-

The fund focuses on investment-grade state and local government debt funding sustainable development, including affordable housing, green spaces and hospitals.

September 10 -

The Federal Reserve said Wednesday in its Beige Book report that U.S. economic growth slipped to a more moderate pace between early July and the end of August.

September 8 -

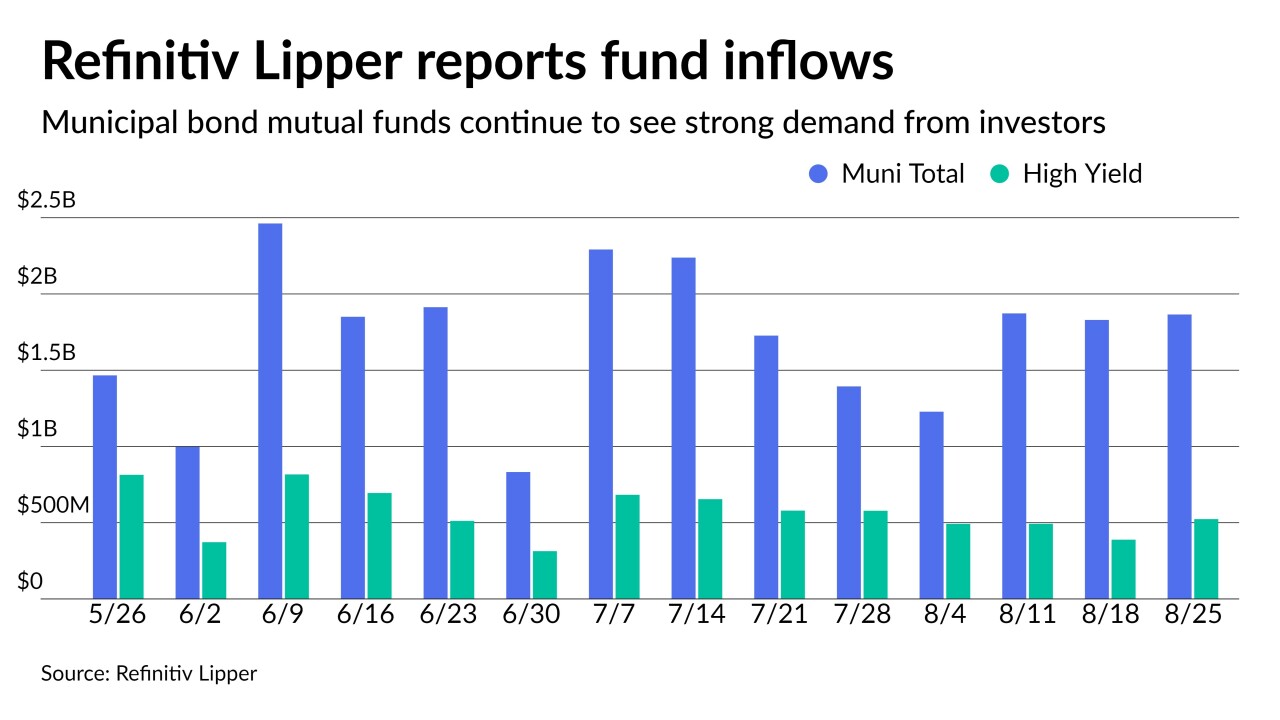

Refinitiv Lipper reported just over $1 billion of inflows into municipal bond mutual funds, an $800 million drop from a week prior, moving the four week moving average to $1.6 billion.

September 2 -

Refinitiv Lipper reported $1.9 billion of inflows, high-yield gaining $524 million, the 25th consecutive week of inflows into municipal bond mutual funds.

August 26 -

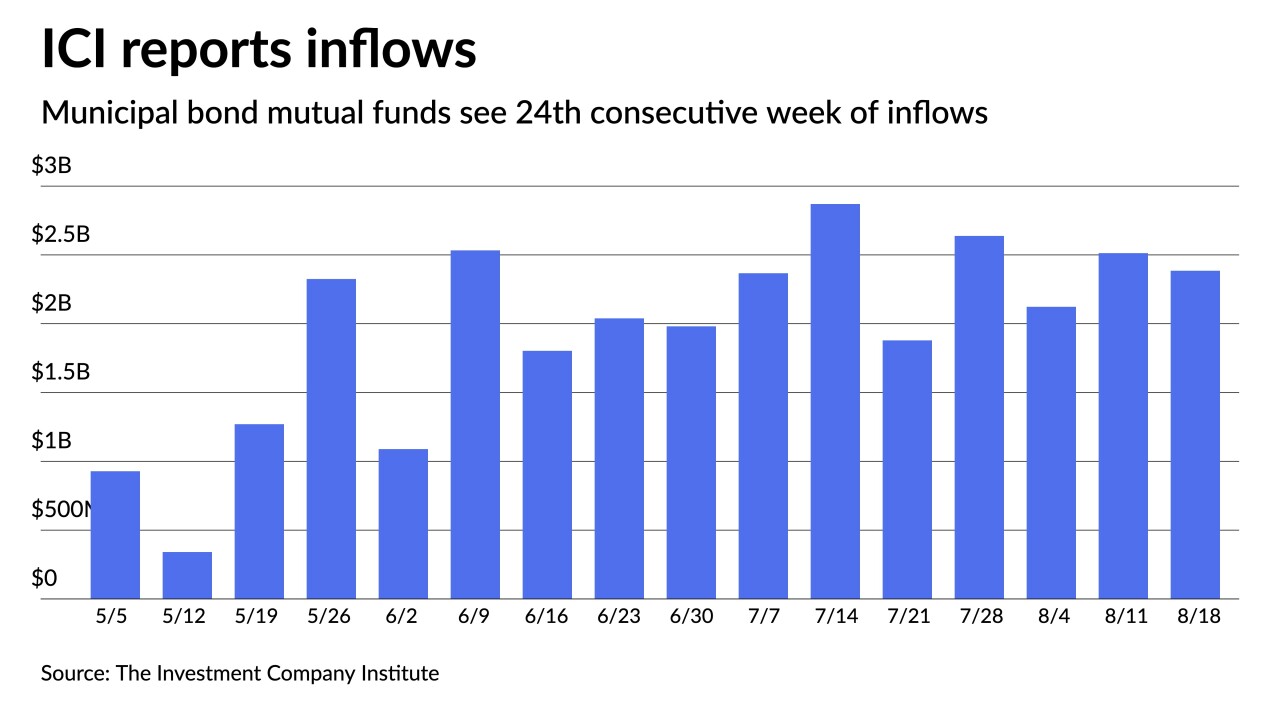

The Investment Company Institute reported $2.3 billion of inflows, bringing 2021 totals to $67 billion.

August 25 -

An influx of investment into high-yield munis has created challenges for fund managers forced to compete against each other to get in on new bond offerings.

August 20 -

Refinitiv Lipper reported $1.87 billion inflows. A solid demand component for the market, but some suggest the move into bonds from equities is more an asset reallocation than investors keen on fixed income.

August 12 -

Another $2 billion-plus was reported flowing into municipal bond mutual funds in the latest week, continuing to be a supportive demand component for munis.

August 11 -

The increasing influence of institutional market participants is even stronger in the taxable muni sector, a Municipal Securities Rulemaking Board report finds.

August 11 -

The lineup of exclusively short-duration fixed-income products, taxable and municipal, still managed an overall gain.

April 21 -

The top 20 performers nearly doubled the gains of their peers over the period.

April 15 -

The top 20 more than doubled the gains of their fixed-income industry peers.

January 6 -

Some market professionals were quick to say that the step would not be sufficient to soften the blows hammering the wider muni market.

March 20 -

Barber and Amoroso will work together during a temporary transition phase.

March 20 -

The 2017 Tax Cuts and Jobs Act continues to influence the composition of the municipal bond market.

March 12 -

With the addition of two new municipal funds, Baird appeals to more shareholders while expanding its current offerings.

November 20 -

Close proximity and presence in small states allows Josh Larson to "kick the tires" when analyzing new and existing credits

August 29 -

Continued selling would put more pressure on an already burdened secondary market.

November 8 -

Changes in tax rates made mutual funds, not banks, the main driver of demand on the long end. The change has had the effect of pushing yields on long-term munis higher.

October 3 -

The household sector’s direct ownership of outstanding muni debt has dropped by $103 billion year over year -- and by more than $300 billion since 2010.

April 3