-

Refinitiv Lipper reported $238.926 million of outflows, but $182.035 million of inflows to high-yield, reversing last week's outflows. New-issues faced concessions.

January 20 -

The Federal Reserve expects Omicron to fizzle in weeks, and while pandemic-related risks remain, the economy is strong and the Fed needs to address inflation and could liftoff as soon as March, Bullard says.

January 6 -

ICI reported $1.101 billion of inflows into municipal bond mutual funds for the last week of 2021. Refinitiv Lipper figures on Thursday may give a sense of investor sentiment for week one of 2022.

January 5 -

Municipal volume is estimated at $1.13 billion for the opening week of 2022. Persistently strong net supply challenges will bias credit spreads tighter, credit discipline weaker in the next few years, analysts say.

December 30 -

2022 volume projections are clouded by many uncertainties. What is not murky is that demand for municipals is unlikely to fade.

December 30 -

Net supply pressure among tax-exempts is expected to worsen in January compared to last year and the move toward richer tax-exempts is unlikely to reverse. "Dealers seem to be acknowledging this looming challenge," MMA notes.

December 29 -

Municipal yield curves were little changed for the seventh straight session while Refinitiv Lipper reported the 40th week of inflows into municipal bond mutual funds, with high-yield seeing a large increase week over week.

December 9 -

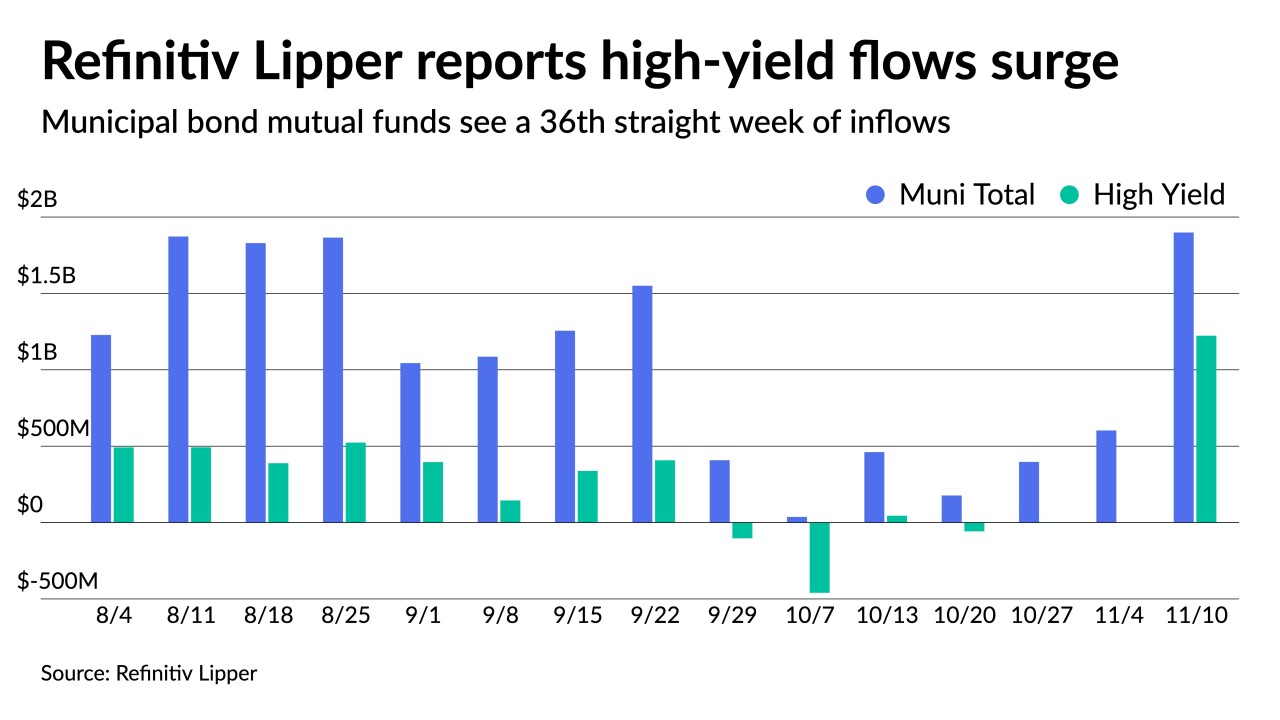

Investors put nearly $2 billion into municipal bond mutual funds for the most recent week with high-yield reversing a downward course to hit $1.2 billion following just $1 million a week prior.

November 12 -

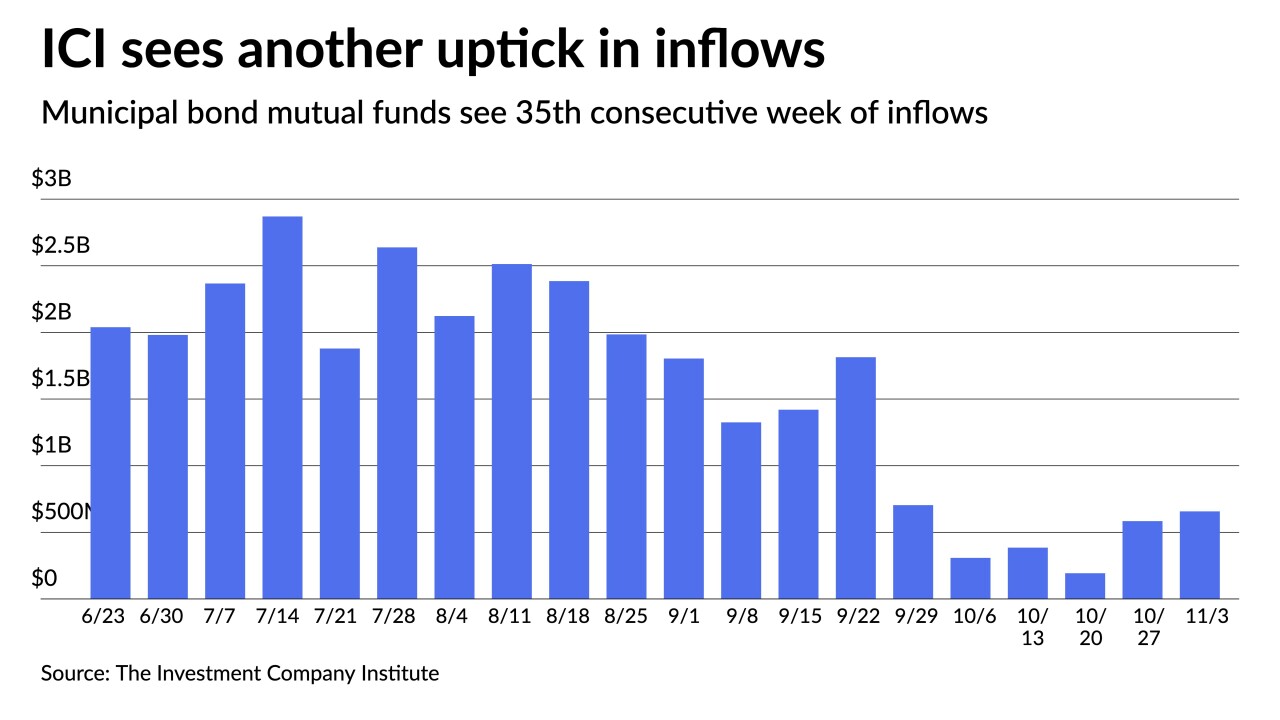

The Investment Company Institute reported $657 million of inflows into municipal bond mutual funds while ETFs saw $828 million of inflows, a massive increase over the $43 million reported a week prior.

November 10 -

Municipal bond mutual fund inflows fell to $177 million while high-yield is back to outflows, both signaling selling may be moving the market toward another larger correction.

October 21