-

The top two municipal bond insurers wrapped $22.814 billion in the first three quarters of 2023, a slight dip of 0.5% from the $22.929 billion of deals done over the same period in 2022, according to Refinitiv data.

October 17 -

After teaching local government finance at the University of North Carolina School of Government, Crews rejoined McGuireWoods's public finance team in Raleigh,

October 17 -

Royden Durham and Tony Tanner, portfolio managers at the Aquila group of funds, talk with Chip Barnett about what's special about Kentucky and Arizona -- what's the same and what's different -- within their municipal bond markets. (18 minutes)

October 17 -

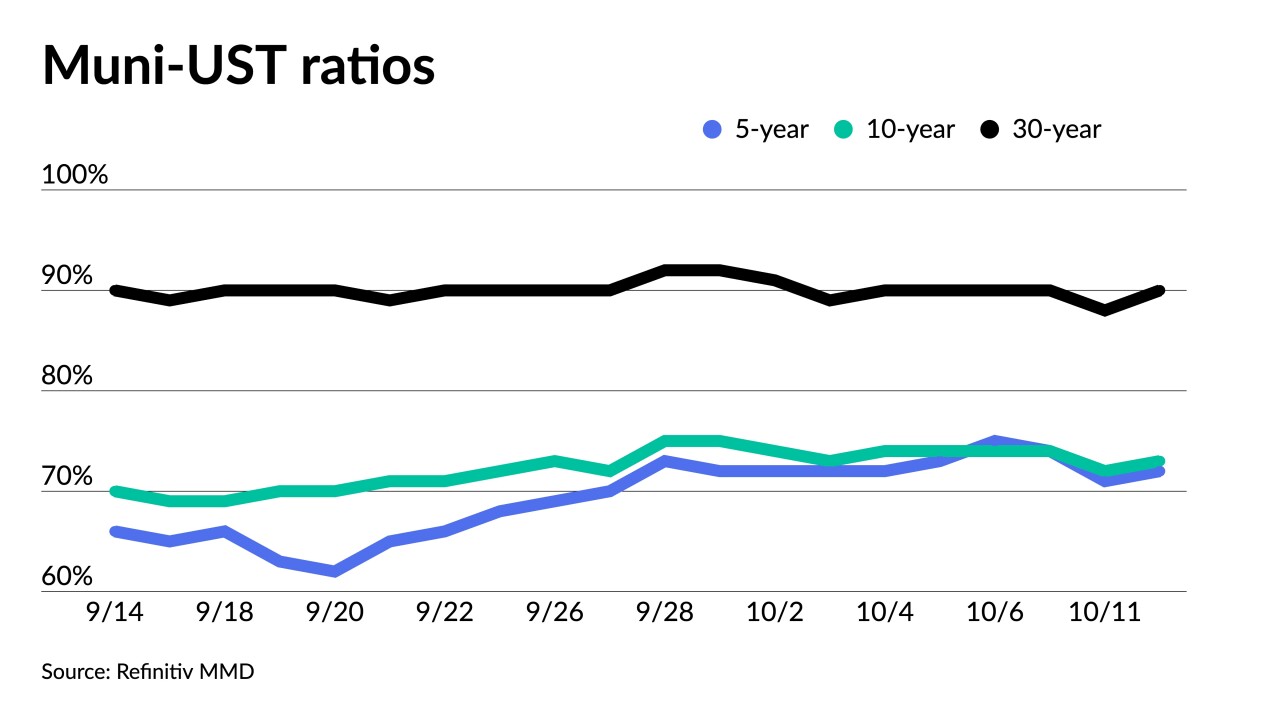

"The combination of higher yields and this week's heavier new-issue calendar will attract attention from income-focused individual investors as well as from institutional investors who are underweight munis," said CreditSights strategists Pat Luby and Sam Berzok.

October 16 -

Endorsed by Donald Trump, Landry has fought against ESG precepts and has had several run-ins with the state Bond Commission over firearms and abortion issues.

October 16 -

As the program inches through the federal appropriation process, Texas lawmakers have allocated state funds and created a five-county district with taxing power.

October 16 -

Current interest rates offer arbitrage opportunities and challenges to bond issuers.

October 16 -

Panelists at this year's GFOA Minimuni Conference remarked on how difficult an environment it is for issuers and why recognizing this is essential for voluntary disclosure.

October 16 -

As valuations got richer after muni outperformance this week, Barclays strategists expect munis to be "truly tested in the next several weeks, with supply picking up."

October 13 -

Officials in Connecticut, Massachusetts and Rhode Island say a multi-state coalition will help address the challenges of the new wind energy industry.

October 13 -

The recent rise in yields has created an opportunity for those investors waiting to "jump into the market," said Roberto Roffo, portfolio manager at SWBC Investment Company.

October 13 -

Analysts discussed proposed changes to its metrics that will be finalized in January. An estimated 35% of ratings could experience upgrades or downgrades.

October 13 -

Loss of aid could hurt the islands' economy, a local senator says.

October 13 -

Despite the sticker shock of rising rates, yields in fact are at average levels for over the last 30 years, panelists said at the GFOA's MiniMuni conference.

October 13 -

In January 2022, mobile sports betting went live. With a 51% tax rate on gross gaming revenues, New York, Rhode Island and New Hampshire have the highest gaming taxes in the nation.

October 13 -

A higher inflation figure sent UST yields higher, complicating Central Bank policymaking and reversing a flight-to-safety bid amid ongoing geopolitical turmoil in Israel.

October 12 -

An EPA investigation will focus on potential discrimination against Black communities in the distribution of wastewater improvement funds following complaints from public advocacy groups.

October 12 -

The California governor is this week signing bills to alter the state's mental health policies in a package that includes a $6.3 billion state bond measure.

October 12 -

Mitigation efforts can't always prevent a ratings drop.

October 12 -

Additionally, the Florida Treasury will follow suit and invest $25 million in Israeli bonds, said Jimmy Patronis, the state's chief financial officer.

October 12