-

The NFMA has floated best disclosure practices for public power agencies that ask for more data on climate and resiliency goals.

December 18 -

Ohio legislators plan to vote Wednesday on a resolution that would put a $2.5 billion general obligation bond measure on statewide ballots May 6.

December 18 -

The Metropolitan Transportation Authority's finance committee approved $9 billion of bonds, some backed by new revenue sources.

December 17 -

Voters in November approved measures to split the Alpine School District, which has more than $500 million of outstanding bonds, into three systems.

December 17 -

Concerns are rising as the Congressional Budget Office has issued a report laying out the benefits of eliminating tax-exempt qualified private activity bonds.

December 17 -

Justices appeared open to narrowing the scope of federal environmental impact reviews during oral arguments on a bond-financed Utah railway to move crude oil.

December 17 -

The county commission, which sued Oklahoma City in June over its denial of permit for the jail site, is pursuing a possible settlement.

December 16 -

The action was taken ahead of a bond sale for a controversial 15-year expansion program that is currently estimated to cost $8.2 billion up from $5 billion.

December 13 -

The president of St. Augustine University in North Carolina called the loan a "necessary evil" as it fights to remain solvent and accredited.

December 12 -

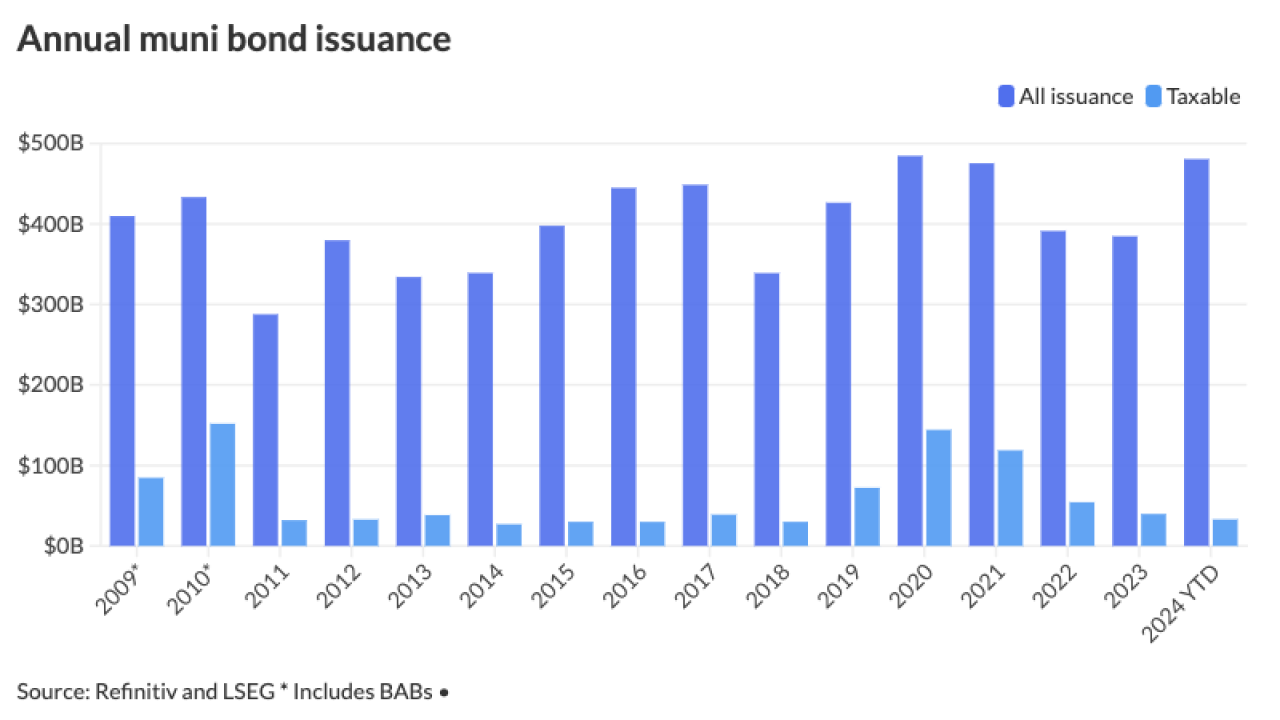

Most on the Street expect issuance to come in around $500 billion, but a few think volume will be much higher, primarily because of potential changes to the tax exemption. Most firms expect refunding volumes to also grow in 2025.

December 12 -

Operator ports, which rely on shipping volume for revenue, are more exposed to trade policy shifts than landlord ports, analysts said.

December 11 -

The top five bond financings came in above $5 billion.

December 11 -

The San Diego County-based healthcare district is at risk of "breaching financial covenants which, absent lender cooperation, could lead to acceleration of all of Palomar's outstanding revenue debt," Moody's Ratings analysts wrote.

December 9 -

A dispute over open meetings laws has stalled progress on UI's plans to purchase online University of Phoenix.

December 6 -

Experts are already predicting where the spending cuts will happen including the status of the tax exemption for municipal bonds.

December 6 -

S&P Global Ratings released a report this week warning that the credit trajectory of the Chicago Board of Education will hinge on several contested factors.

December 6 -

Nonprofit Provident Resources Group is buying a five-year old student housing building that serves the University of Central Florida and Valencia College.

December 5 -

Issuance of housing bonds for the first half of the year was at $22.243 billion in 357 issues, up 31.7% from 1H 2023's figure of $16.891 billion in 381 issues.

December 5 -

Blackstone Inc. is refinancing tax-exempt debt for a 76-story residential tower in downtown Manhattan designed by famed architect Frank Gehry.

December 4 -

Chicago plans to bring to market $806 million of bonds on Thursday, a refinancing deal that will help close its fiscal 2024 budget gap.

December 4