-

However another town is still struggling with issues that further threaten its already-strained viability while 14 local governments were designated as distressed under the viable utility reserve legislation.

August 2 -

J.P. Morgan held a one-day retail order for $1.65 billion of revenue bonds from the Dormitory Authority of the State of New York, while Minnesota sold $1.02 billion of GOs in the competitive market in five deals.

August 1 -

This week kicks off a flip of calendar to the final month of the summer reinvestment season and one of the larger new-issue calendars of the year.

July 31 -

For the coming week, investors will be greeted with a larger new-issue calendar led by large New York and Texas ISD issuers, along with gilt-edged Minnesota selling competitively.

July 28 -

Municipal bond mutual fund saw inflows with Refinitiv Lipper on Thursday reporting investors added $552.219 million to funds for the week ending Wednesday following $1.040 billion of outflows the previous week.

July 27 -

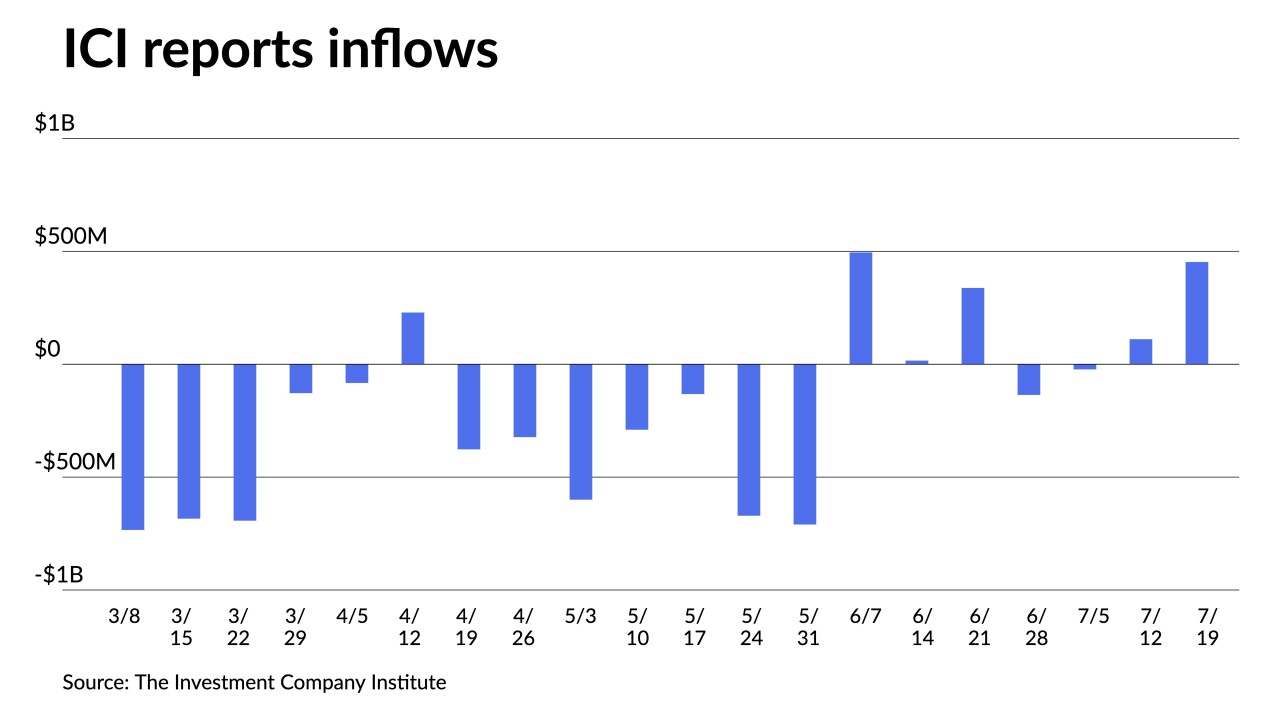

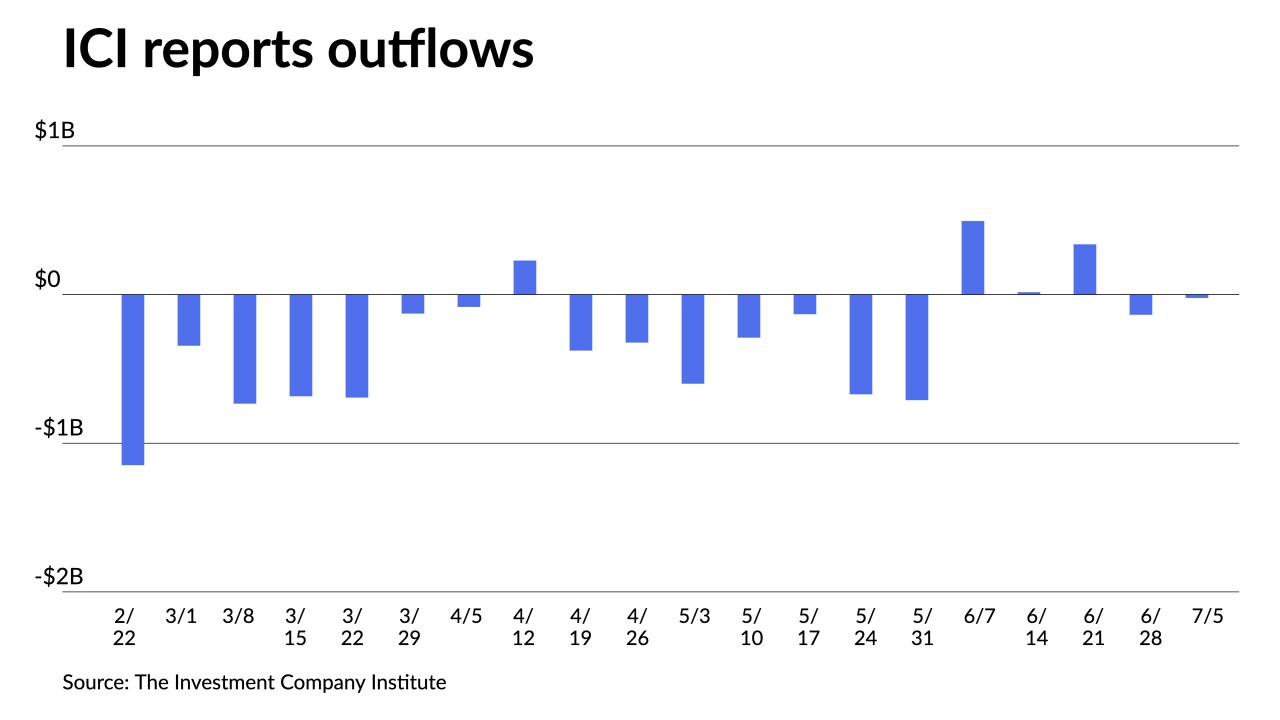

The Investment Company Institute reported investors added $453 million to municipal bond mutual funds in the week ending July 19, after $111 million of inflows the previous week.

July 26 -

The offered side "has continued to pack the primary market with value to manage their (and the market's) potential downside if disruption did occur; this also helps the context for muni buyers headed into the Fed," said Matt Fabian, partner at Municipal Market Analytics.

July 25 -

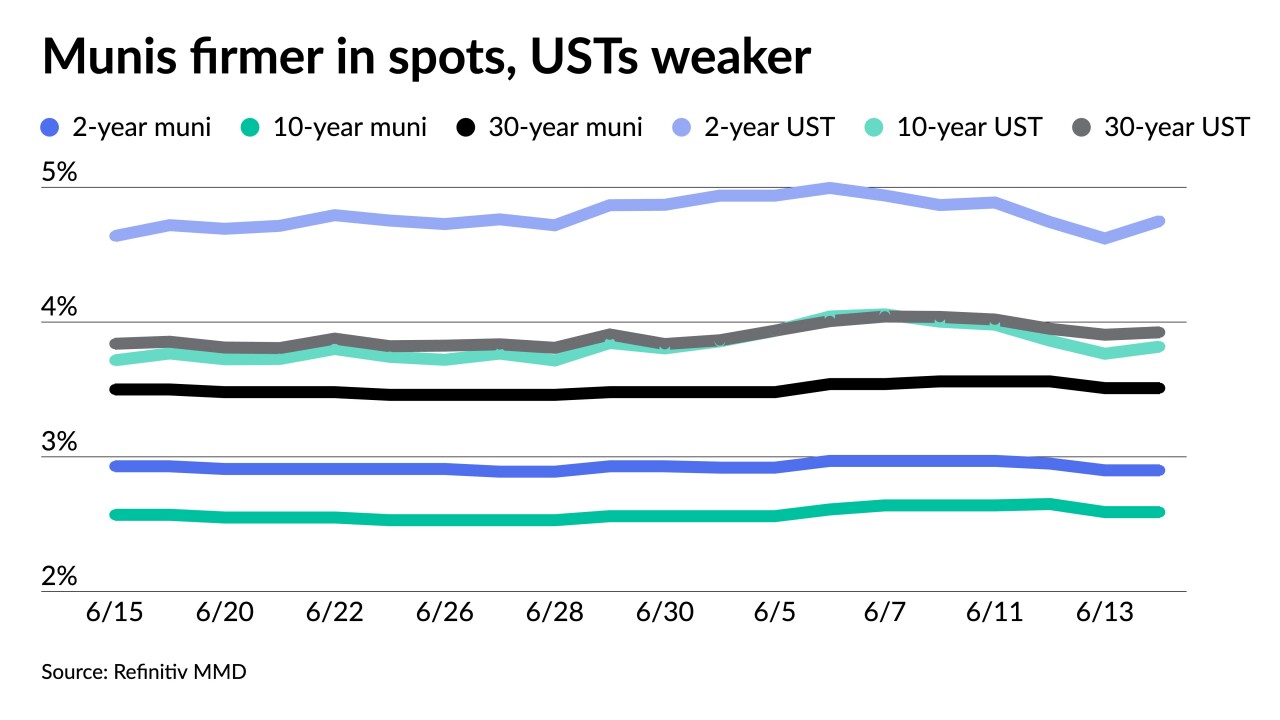

"Longer-dated bonds look attractive, as investors are locking in long-term rates before the expected decline in 2024," while "a tremendous amount of money is also invested in the short end of the curve," Nuveen strategists said.

July 24 -

Proceeds of the $178 million Series 2023 capital asset acquisition obligation bonds will finance programs for the county's general government and departments.

July 24 -

Washington will bring $1.1 billion of GOs in four competitive sales Tuesday, leading a new-issue calendar estimated at $5.439 billion.

July 21 -

Municipal bond mutual fund saw inflows with Refinitiv Lipper reporting investors added $1.040 billion to funds for the week ending Wednesday following $136.174 million of outflows the previous week.

July 20 -

The Investment Company Institute reported investors added $111 million to municipal bond mutual funds in the week ending July 12, after $ 23 million of outflows the previous week.

July 19 -

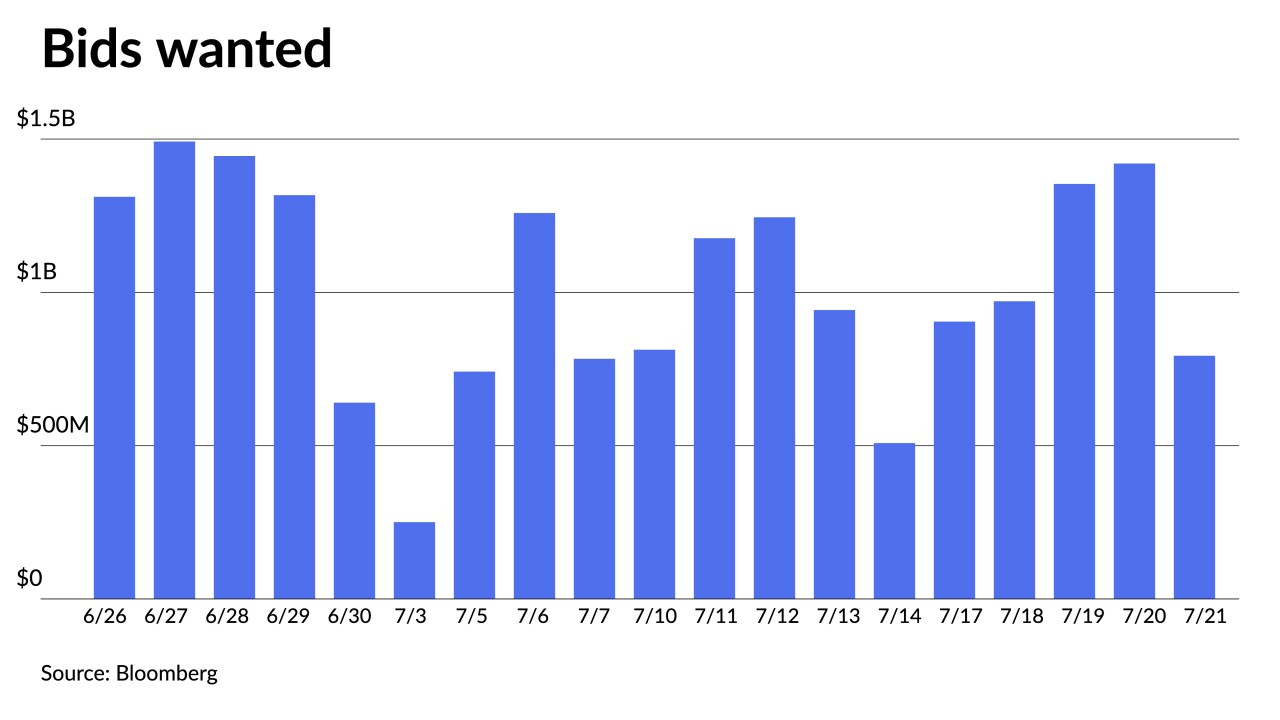

The back half of July is starting "much like the front half with ongoing UST volatility and municipal supply staying in the forefront," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

July 18 -

Long-duration and shorter-coupon munis saw ample demand last week. Investors, believing rates will fall as early as the first part of next year, continue to lock in long-bond yields, Nuveen strategists said.

July 17 -

The IFA and CWA launched a tender offer June 23 that closed Friday. The IFA and Citizens' tender invited holders of some bonds sold in 2014, 2016, and 2018 to tender their bonds as part of the water refunding.

July 14 -

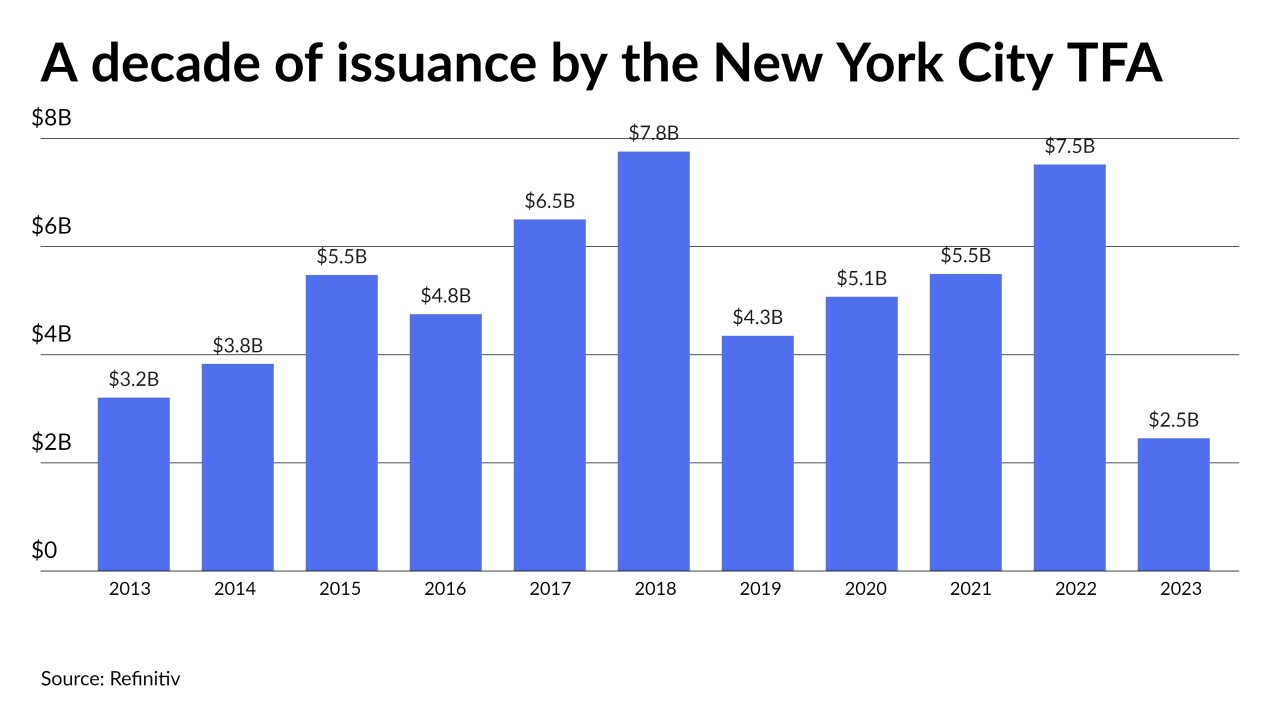

Bond Buyer 30-day visible supply climbs to $13.42 billion while the new-issue calendar is led by a $1 billion-plus New York City Transitional Finance Authority future tax-secured subordinate deal.

July 14 -

Proceeds from the sale will be used to fund infrastructure projects in the city's $164.8 billion 10-year capital plan.

July 14 -

Municipal bond mutual fund outflows continued as Refinitiv Lipper reported investors pulled $136.174 million from the funds for the week ending Wednesday following $855.719 million of outflows the week prior.

July 13 -

"The bond market finally got the relief from inflation it was hoping for," said Bryce Doty, senior vice president and senior portfolio manager at Sit Investment Associates.

July 12 -

With the third quarter officially under way, municipal bond experts say the tax-exempt market is poised for better performance and stronger market technicals ahead in the second half.

July 11