-

Photos from The Bond Buyer's 2023 Infrastructure conference.

October 6 -

The largest healthcare strike in U.S. history hit Kaiser Permanente Wednesday. The nonprofit giant operates 39 hospitals and 622 medical offices.

October 6 -

While the market broadly is still in the early stages of using artificial intelligence, more firms are starting to implement it, panelists said at MuniTech NYC, an event hosted by Munichain and Spline Data that brought together a gathering of technology-focused market participants.

October 6 -

The two-day meeting in Atlanta kicked off what the mayors say will be a regular meeting to promote more public-private partnerships for infrastructure projects.

October 6 -

All eyes will be on Friday's report, though "it seems most leading indicators suggest job growth will remain healthy, which should keep the bond market selloff going strong," said OANDA's Edward Moya.

October 5 -

It's the bank's eighth issuance of its climate-certified one-year notes. Buy-in starts at $100.

October 5 -

At stake is nearly $800 million in Federal Transit Administration funds.

October 5 -

"If we continue to see a cooling labor market and inflation heading back to our target, we can hold interest rates steady and let the effects of policy continue to work," Daly said.

October 5 -

California-based Fulcrum Bioenergy will build a facility in Gary that converts household garbage into sustainable synthetic aviation fuel.

October 5 -

"After more than 36 years as investor and leader, Peter has decided the timing is right to begin his own retirement next year," said Rich Kushel, senior managing director at BlackRock.

October 5 -

The question is raised whether "invitations" to support the plan were the same as "solicitations."

October 4 -

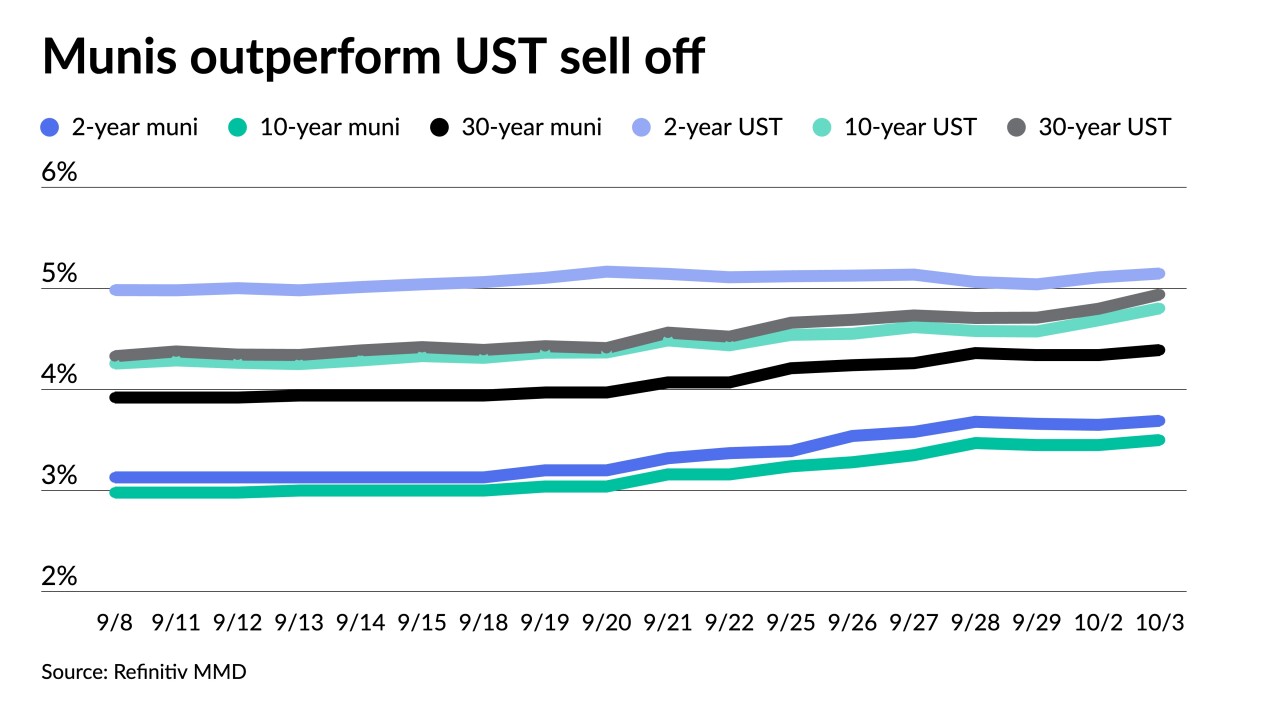

Municipal yields fell up to three basis points, depending on the scale, but underperform a better UST market.

October 4 -

Economic and demographic trends working against revenues at U.S. higher education institutions are very evident in West Virginia at the start of the school year.

October 4 -

Public finance advocates are examining House speaker candidates to see which ones have local and state experience.

October 4 -

Legacy Cares, which filed for bankruptcy in May, is trying to sell Legacy Park, which was financed with now-defaulted bonds issued in 2020 and 2021.

October 4 -

"I am excited to lead the team through what will be an exciting period of growth in public finance," Anjali Sharma said.

October 4 -

S&P Global Ratings placed Maryland Heights, Missouri, on credit watch with negative implications because of bonds from a related authority for a hockey rink.

October 4 -

The upgrade was spurred by improving ridership as well as increased financial flexibility, said S&P credit analyst Joseph Pezzimenti.

October 4 -

-

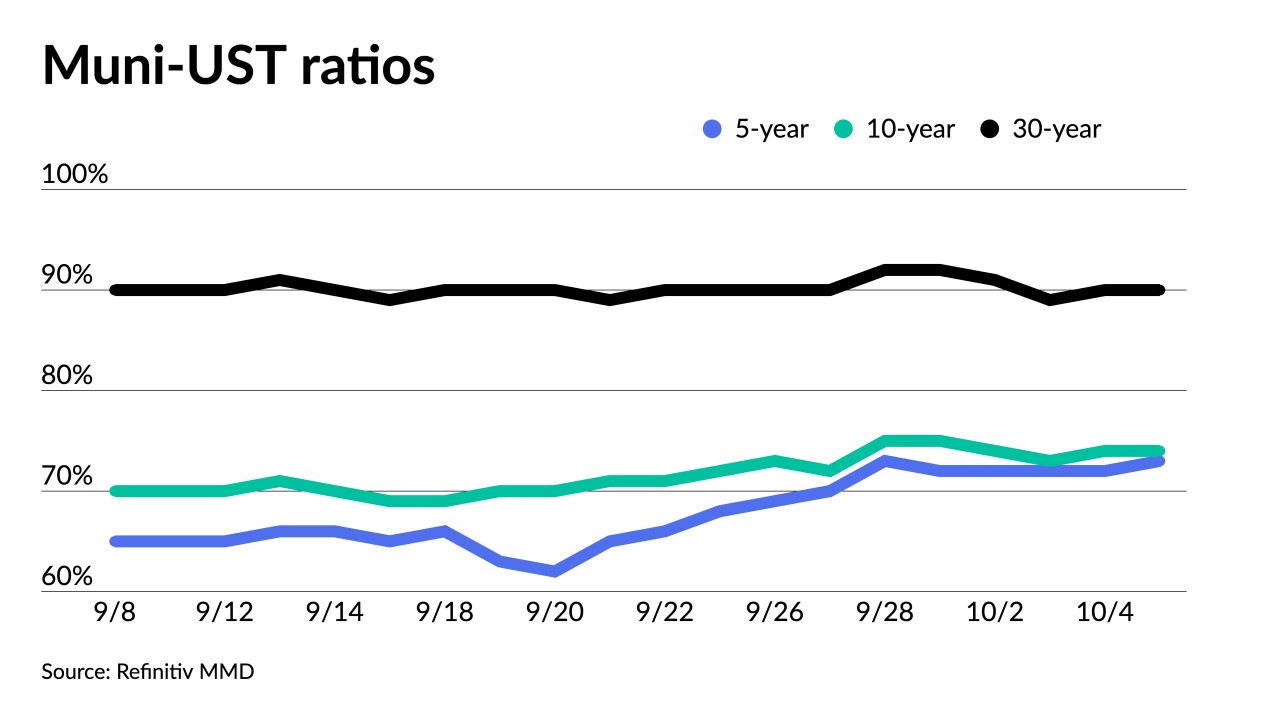

UST rates are driving all things in the muni market, said Jon Mondillo, head of North American Fixed Income at abrdn.

October 3