Municipals were steady Friday ahead of a new-issue calendar next week at $6.6 billion, while U.S. Treasuries were weaker five years and in and equities rallied.

"While the U.S. economic data remain relatively strong, this hawkish tone continues to put pressure on Treasury rates, which have moved higher by 10-15 basis points this week, more so in the front end," according to Barclays PLC.

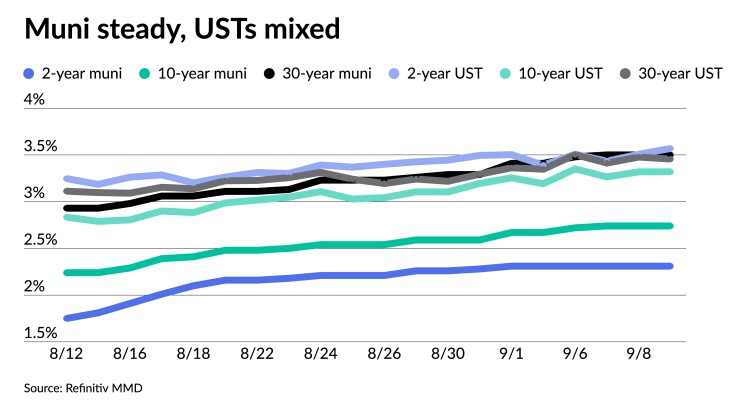

Tax-exempts have "largely kept up with the UST move, and MMD-UST ratios have moved sideways," said Barclays strategists Mikhail Foux, Clare Pickering and Mayur Patel.

Compared with the mid-August levels, they noted that ratios "are substantially higher, especially for shorter-dated maturities."

Two- and three-year muni-UST ratios are around 64% to 66%. The five-year was at 70%, the 10-year at 83% and the 30-year at 101%, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 69%, the 10 at 85% and the 30 at 100% at a 4 p.m. read.

"Treasury rates are closing in on their June peaks as the Fed ups its QT to the cap of $95 billion per month," with muni rates following, said BofA strategists Yingchen Li and Ian Rogow. "The only difference lies between how the two curves twisted in the 'non-recession' environment."

For USTs, "the 10-year became the center of bearishness as 2/10 Treasury steepened and 10/30 flattened." In munis, though, "the 10-year was the point of resilience, with 2/10 AAA flattening and 10/30 AAA steepening," Li and Rogow noted.

"The directions of SIFMA and short AAA coupon bonds have reversed in the past three weeks," Barclays strategists said. The SIFMA Index is at 1.39% after reaching a peak of 1.89% on Aug. 10.

The SIFMA index has "rallied more than 40 basis points since mid-August, while yields of short bonds have increased about 65 basis points, resulting in a more than 100 basis point underperformance for the latter in less than one month," they noted. Shorter-dated bonds are starting to look more interesting to at current levels.

While tax-exempts had a difficult end of August, taxables did relatively well, especially compared with corporates. "Taxable municipal spreads tightened about 10 basis points, while the corporate index widened nearly 15 basis points," Barclays strategists said.

They are cautious on all risky assets in the next one to two months, "but with taxable muni spreads not far from the lows reached in early summer," they are especially cautious with this sub-municipal sector. "If corporate spreads continue to widen, taxables will follow," they said.

Muni supply-demand conditions, BofA strategists said, "have been weaker recently as

However, they said there is a difference between this time and May, as "investors do not seem to have the urge to sell as evidenced by very light secondary market trading volumes."

This is because "the primary market is lighter in September and fund outflows are much lighter than in May" and "dealer inventories are at a very low level — just like in the beginning of the year," Li and Rogow said.

"Since which Fed meeting is the second-to-last hike is not known currently, we believe holding positions and hedging dynamically are more appropriate until at least next week's CPI report," or even to the Fed meeting on Sept. 21, "while keeping in mind that the pivot time is moving closer," they said. New purchases should be focused on high grades and high coupons, they said. Ratios in the long end remain cheap to Treasuries.

For trading accounts with short horizons, deep discount bonds "are not necessarily something to fear as such bonds' durations are more stable and thus easier to hedge," Li and Rogow said. Some of these bonds are discounted beyond their fair values and "deserve to be looked at should extreme multi-year bearish views turn out to be excessive."

More constructively, they said, if the market rallies significantly in a short period of time, "tax consequences of de minimus would be very small as the rule is really a tax on time, i.e., 'the price appreciation due to accretion,' not 'the price appreciation due to yield change.' "

Calendar growing

Bond Buyer 30-day visible supply sits at $14.15 billion while Bloomberg data puts net negative supply at $4.776 billion.

Investors will be greeted Monday with a new-issue calendar estimated at $6.559 billion.

There are $5.117 billion of negotiated deals on tap and $1.443 billion on the competitive calendar.

The negotiated calendar is led by the $667 of system revenue refunding bonds from the North Texas Tollway Authority, followed by $491 million of gas project revenue bonds from the Black Belt Energy Gas District, Alabama; $452 million of pollution control revenue refunding bonds from the Public Finance Authority, Wisconsin; and $450 million of consolidated bonds from the Port Authority of New York and New Jersey.

Los Angeles leads the competitive calendar with $389 million of taxable GOs, along with $264 million of revenue bonds from the California Department of Water Resources and $100 million of GOs from Norwood, Massachusetts.

Secondary trading

Ohio 5s of 2023 at 2.30%. Wake County, North Carolina, 5s of 2024 at 2.33%-2.31%. Maryland 5s of 2024 at 2.34% versus 2.17%-2.16% on 8/18.

Minnesota 5s of 2027 at 2.47%-2.46% versus 2.32% on 8/29 and 2.33% on 8/25. Maryland 5s of 2027 at 2.43%.

Dallas County, Texas, 5s of 2032 at 2.98% versus 2.70%-2.71% on 8/22 and 2.70% original on 8/18. Montgomery County, Pennsylvania, 5s of 2034 at 3.03% versus 3.10% Thursday.

LA DWP 5s of 2041 at 3.65% versus 3.43%-3.42% on 8/25. California 5s of 2041 at 3.68%-3.67% versus 3.73% Wednesday and 3.24% on 8/24. Washington 5s of 2043 at 3.81%-3.80% versus 3.82% Wednesday.

AAA scales

Refinitiv MMD's scale was unchanged at 3 p.m. read: the one-year at 2.28% and 2.31% in two years. The five-year at 2.40%, the 10-year at 2.74% and the 30-year at 3.50%.

The ICE AAA yield curve was bumped one basis point bumped 10 years and in: 2.31% (-1) in 2023 and 2.33% (-1) in 2024. The five-year at 2.40% (-1), the 10-year was at 2.80% (-1) and the 30-year yield was at 3.50% (flat) at a 3:30 p.m. read.

The IHS Markit municipal curve was unchanged: 2.26% in 2023 and 2.34% in 2024. The five-year was at 2.44%, the 10-year was at 2.75% and the 30-year yield was at 3.48% at a 4 p.m. read.

Bloomberg BVAL was steady: 2.33% (unch) in 2023 and 2.35% (unch) in 2024. The five-year at 2.38% (unch), the 10-year at 2.71% (unch) and the 30-year at 3.48% (unch) at 3:30 p.m.

Treasuries were mixed

The two-year UST was yielding 3.561% (+5), the three-year was at 3.600% (+3), the five-year at 3.440% (+2), the seven-year 3.410% (flat), the 10-year yielding 3.320% (flat), the 20-year at 3.711% (-1) and the 30-year Treasury was yielding 3.460% (-2) near the close.

Primary to come:

The North Texas Tollway Authority is set to price Wednesday $667.185 million of system revenue refunding bonds, consisting of $480.330 million of first tier bonds (A1/AA-//), Series 2022A, serials 2024-2026 and 2036-2040, and $186.855 million of second tier bonds (A2/A+//), Series 2022B, serials 2024-2029. Siebert Williams Shank & Co.

The Black Belt Energy Gas District, Alabama, (Baa1//A-/) is set to price Tuesday $491.015 million of gas project revenue bonds, 2022 Series F. Goldman Sachs & Co.

The Public Finance Authority, Wisconsin, (Aa3/A//) is set to price Tuesday $451.700 million of Duke Energy Progress Project pollution control revenue refunding bonds, consisting of $410 million of non-AMT bonds, Series 2022A, and $41.700 million of AMT bonds, Series 2022B. J.P. Morgan Securities .

The Port Authority of New York and New Jersey is set to price Thursday $450 million of consolidated bonds, consisting of $250 million, Series 233, and $200 million, Series 234. Citigroup Global Markets.

The Los Angeles Community College District, California, (Aaa/AA+//) is set to price Wednesday $400 million of 2016 Election general obligation bonds, consisting of $300 million, Series C-1, serials 2023-2026, and $100 million, Series C-2, serial 2023. Citigroup Global Markets.

The issuer is also set to price Thursday $375 million of 2008 Election general obligation bonds, consisting of $200 million of tax-exempts, Series L-2, serials 2025-2037, and $175 million of taxable, Series L-2, serials 2023-2025. Ramirez & Co.

The Board Of Regents of the University of Texas System (Aaa/AAA/AAA/) is set to price Monday $338.100 million of permanent university fund bonds, Series 2022A, serials 2024-2034 and 2042. Barclays Capital.

Colorado Springs, Colorado, (Aa2/AA+//) is set to price Tuesday $286.275 million, consisting of $124.205 million of utilities system refunding revenue bonds, Series 2022A, and $162.070 million of utilities system improvement revenue bonds, Series 2022B. J.P. Morgan Securities.

Bon Secours Mercy Health, Ohio, (A1/A+/AA-/) is set to price Thursday $211.565 million, Series 2022B, consisting of $106.740 million, Series B-1, and $104.825 million, Series B-2. J.P. Morgan Securities .

The healthcare system (A1/A+/AA-/) also is set to price Thursday $189.110 million, Series 2022A, consisting of $93.785 million, Series SC, and $95.325 million, Series VA. J.P. Morgan Securities.

Austin, Texas, (/AAA/AA+/) is set to price Tuesday $164.955 million, consisting of $155.700 million of public improvement and refunding bonds, Series 2022, serials 2023-2042, and $9.255 million of public property finance contractual obligations, Series 2022, serials 2023-2029. Raymond James & Associates.

The Texas Department of Housing and Community Affairs (Aaa/AA+//) is set to price Wednesday $150 million of social non-AMT residential mortgage revenue bonds, Series 2022 B. Jefferies.

Sarasota County, Florida, (/AA+/AA+/) is set to price Wednesday $132.720 million of utility system revenue bonds, Series 2022, serials 2028-2042, terms 2047 and 2052. Citigroup Global Markets.

The Mississippi Business Finance Corporation is set to price Friday $100 million of green Enviva Inc. Project exempt facilities revenue bonds, Series 2022. Citigroup Global Markets.

Competitive:

The California Department of Water Resources (Aa1/AAA//) is set to sell $264.325 million of Central Valley Project water system revenue bonds, Series BF, at 11:30 a.m. eastern Tuesday.

Norwood, Massachusetts, is set to sell $100 million of unlimited tax general obligation school program, Chapter 70B bonds, at 11 a.m. Tuesday.

Los Angeles (Aa2/AA/AAA/) is set to sell $389.435 million of taxable social general obligation bonds, Series 2022-A, at noon eastern Thursday.