-

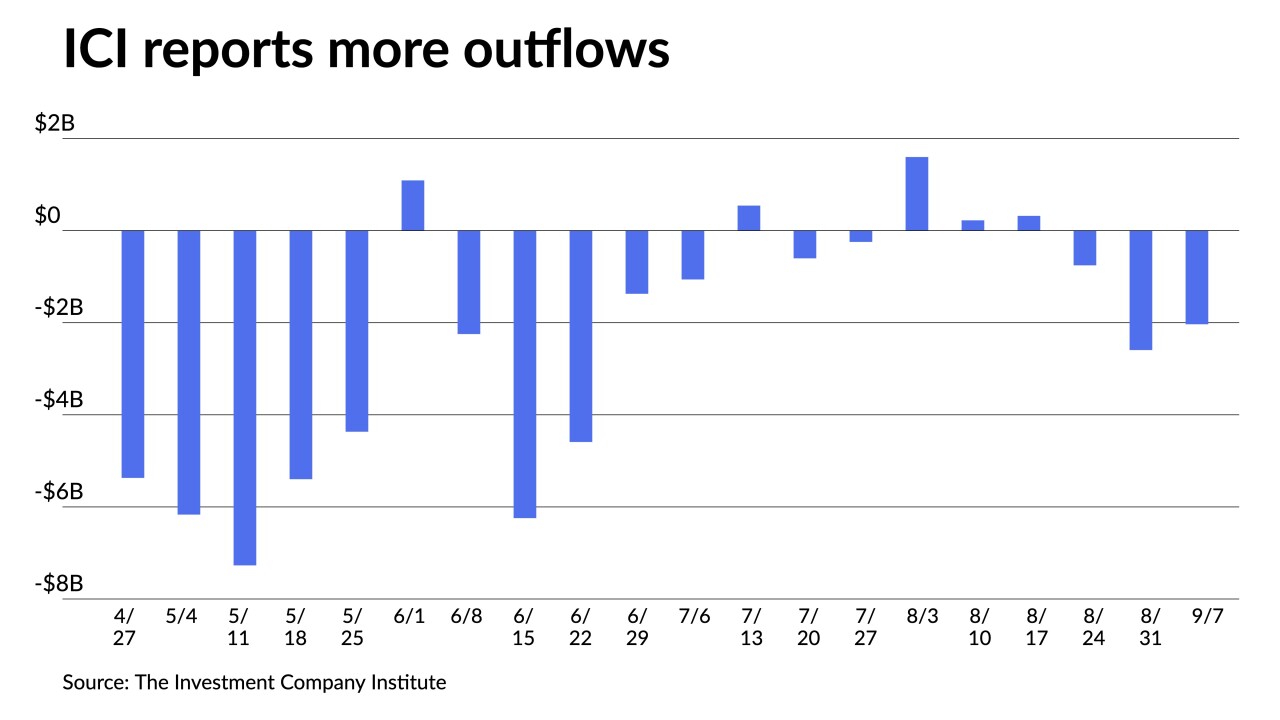

"Everyone is trying to figure out when the outflow cycle is over," said Craig Brandon, co-director of municipal investments at Eaton Vance.

September 15 -

The Investment Company Institute reported $2.034 billion of outflows from muni bond mutual funds in the week ending Sept. 7 compared to $2.594 billion of outflows the previous week.

September 14 -

A whopping 91% of Bond Buyer California Public Finance Conference survey respondents expect municipal interest rates will end the year higher than current rates and 73% said rates will have the largest impact on the public finance industry in the next two quarters

September 14 -

Muni and UST yields surged Tuesday on expectations the Fed will have to aggressively raise interest rates to bring down inflation.

September 13 -

Even after investors received an infusion of $18 billion of matured and called bond proceeds on Sept. 1, muni prices have continued to weaken, note CreditSights strategists Pat Luby and John Ceffalio.

September 12 -

The calendar for the week of Sept. 12 is at $6.6 billion while Bond Buyer 30-day visible supply sits at $14.15 billion.

September 9 -

The state will hold an in-person and remote investor meeting Sept. 21 before heading into the market the following week.

September 9 -

Outflows from municipal bond mutual funds receded as investors pulled $1.090 billion out of funds in the latest week, versus the $3.416 billion of outflows the prior week, according to Refinitiv Lipper data.

September 8 -

Richmond issued $154.1 million in pension obligation bonds in a refunding that terminates swaps, ends a county intercept, and extends the final maturity.

September 8 -

Tollway revenue in the first half of 2022 surpassed pre-pandemic 2019 levels in five of the months.

September 8