-

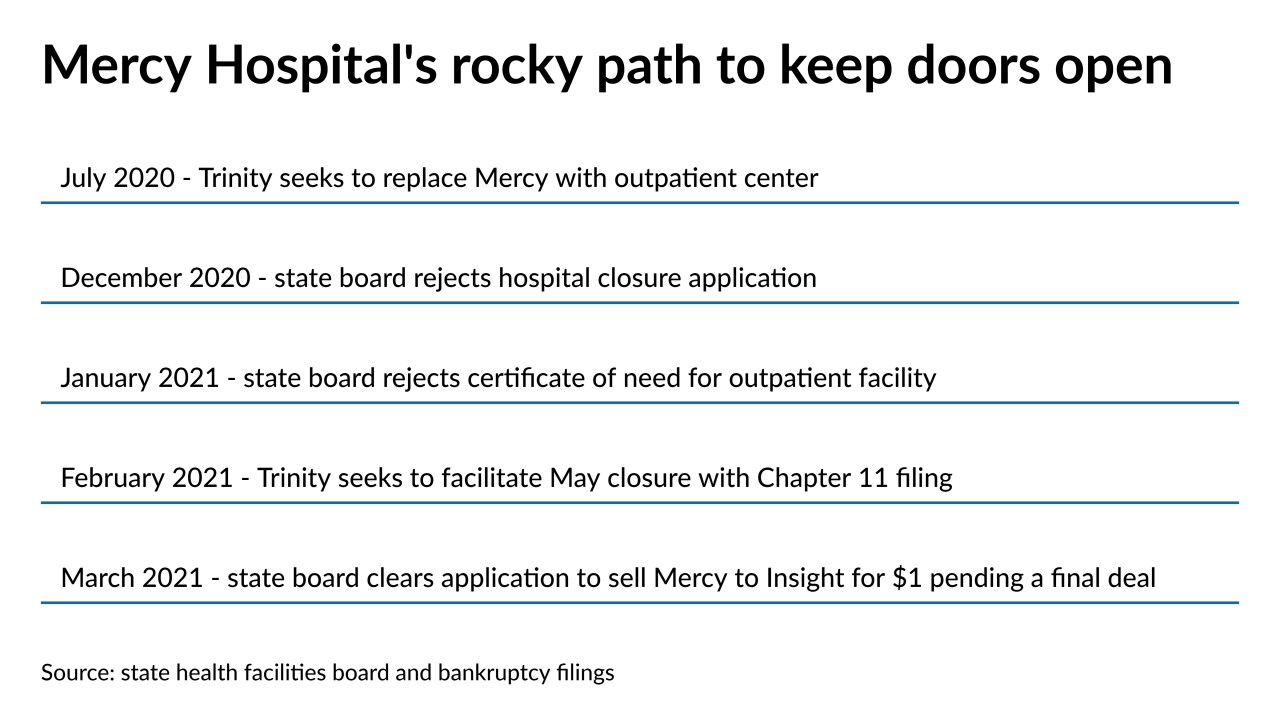

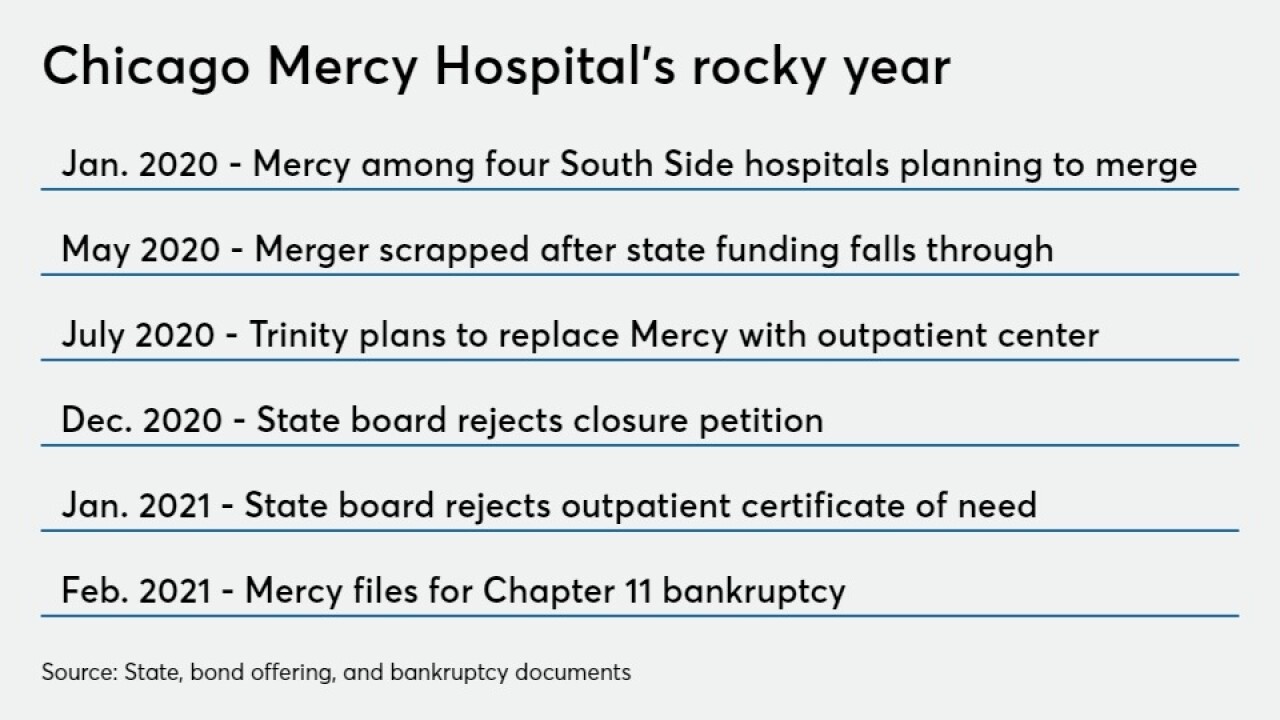

The proposed sale has dual benefits: Trinity gets to shed the facility outside of bankruptcy and the facility would remain open quieting local critics.

March 23 -

BJC Health System is selling $805 million of mostly refunding debt with its ratings and balance sheet intact as its manages COVID-19 pandemic wounds.

March 16 -

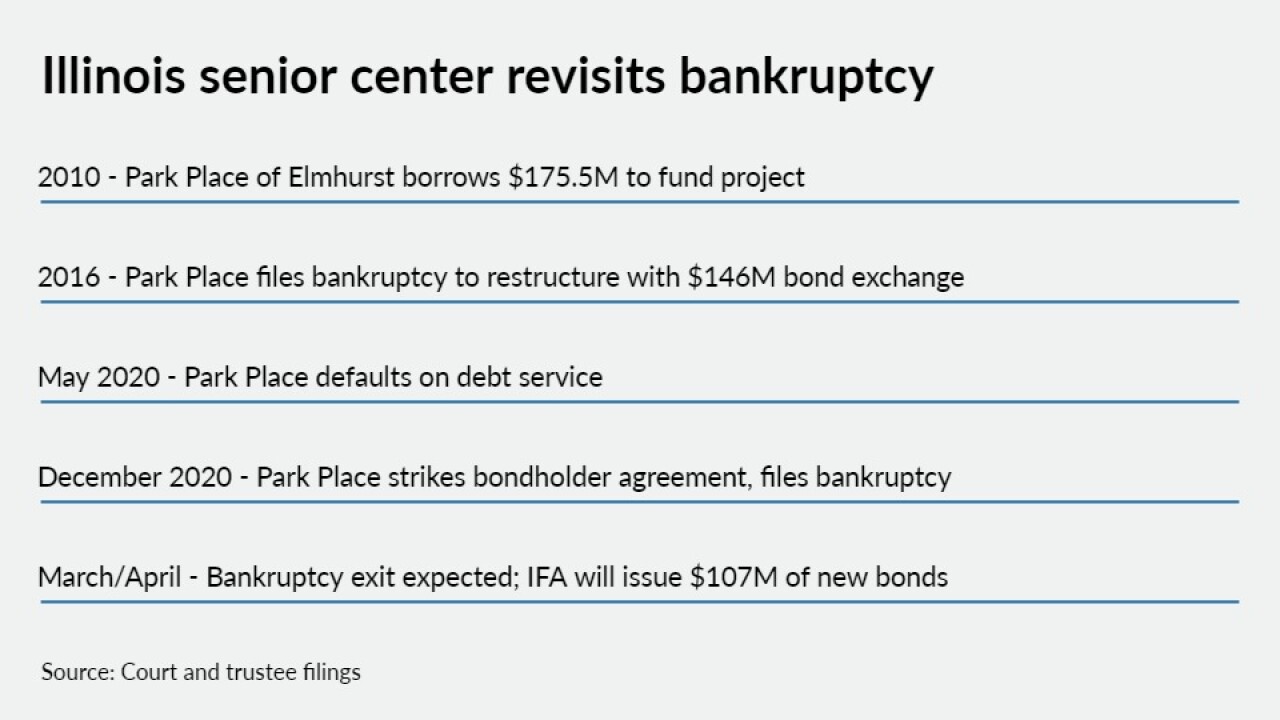

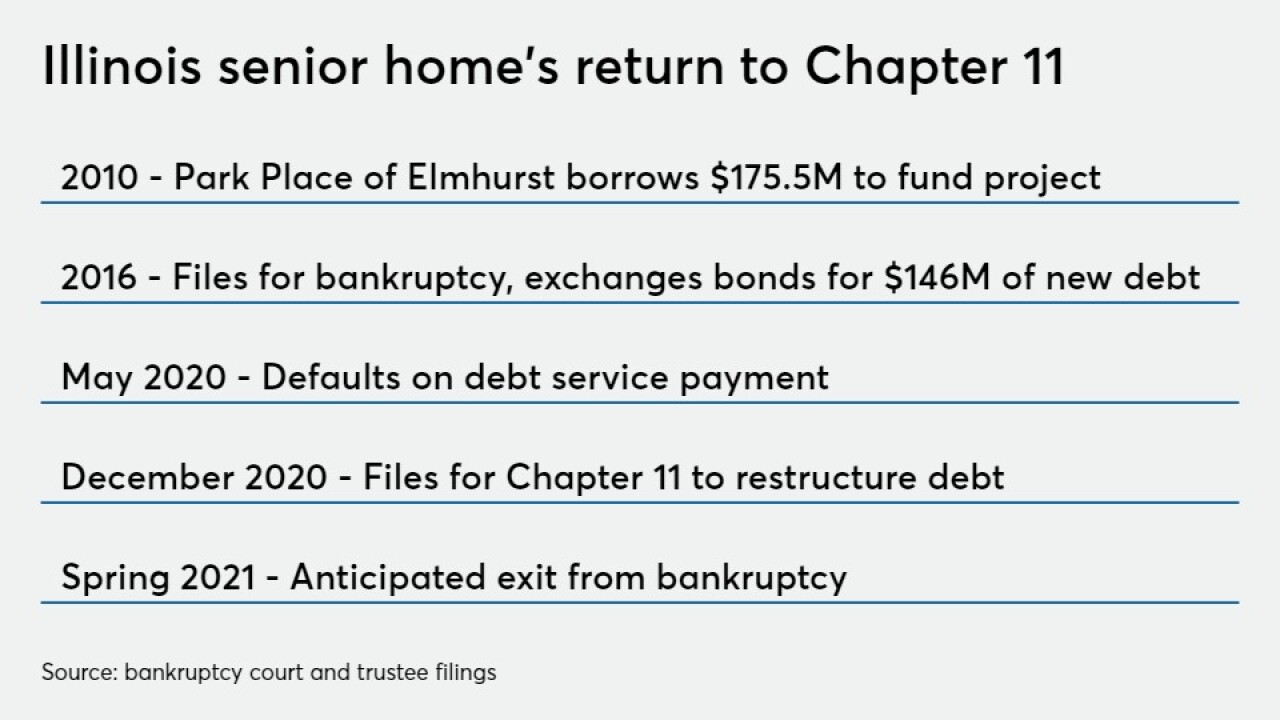

The facility and a majority of bondholders agreed to a restructuring that aims to ease repayment problems not solved by the previous bankruptcy in 2016.

February 24 -

S&P says Trinity's efforts to shed the fiscally struggling Mercy poses benefits and risks but the hospital is a small piece of the national not-for-profit's overall portfolio.

February 16 -

The Michigan-based nonprofit hospital chain expects a restructuring charge from the Mercy Hospital bankruptcy but no impact to its municipal bond debt.

February 11 -

HJ Sims has used Cinderella bonds, tender offers and forward deliveries to help senior living clients refinance without tax-exempt advance refundings.

February 10 -

CommonSpirt would shed some hospitals — mostly smaller critical access ones — under a letter of intent with the Minnesota-based system.

January 11 -

Federal CARES Act grants and loans, and bond market access, have helped mitigate the financial damage to hospitals caused by the pandemic.

January 7 -

Park Place at Elmhurst would restructure and redeem $141 million of bonds issued to exit its 2016 Chapter 11 under a plan pending before a bankruptcy court.

January 5 -

Pennsylvania nonprofit health system’s aggressive expansion has left it with a massive debt load, although default not an issue.

November 25