-

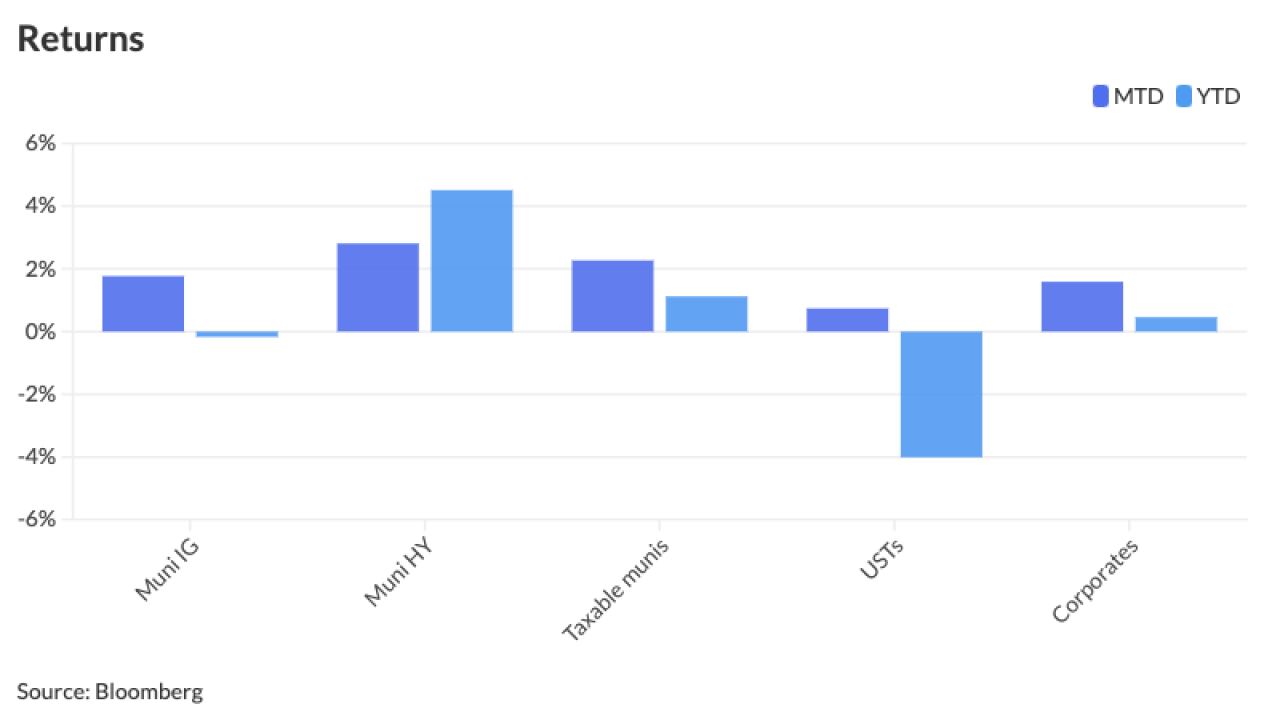

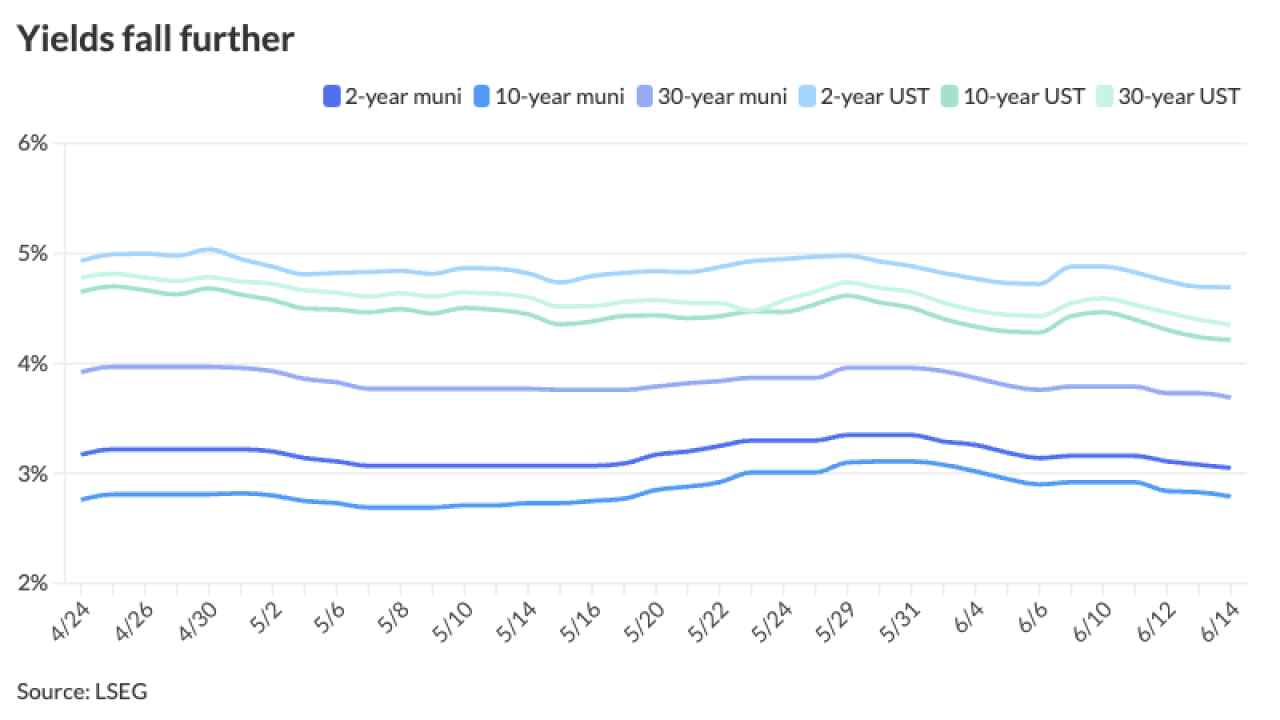

Despite some slight weakness Monday, munis continued an "impressive start to June," with yields falling 10 to 13 basis points last week, Birch Creek strategists said.

June 17 -

The City of Angels is the latest in recent days to score a ratings upgrade as Fitch reviews its local government ratings using amended criteria.

June 17 -

According to the board, the addition is an important means to enhance market transparency and is in line with its FY24 priority to expand the EMMA platform.

June 17 -

The Philadelphia Fed president said there can be as few as no cuts or as many as two this year, but if his projections are accurate, one decrease would be appropriate this year.

June 17 -

"We need to see more evidence to convince us that inflation is well on our way back down to 2%," Federal Reserve Bank of Minneapolis President Neel Kashkari said.

June 17 -

The county hopes one-time revenues will help it "live to fight another day" as it awaits a state-assisted financial plan.

June 17 -

The new-issue calendar is led by the New York Transportation Development Corp. with $1.5 billion of green AMT special facilities revenue bonds for the John F. Kennedy International Airport New Terminal One project,

June 14 -

"I think the risks to inflation are still on the upside," Federal Reserve Bank of Cleveland President Loretta Mester said. "I think the risk to the labor market is dual-sided."

June 14 -

Ten other pension obligation bonds are under review by Fitch Ratings as a result of the agency's new local government criteria.

June 14 -

House Transportation and Infrastructure Committee lawmakers urged new bills and new ways for transit authorities to deal with the post-COVID dynamics.

June 14 -

Louis English joined Janney Montgomery Scott as managing director and head of municipal sales in the fixed-income division, based out of the Chicago office.

June 14 -

Observers and participants said the ruling sends a message that the municipal revenue bond pledge is strong and the Oversight Board's plan of adjustment for PREPA as it currently is proposed is unlikely to be able to stand.

June 13 -

"Even after this week's rally, absolute yields look attractive in the context of the trading range over the past three years, May's underperformance versus taxable fixed-income, and our longer-term projections for lower rates this year," J.P. Morgan strategists said.

June 13 -

The spending plan for the fiscal year that begins July 1 contains no tax increases or new fees and puts off finding a recurring solution for a structural budget gap.

June 13 -

Interest on out of state municipal bonds will now be taxable.

June 13 -

"It would be irresponsible for us to ignore factors that can fundamentally impact the long-term viability of investments," said CalPERS interim Chief Investment Officer Dan Bienvenue of climate risks.

June 13 -

Oversight Board Executive Director Robert Mujica said the only recently released fiscal 2022 ACFR showed revenues and expenditures continue to be imbalanced.

June 13 -

Household ownership of munis — which includes direct ownership of individual bonds in brokerage accounts, fee-based advisory accounts and SMAs — rose to $1.779 trillion, up 0.3% from Q4 2023 and from 5.6% in Q1 2023.

June 13 -

Judges say PREPA bondholders have a lien on net revenues collected post-bankruptcy.

June 12 -

The top five bond financings have an average dollar volume of more than $1.9 billion.

June 12