-

The second quarter should bring more opportunity and less volatility following the worst quarter in four decades, analysts said.

April 14 -

Investors pulled more from municipal bond mutual funds as the Investment Company Institute on Wednesday reported $4.786 billion of outflows, up from $4.459 billion of outflows in the previous week.

April 13 -

The the $389.495 million of tax-exempts were sold late last month to help fund construction of the Broward County Convention Center Headquarters Hotel.

April 13 -

Denver will head to the municipal market next week with its biggest new money general obligation bond sale ever at $366.4 million.

April 13 -

Apollo will make an equity and credit investment that will significantly increase SWS’s underwriting capacity for municipal and corporate debt, as well as equity offerings, the firms said.

April 13 -

The March consumer price index offered little to deter the Federal Reserve from its aggressive plans, but markets saw it as a positive, having feared an upside miss.

April 12 -

Triple-A yields continue to rise, with the two-year muni just below 2%, the five well above and the 10-year approaching 2.5%.

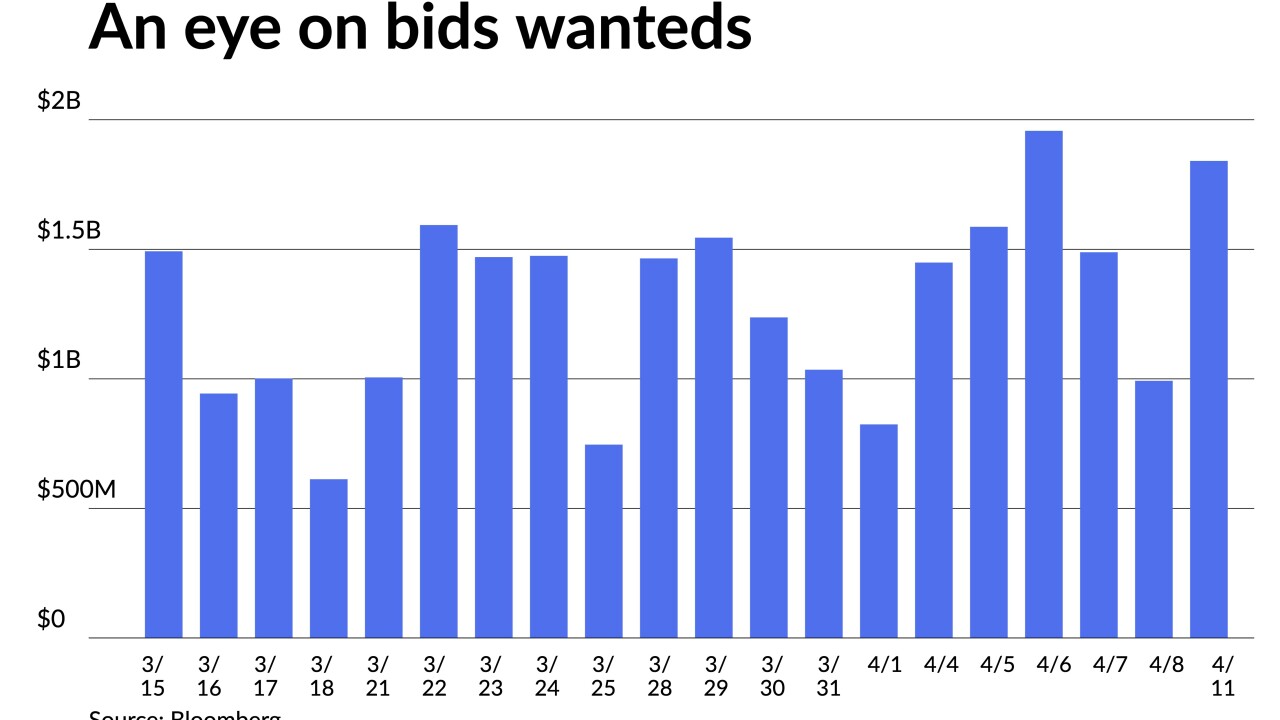

April 11 -

Supply for the holiday-shortened week is $4.8 billion. Municipals performed the worst since 1980 in the first quarter of 2022, but some analysts see the pain subsiding.

April 8 -

Investors pulled more from municipal bond mutual funds in the latest week, with Refinitiv Lipper reporting $3.247 billion of outflows, of that $1 billion was high-yield. ETFs are still seeing inflows.

April 7 -

The university will decide on a final structure for a $500 million sale that could go as long as 100 years at the time of pricing, which is expected next week.

April 7