-

Inflows returned as Lipper reported $775.006 million was added to municipal bond mutual funds in the week ended Wednesday after $361.649 million of outflows the week prior.

February 9 -

The issue is important to lawmakers in high-tax states, and is also important to municipal issuers in those places who have said the cap infringes on their fiancial sovereignty.

February 9 -

"I think ESG is here to stay in our market. I think it's a natural fit with the types of infrastructure that our market finances," said MSRB CEO Mark Kim.

February 9 -

A California conduit will price private activity bonds to replace the intakes for a San Diego County water desalination plant.

February 9 -

Public school districts faced $1.38 billion in spending cuts next month due to a constitutional cap on expenditures.

February 9 -

New legislation on the high priority is on its way.

February 9 -

Although there is some volatility in the municipal market, the landscape is in good shape, according to Cooper Howard, fixed income strategist at Charles Schwab.

February 8 -

Photos from The Bond Buyer's annual National Outlook Conference.

February 8 -

The Securities and Exchange Commission's examination priorities for the year include big ticket items like Regulation Best Interest.

February 8 -

Translating bipartisan support for infrastructure funding into support for long-term financing is a key lobbying goal for the municipal bond market.

February 8 -

The award to the South Terminal's private operator comes as Austin plans to demolish the facility as part of an expansion project to accommodate increased airport traffic.

February 8 -

States are dealing with budget surpluses with taxpayer rebates, infrastructure projects and debt service.

February 8 -

The Oversight Board and the other PREPA parties are attempting to create precedent that frontally attacks not only PREPA bondholders and their insurers but also municipal revenue bond finance and basic bankruptcy jurisprudence.

February 8 Mintz Levin

Mintz Levin -

While some sectors have fared better than others, those requiring construction struggle as costs rise.

February 8 -

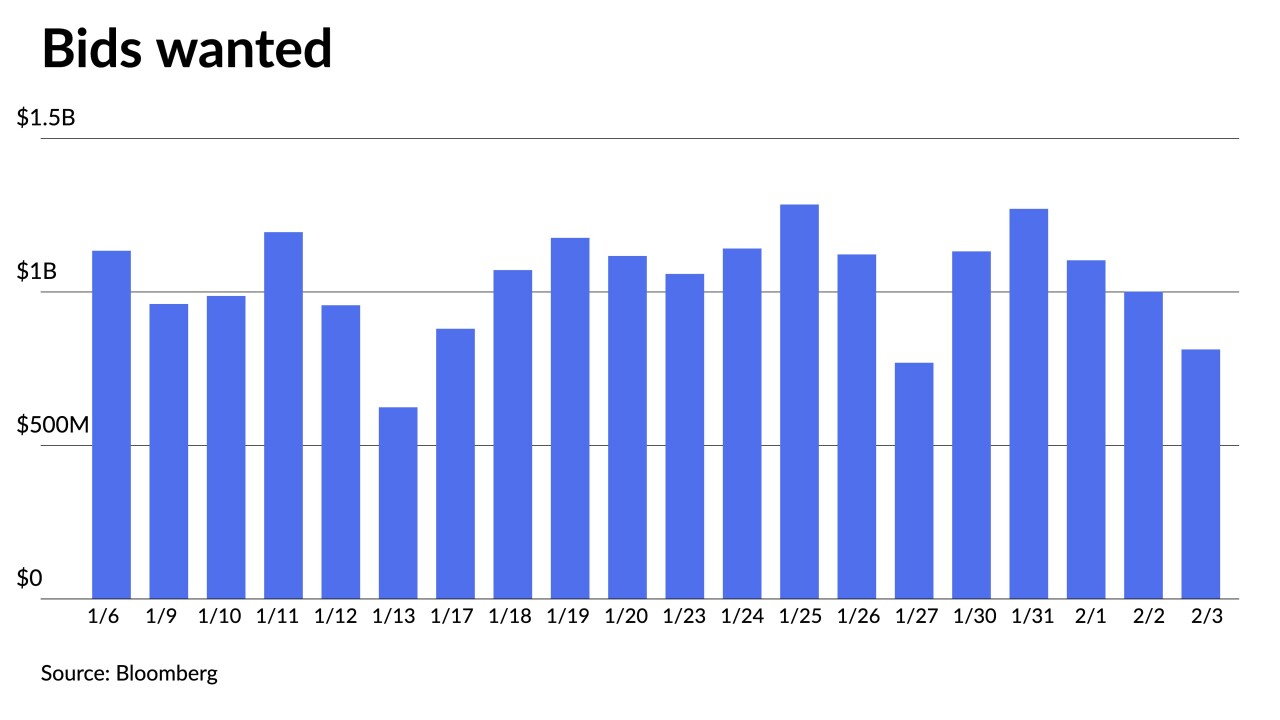

"The market started the year with a reduction of the oppressive pressure caused by last year's heavy net outflows from mutual funds," said CreditSights strategists Pat Luby and Sam Berzok.

February 7 -

The Financial Industry Regulatory Authority found that BNA Wealth didn't meet the regulatory requirements when it sold shares in 529 plans.

February 7 -

Recent federal legislation marks the largest investment in carbon management in the history of the U.S., which is already a global leader in the space.

February 7 -

Gov. Kevin Stitt wants to tap surplus revenue to build up reserves and is once again asking the legislature to eliminate the state sales tax on groceries and pass an expanded school voucher program.

February 7 -

Keeley Webster, a Bond Buyer senior reporter, discusses with Rudy Salo, a Nixon Peabody partner, funding and logistical challenges California, and the country, face as they stretch toward the future with plans for high speed rail, electric vehicle charging networks while incorporating more traditional mass transit. (29 minutes)

February 7 -

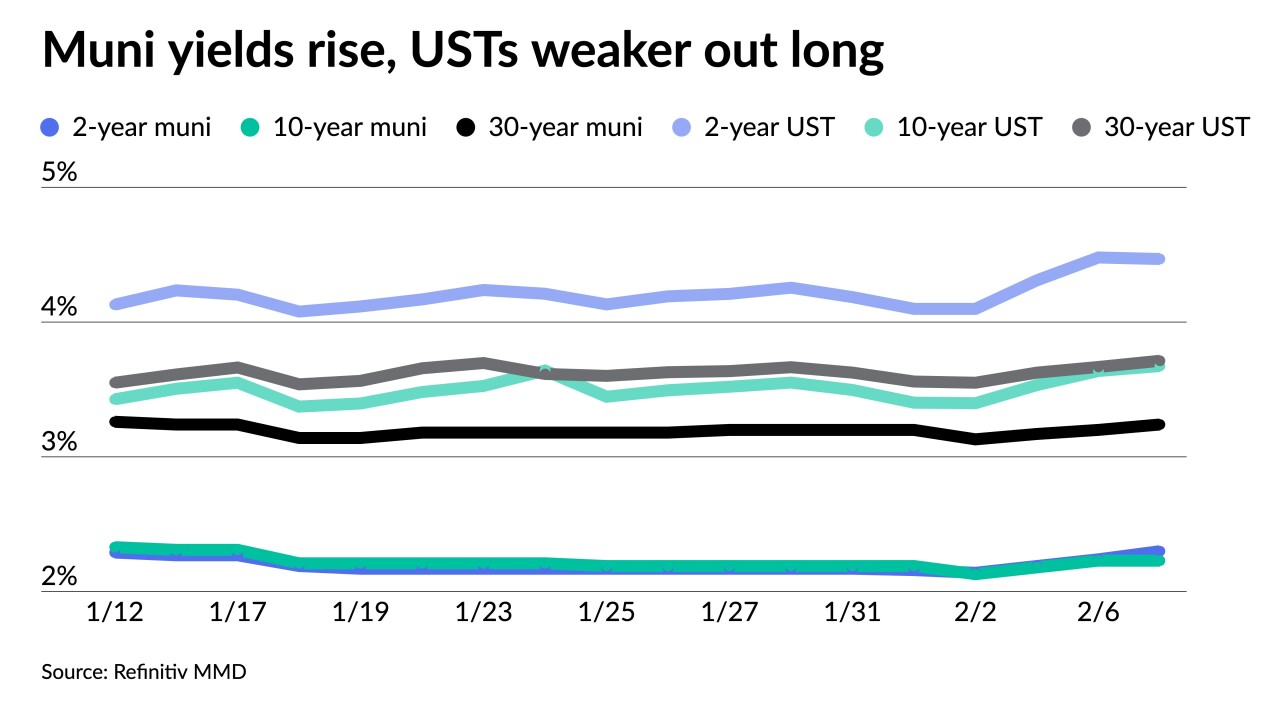

"We did see some bump in the curve as a result of the FOMC hiking rates by 25 basis points on Wednesday," said Jason Wong, vice president of municipals at AmeriVet Securities. "However, with an unexpected high employment number, fixed-income yields rose."

February 6