-

Pensions funds are increasingly investing in riskier asset classes, with more than half their investments in 2022 in these, according to some estimates.

February 21 -

"With the new economic data signaling a delay of the Fed starting rate cuts to further into the year, we should continue to see yields rise until we get near to the Fed's target of a 2% 'neutral' rate for inflation," said Jason Wong, vice president of municipals at AmeriVet Securities.

February 20 -

The Federal Railroad Administration plans to make formal recommendations to Congress this spring.

February 20 -

A private university in Milwaukee will borrow $163.7 million through tax-exempt bonds to build new emergency response facilities for the state and county.

February 20 -

Robert Poole, a leading expert in the U.S. public-private partnership transportation sector, joins infrastructure reporter Caitlin Devitt to talk about upcoming deals including toll lanes and bridges in the Southeast and high speed rail in the West as well as states that are advancing P3s and action on the federal front. (37 minutes)

February 20 -

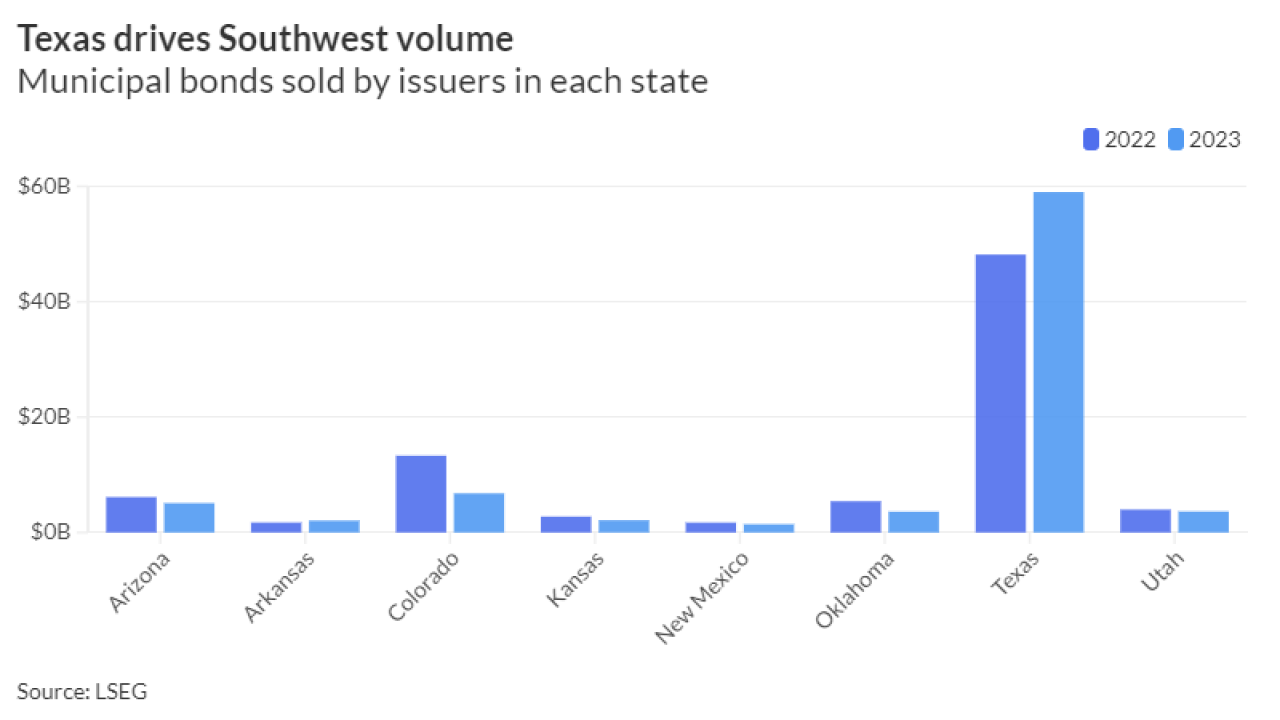

A state-by-state review of 2023 issuance in the Southwest.

February 20 -

The board has initiated a review of the annual rate card process.

February 20 -

Long-term municipal bond sales dropped for the second straight year, but a late year surge of issuance nearly brought volume level with the prior year and raised hopes for a rebound in 2024.

February 20 -

All municipal bond insurers wrapped $35.381 billion in 2023, a 5.8% increase from the $33.428 billion insured in 2022, according to LSEG data.

February 20 -

Bond volume fell slightly, as volatility, higher interest rates, falling pandemic aid and slower economic growth kept issuers on the sidelines.

February 20 -

Issuance has fluctuated throughout the years since the financial crisis, following interest rate changes — rising when rates rise and falling when rates fall — but the totals have come in well below $15 billion every year since 2012, save for 2017 when $15.234 billion was sold.

February 20 -

"Tight underwriting spreads in 2023 followed, for the most part, a well-entrenched trajectory that has backdropped the primary municipal market for years, and so the negligible bump in spreads does not come as a surprise," said Jeff Lipton, managing director of credit research at Oppenheimer.

February 20 -

Texas bond volume climbed 22.5% to lead the nation in a year when issuance in the eight-state Southwest region increased by only 0.6%.

February 20 -

According to FINRA, the banking giant failed to close out 239 inter-dealer transactions in a timely manner as well as failing to take possession of 247 short positions.

February 16 -

"With supply still low, and fund outflows just marginal, it is not clear what would substantially cheapen the market, and we could get stuck in the current range for some time time," Barclays strategists said.

February 16 -

Austin Transit Partnership, which was created by the city and its mass transit agency to develop and finance Project Connect, approved an initial bond sale of up to $150 million.

February 16 -

What do investors want for their investment strategies, a look at the various demand components in the market, as well as the uptick of alternative financing products issuers are using and what they mean for the buy-side community.

February 16 -

Western Alliance Bank has named Woo senior director of treasury management in the bank's corporate finance and public and nonprofit finance groups.

February 16 -

Expanded domestic purchasing requirements under the infrastructure law are well-intended but confusing and costly, state transportation and construction groups say.

February 16 -

Comments submitted to the SEC on the MSRB's amendments to Rule G-14 note how important exceptions for manual trades and limited trading activity are in the move to a one-minute reporting standard.

February 16