-

"The curve slope has undergone a massive flattening this year and recent trends suggest demand pockets are developing in specific ranges," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

October 20 -

If the IRA's tax credits prove popular for building clean energy projects, they may be expanded into basic infrastructure financing, said University of Chicago professor Justin Marlowe.

October 20 -

Between them, the California State University trustees and University of California regents have sold more than $23 billion of bonds since 2017.

October 20 -

Variable-rate debt, tender option bonds and even prepaid gas bonds may stage a comeback in the current market, panelists at a GFOA conference said.

October 20 -

They say the Oversight Board's argument restricting their claims just to money in the sinking fund is wrong.

October 19 -

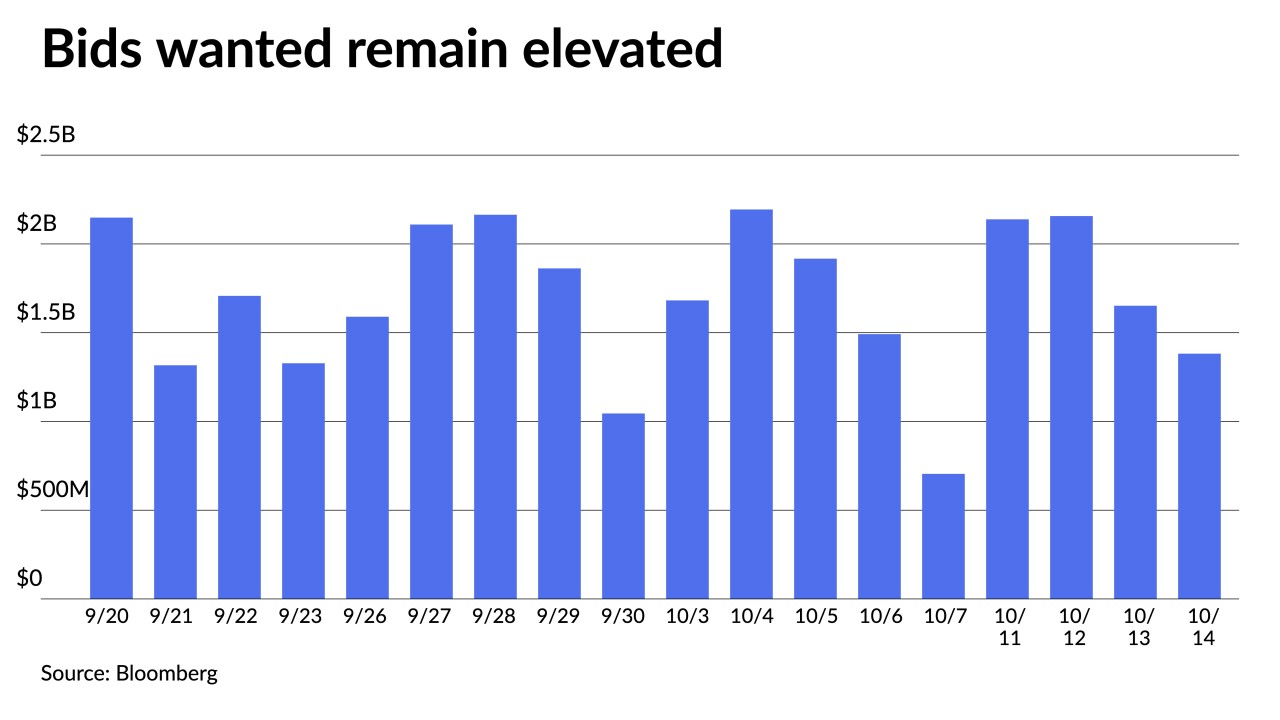

Outflows continued as investors pulled $4.532 billion from mutual funds in the week ending Oct. 12 after $5.172 billion of outflows the previous week, according to the Investment Company Institute.

October 19 -

CommonSpirit Health priced more than $1 billion of debt on schedule Tuesday after disclosing a ransomware attack that has impacted some IT operations.

October 19 -

Cybercrime, inflation and more severe storms are among the increased risk factors confronting colleges and universities in the Southeast.

October 19 -

Any new legislation should fit the "unique" nature of the municipal bond market, Sanchez said.

October 19 -

The Internal Revenue Service has closed its examination of Burlington's taxable Qualified School Construction Bonds with no change after requesting a use of proceeds earlier this year

October 19 -

Triple-A curves were a touch firmer in spots as secondary trading took a backseat to the larger primary activity with Connecticut and Massachusetts pricing general obligation bonds, a large CommonSpirit healthcare and several competitive issues led by Rhode Island GOs.

October 18 -

The Federal Highway Administration mandates would "commandeer" state department of transportation authority, opponents say.

October 18 -

MSU must find a new president after friction between board members and the president hired in the wake of the Larry Nassar scandals led to his resignation.

October 18 -

Volume rebounds eightfold this week with a new-issue calendar of $8.5 billion, including several billion-dollar deals.

October 17 -

The status allows the firm to assign the label to bonds based on a review of a project's adherence to the Climate Bonds Standard and Certification Scheme.

October 17 -

Texas university lands in the Permian Basin, which face a potential EPA crackdown, generated $2.124 billion for the Permanent University Fund in fiscal 2022.

October 17 -

Luisella "Sella" Perri has wide experience in the public finance arena, with a focus on federal tax laws and regulations related to tax-exempt financings.

October 17 -

The municipal dealer community supports market transparency. The proposal before Congress, however, is poorly conceived, has few if any market supporters, and has the potential to be very expensive.

October 17 Bond Dealers of America

Bond Dealers of America -

FAFAA and Gov. Pedro Pierluisi retain some influence over the direction of an adversary proceeding in the PREPA bankruptcy and on the ultimate PREPA bond deal.

October 14 -

"Despite a pick-up in volatility in the rates market, municipals have been performing relatively well in October," according to Barclays PLC.

October 14