Mutual fund outflows may pose an increasing challenge in the municipal market as the year winds down.

With Federal Reserve policy makers expected to raise interest rates at least once more, at its December policy meeting, some market professionals are saying outflows could become more problematic.

“Continued selling by investors would put more pressure on an already overburdened secondary market,” Peter Block, managing director of credit research at Ramirez & Co. wrote in an Oct. 31 weekly report.

Outflows more than doubled among weekly reporting municipal bond funds as investors withdrew $1.320 billion in the week ended Oct. 31, the sixth week of negative flows in a row. That came after outflows of $494.914 million the previous last week, and $642.032 million the week before that, according to Lipper data released on Nov. 1.

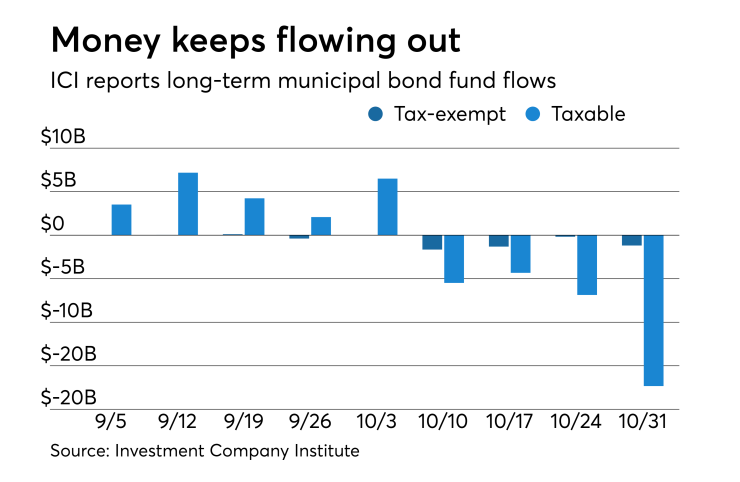

Long-term tax-exempt municipal bond funds reported an outflow of $1.186 billion in the week ended Oct. 31, the Investment Company Institute reported Wednesday. This followed an outflow of $179 million in the week ended Oct. 24 and outflows of $1.310 billion, $1.653 billion, $3 million and $374 million in the previous four weeks.

“The market is trading very cautiously around the suspicion that we are in the early innings of more potential outflows,” a Florida trader said last week.

Exchange traded funds have been affected over the last several weeks as rising yields took a toll on municipal prices and performance, the Florida trader said.

“The big move in rates has really given a price mismatch in the ETF space,” he said. “ETFs are selling and guys have lost money.”

The outflows, which are not uncommon in rising rate cycles, began following the September Fed meeting that signaled the end of its “accommodative” era and the continuation of a rate hike cycle, experts said.

“Outflows in the mutual fund space are something we commonly see in an active period of an uptick in rates,“ the Florida trader said.

As of Nov. 5, the yield on the triple-A general obligation 30-year benchmark municipal bond ended at 3.44% — 42 basis points from where it was on Aug. 31 before the Fed's September meeting. High-grade municipals were mostly weaker on Nov. 1, with yields calculated on MBIS' AAA scale rising as much as seven basis points in the four- to eight-year and 11- to 30-year maturities.

Municipals were weaker on MMD’s AAA benchmark scale, which showed the yield on both the 10-year municipal GO and on 30-year municipal yields gained two basis points, while The Bond Buyer yield indices were at their highest level in two to four weeks as of Nov. 1.

The Florida trader and other municipal experts agreed there could be further impact on the municipal market, with potentially increasing outflows to blame. In addition, any pace of heavy volume before year end could cause spreads to widen out, the Florida trader said.

“There could be pressure from the supply side, because there’s not enough reinvestment cash available to purchase new supply on top of the heavy amount of dollars pulled from the marketplace through mutual funds and ETFs,” he said.

Performance, he continued, will hinge on flows in the final weeks of 2018.

“The market could underperform rates going into the next month if we continue to see outflows,” the Florida trader said. “But, if outflows can slow a little the next few weeks it might prove to be a good buying opportunity going into year end,” the trader added.

On the rates front, the 10 and 30-year benchmark municipal yields have risen between 33 and 42 basis points as of Nov. 5, versus Aug. 31 before the Federal Reserve Board raised the federal funds rate by 25 basis points, to a range of 2% to 2.25%, its third rate hike of the year.

With less than two months remaining in 2018, outflows remain one of the threats of rising rates, even if they are manageable for now, experts said.

As yields continue on their upward path, outflows among weekly reporting municipal mutual funds have slightly decreased — albeit remain in negative territory.

Long-term muni bond funds had outflows of $657.629 million in the latest week after outflows of $368.134 million in the previous week, according to Lipper. Intermediate-term funds had outflows of $500.907 million after outflows of $143.005 million in the prior week.

National funds had outflows of $1.008 billion after outflows of $370.522 million in the previous week. High-yield muni funds reported outflows of $511.540 million in the latest week, after outflows of $230.226 million the previous week.

Though ETFs reported inflows of $105.897 million in the latest week, they saw outflows of $25.091 million in the previous week, according to Lipper.

"Last week’s equity rout and subsequent Treasury market rally clearly mitigated the deleterious effect of mutual fund outflows on muni prices,” Block said in his Oct. 31report.

To be sure, the Florida trader said the outflows so far have been "orderly," with no signs of "massive under-performance" as yet.

“Redemptions are not killing the market, but there’s enough bid-wanteds on a daily basis commanding attention the last three weeks,” a New York trader said last week. “You come in and instead of seeing what’s selling, there are four more lists out by 9:30 a.m.”

While modest, the impact of continued outflows over six weeks is enough to raise a red flag, and a reminder of losses felt by large institutions, such as ETFs, since September, the Florida trader said.

“We don’t have an avalanche of outflows, but we are keeping an eye on it in case it does become material,” Fred Yosca, managing director at BNY Mellon said in an interview.

He said the current outflow situation is manageable and doesn’t compare with past periods of rising rates, such as 2013's Taper Tantrum and the aftermath of the 2016 Presidential Election.

The Taper Tantrum ensued after the surge in U.S. Treasury yields when investors panicked in reaction to the Federal Reserve’s plan to taper the amount of money it was feeding into the economy and yanked their money out of the bond market, driving bond yields higher.

“I haven’t seen it soften the market drastically — not as it did in past years under extreme Treasury weakness and rising muni yields,” the New York trader said.

Even with outflows resulting from insurance companies selling bonds to raise cash to pay recent hurricane premiums, the dearth of supply is offsetting the swell of outflow activity.

“The supply could be a huge factor” in stemming the impact of mutual fund outflows going forward, the New York trader noted. “Because supply is already so bad, when one buyer sells a bond, there is another buyer waiting to buy."