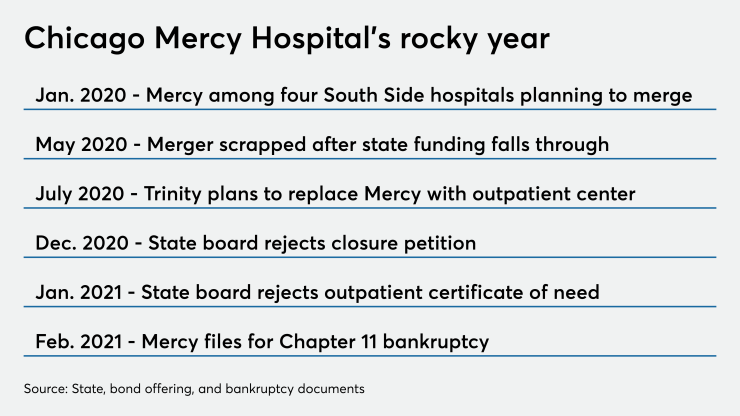

Michigan-based Trinity Health’s rating remains unchanged after its decision to unload Chicago-based Mercy Hospital through a Chapter 11 bankruptcy but the decision that has faced pushback from local officials could pose reputational risks, S&P Global Ratings said in a bulletin last week.

Trinity Health Credit Group carries a AA-minus rating from S&P. The bankruptcy filing last week in Chicago followed failed efforts to find a new operator and state efforts to block the facility’s closure and construct a $13 million outpatient center.

The decision to shutter the facility through

Mercy Hospital and Medical Center just south of Chicago’s downtown is not a member of the credit group and does not carry a designated affiliate designation that contributes to repayment of Trinity’s rated bonds. Management also assured S&P the action will not trigger any cross-default covenants under the master trust indenture.

“We believe there is reputational risk around the decision to file bankruptcy, but also recognize that on balance Mercy has significantly diluted system earnings and cash flow and requires meaningful capital investments so there are positive aspects to the decision for the overall Trinity Health credit,” S&P said.

S&P includes the entire Trinity Health system in its analysis, including non-obligated group members. Mercy accounted for a small portion of the system's total operating revenue and assets at 1.5% and 0.32%, respectively, for fiscal year 2020, S&P said in the bulletin.

Mercy has $76.4 million of outstanding long-term debt consisting of $48.9 million under two mortgage loans from the U.S. Department of Housing and Urban Development with the remaining liability an intercompany loan from Trinity Health. Trinity Health guarantees the HUD loan and will continue making payments.

“Should this change, the rating on Trinity Health could be negatively affected because, although this is not obligated group debt, it reflects on Trinity Health's overall willingness to fulfill its financial and contractual responsibilities,” the bulletin stated.

Local officials including Gov. J.B. Pritzker have blasted the effort to shutter the hospital without state approval and fear the impact on an area considered underserved by healthcare facilities. Some have vowed to fight it.

Mercy became part of the national system nearly a decade ago operating as a “health ministry” under the system. Trinity will record restructuring charges estimated between $90 million to $115 million. Trinity is also owner of Loyola Medicine in the Chicago suburbs.

Losses incurred at Mercy for the first six months of fiscal year 2021 totaled $30.2 million and averaged $5 million per month. The facility also has capital needs. It lost $303 million over the past seven years, according to Trinity’s January bond offering statement. The hospital recorded a $36.4 million loss for fiscal 2019 but ended fiscal 2020 with a positive position of $4.1 million due to an infusion of federal CARES Act aid.

Trinity, headquartered in Livonia, Michigan, is one of the largest U.S. non-profit systems, owning or managing 92 hospitals in 22 states with total operating revenues of $18.8 billion for fiscal 2020. It has $8 billion of debt.

“For investors in Trinity Health bonds, this is not a significant credit event. It cuts the losses so the impact upon the overall Trinity credit from that standpoint is positive,” Joseph Krist, publisher of Muni Credit News wrote late last week.

Mercy and Trinity say the wind-down of operations is a safety issue as physicians and other staff have quit and operating losses have accelerated to $7 million per month.