in the short term, BlackRock strategists expect buying on the weakness. The recent declines have restored value to the asset class, with municipal-to-Treasury ratios now on par with their five-year averages, they note.

The investment-grade muni-to-US-corporate ratio fell from 46% t to 61%, close to its five-year average, indicating a drop in muni valuation to a level not seen since late 2020, according to a report from BlackRock's Peter Hayes, head of the Municipal Bonds Group, James Schwartz, head of municipal credit research and Sean Carney, head of municipal strategy.

The single-A to triple-B ratio in the municipal market has risen to levels not seen since 2018, indicating an opportunity to increase exposure to higher-quality bonds, they said. In comparison to its five-year average, the BBB- to-high-yield ratio has also increased from last summer's low and is approaching fair value.

With the surge in rates, they said high-yield municipals have become more affordable, lagging the broader market by 21 basis points. Any forced selling caused by negative fund flows should be considered as an opportunity to find cheap bonds on the secondary market, they said.

“Rising interest rates, spurred by waning fears of the new COVID-19 Omicron variant and plans by the U.S. Federal Reserve to withdraw monetary support, pressured the market early in the month,” they said. “However, amid less favorable supply/demand dynamics and rich valuations, munis underperformed comparable U.S. Treasuries into month-end.”

While new-issue supply has been lower in January and February, “the market contended with elevated secondary trading as bid-wanted activity accelerated when sentiment turned less constructive and fund managers were forced to raise cash to meet redemptions,” they said. “This ‘shadow supply’ weighed on the market.”

Within a barbell yield curve strategy, BlackRock has shifted to a long duration stance on municipal bond positioning.

"We prefer higher-quality bonds overall but will look to add select lower-quality credits with more attractive valuations," they said. "We continue to focus on defensive sectors and favor bonds with higher coupons and shorter calls."

In the primary market Tuesday, Citigroup Global Market priced for University of Washington (Aaa/AA+//) $209.09 million of taxable general revenue refunding bonds, Series 2022B. Bonds all priced at par: 0.90% in 7/2022, 2.211% in 2027, 2.637% in 2032 and 3.35% in 2041, callable 7/1/2032.

J.P. Morgan Securities priced for Mount Nittany Medical Center, Pennsylvania (/A+/AA-/) $300 million of taxable revenue bonds, Series 2022. Bonds in 11/2052 priced at 3.799% par.

J.P. Morgan Securities priced for Peninsula Corridor Joint Powers Board, California (/AA+//AAA/) $140 million of green climate-certified Measure RR sales tax revenue bonds, 2022 Series A. Bonds in 6/2025 with a 5% coupon yield 1.24%, 5s of 2027 at 1.42%, 5s of 2032 at 1.76%, 5s of 2037 at 2.04%, 5s of 2042 at 2.17%, 5s of 2042 at 2.30% and 5s of 2051 at 2.34%, callable 6/1/2031.

In the competitive market, Wake County, North Carolina (Aaa/AAA/AAA/) sold $206.06 million of general obligation public improvement bonds, Series 2022A, to BofA Securities. Bonds in 2/2023 with a 5% coupon yield 0.80%, 5s of 2027 at 1.43%, 5s of 2032 at 1.73%, 3s of 2037 at 2.22% and 2.5s of 2041 at 2.55%, callable 2/1/2032.

Wake County, North Carolina (Aaa/AAA/AAA/) also sold $42.215 million of general obligation parks, greenways recreation and open space bonds, Series 2022C, to BofA Securities. Bonds in 2/2023 with a 5% coupon yield 0.80%, 5s of 2027 at 1.43%, 5s of 2032 at 1.73%, 3s of 2037 at 2.23% and 3s of 2041 at 2.32%, callable 2/1/2032.

Wake County, North Carolina (Aaa/AAA/AAA/) also sold $39.705 million of general obligation refunding bonds, Series 2022B, to J.P. Morgan Securities. Bonds in 2/2023 with a 5% coupon yields 0.81%, 5s of 2027 at 1.43% and 5s of 2031 at 1.69%, noncall.

Waco, Texas (Aa1/AA+/) sold $103.22 million of combination tax and revenue certificates of obligation, Series 2022A, to HilltopSecurities. Bonds in 2/2023 with a 4% coupon yield 0.90%, 4s of 2027 at 1.55%, 5s of 2032 at 1.93%, 3s of 2037 at 2.52%, 4s of 2042 at 2.42%, 3s of 2047 at par and 3s of 2052 at 3.051%, callable 2/1/2032.

Secondary trading

Massachusetts 5s of 2023 at 0.99%. New York City 5s of 2025 at 1.42%-1.40%. Maryland 5s of 2025 at 1.39% versus 1.07% on 2/10.

North Carolina 5s of 2027 at 1.47%. Columbia University 5s of 2028 at 1.55%. District of Columbia 5s of 2029 at 1.69%-1.68%.

Triborough Bridge and Tunnel Authority 5s of 2031 at 1.74%. Charleston, South Carolina 4s of 2032 at 1.76%-1.75%. Massachusetts Clean Water Trust 5s of 2033 at 1.85%-1.86%.

Los Angeles County Metropolitan Transportation Authority 5s of 2041 at 2.02% versus 1.85%-1.78% on 2/9. Washington 5s of 2042 at 2.17%-2.15% versus 1.93%-1.91% on 2/7. Washington 5s of 2046 at 2.15%.

New York City TFA 3s of 2051 at 3.10%. Los Angeles DWP 5s of 2051 at 2.39% versus 2.00%-1.99% on 2/3.

AAA scales

Refinitiv MMD's scale saw were cut six basis points at the 3 p.m. read: the one-year at 0.84% (+6) and 1.11% (+6) in two years. The five-year at 1.44% (+6), the 10-year at 1.71% (+6) and the 30-year at 2.09% (+6).

The ICE municipal yield curve saw cuts of four to five basis points: 0.87% (+5) in 2023 and 1.16% (+5) in 2024. The five-year at 1.41% (+4), the 10-year was at 1.73% (+4) and the 30-year yield was at 2.10% (+3) in a 4 p.m. read.

The IHS Markit municipal curve was cut: 0.83% (+6) in 2023 and 1.10% (+6) in 2024. The five-year at 1.45% (+6), the 10-year at 1.70% (+6) and the 30-year at 2.09% (+6) at a 4 p.m. read.

Bloomberg BVAL was cut four to five three basis points: 0.86% (+4) in 2023 and 1.09% (+4) in 2024. The five-year at 1.44% (+5), the 10-year at 1.70% (+5) and the 30-year at 2.08% (+4) at a 4 p.m. read.

Treasuries were mixed while equities ended in the black.

The two-year UST was yielding 1.576%, the five-year was yielding 1.938%, the 10-year yielding 2.044%, and the 30-year Treasury was yielding 2.416% at the close. The Dow Jones Industrial Average gained 422 points or 1.22%, the S&P was up 1.58% while the Nasdaq was up 2.53% at the close.

Inflation rages, Fed speculation continues

Inflation continues to run hot, as Tuesday’s data suggests, leaving analysts to speculate about how fast and how often the Federal Reserve will increase interest rates.

“Some Fed officials have taken the recent uptick in costs to indicate the need for a faster pace of rate hikes, however, these voices appear to be the more hawkish outliers of the group,” said Stifel Chief Economist Lindsey Piegza. “The consensus continues to support a more measured approach to rate hikes against the backdrop of the Fed's forecast for price pressures to ease markedly heading into the second half of the year and further into 2023.”

But the Fed is “most likely” behind the curve, she noted. “The Fed could have easily initiated a rollback of crisis-level policies months ago.” While raising rates could have curbed inflation expectations and tamped down demand, Piegza said, the fed funds rate won’t impact “supply-side price pressures stemming from supply chain disruptions.”

Plus, the recovery is “fragile,” so the Fed needs to be careful with its actions, she said. “The Committee understands that an overly aggressive pathway will not address heightened costs due to supply chain limitations but would rather leave consumers to still face rising end prices and the effects of a weakened economy.”

While the January producer price index soared 1.0%, with December’s gain revised up to 0.4% and the core up 0.8% after an upwardly revised 0.6%, bringing the annual climbs to 9.7% and 8.3%, respectively, Craig Brothers, senior portfolio manager and co-head, fixed income/partner at Bel Air Investment Advisors, said, “the telling number in the Empire State Manufacturing Survey was the prices received component,” which was at its highest level since 2001, “proving that prices are being passed on to the consumer."

Waiting for inflation to wane “is clearly not working,” Brothers said. The Fed will have another read on CPI and PPI and two on employment before its next meeting.

“At this point, the market is pricing in 63% chance of a 50 bp hike in March,” he said. “Historically, if the market pricing gets to an 85% likelihood, the Fed goes with the market sentiment. Leading with a 50 bp hike is out of character but the Fed is way behind and the market might force their hand. The Fed needs to show the market that it can respond forcefully or risk having to go much higher later and risk a recession."

But supply chain issues are the true problem, said Bryce Doty, senior vice president/portfolio manager of Sit Investment Associates. “Supply chain constraints are worsening.”

The number of container ships waiting to get into California ports have jumped in the past two months, he said. “It takes this kind of mess to have finished goods producer prices running at three-month inflation rates not seen since the raging inflation days in 1981.”

Supply shortages affected the Empire State manufacturing report, with demand still strong, Doty said.

“No amount of rate hikes will resolve these shortages yet the Fed wants rates higher and a smaller balance sheet,” he added. “This data gives them all the firepower necessary to raise rates more quickly. I believe they want fed funds to get to 2% as quickly as possible and to break free from quarter point increments.”

Low borrowing costs have added to leverage levels, Doty said, so rate increases may have to start slowly. “But we expect one or two 50 bp increases sometime this year and for fed funds to rise by 1.5% to 2.0% over the next 12 months.”

Primary to come

Pennsylvania Housing Finance Agency (Aa1/AA+//) is set to price Wednesday $255.495 million of non-alternative minimum tax social single-family mortgage revenue bonds, Series 2022-138, serials 2022-2032, terms 2037, 2042, 2047 and 2052. Wells Fargo Bank.

Wisconsin (Aa1/AA+//AAA/) is set to price daily $236.975 million of taxable general obligation refunding bonds of 2022, Series 2, serials 2023-3032 and 2037. UBS Financial Services.

Waco Independent School District, Texas, is set to price Thursday $185 million of unlimited tax school building bonds, Series 2022. Oppenheimer & Co.

Sanger Unified School District, California, is set to price Wednesday $105 million of 2022 certificate of participation. Stifel, Nicolaus & Co.

Georgetown Independent School District, Texas, (Aaa/AAA//) is set to price daily $103.88 million of taxable unlimited tax refunding bonds, Series 2022-A, insured by Permanent School Fund Guarantee Program. FHN Financial Capital Markets.

Northside Independent School District, Texas, (Aaa//AAA//) is set to price Tuesday $100.42 million of unlimited tax school building bonds, Series 2022A, insured by Permanent School Fund Guarantee Program. Morgan Stanley & Co.

Competitive:

Delaware is set to sell $251.55 million of general obligation bonds, Series 2022 at 11 a.m. eastern Wednesday.