-

LIPA's prepares to go to market with new leadership as it prepares to decide on its next power supply management services provider.

August 5 -

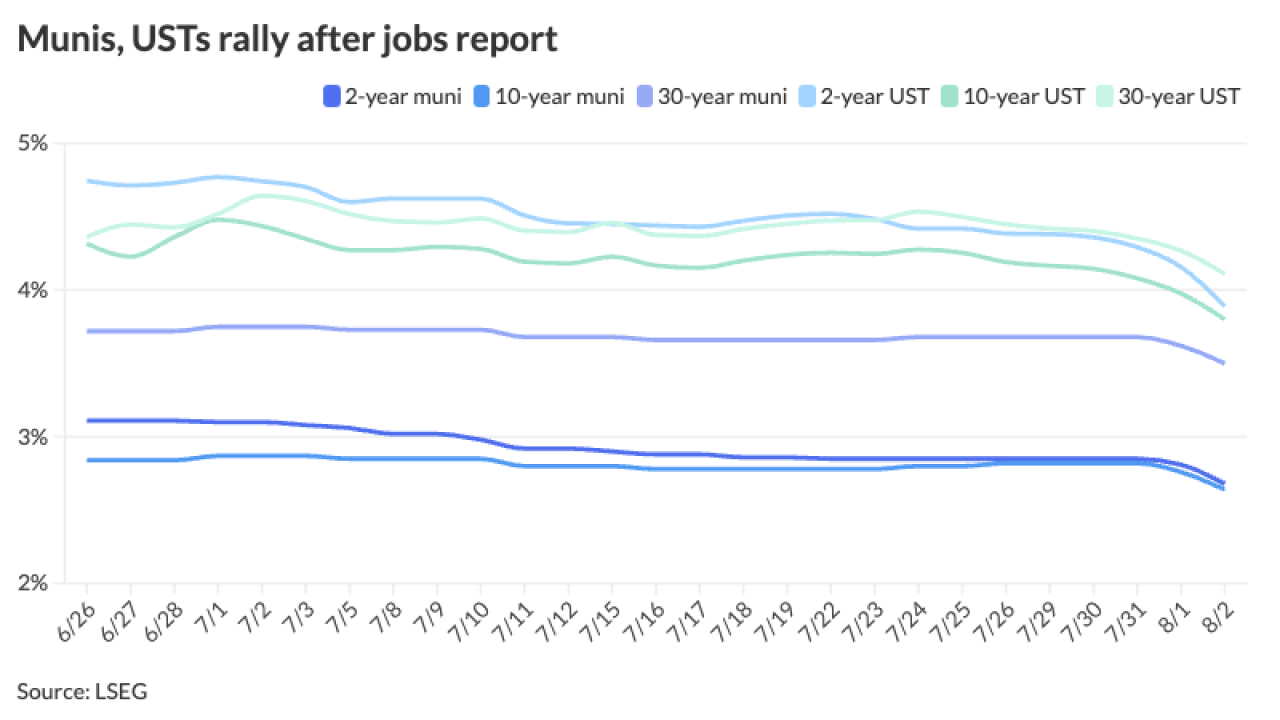

All eyes now turn to the September Federal Open Market Committee meeting where the Fed is expected to cut rates, but market participants are mixed on whether it will be a 25- or 50-basis-point cut.

August 2 -

The Palisades Tunnel project and phase two of the Hudson River Ground Stabilization project will officially begin later this year.

August 2 -

The alma mater of former President James Garfield and current U.S. Rugby Olympian Kristi Kirshe plans to sell $108 million of bonds next week to help fund a new art museum and a multipurpose recreation center, according to bond documents.

August 2 -

Federal agencies have at least initially determined that CUSIP is not the best choice for an identifier as they develop rules pursuant to the FDTA.

August 2 -

Muni ETFs have grown in popularity ever since the first launch in 2007, gaining a foothold due to their cost-effective nature and ability to help investors acquire a significant amount of diversification.

August 2 -

The three new members will serve four-year terms beginning with the board's new fiscal year in October.

August 2 -

Lawsuits targeting validation lawsuits for pension obligation bonds in California generally stop issuers from considering issuance, but two cities have fought and, so far, won.

August 2 -

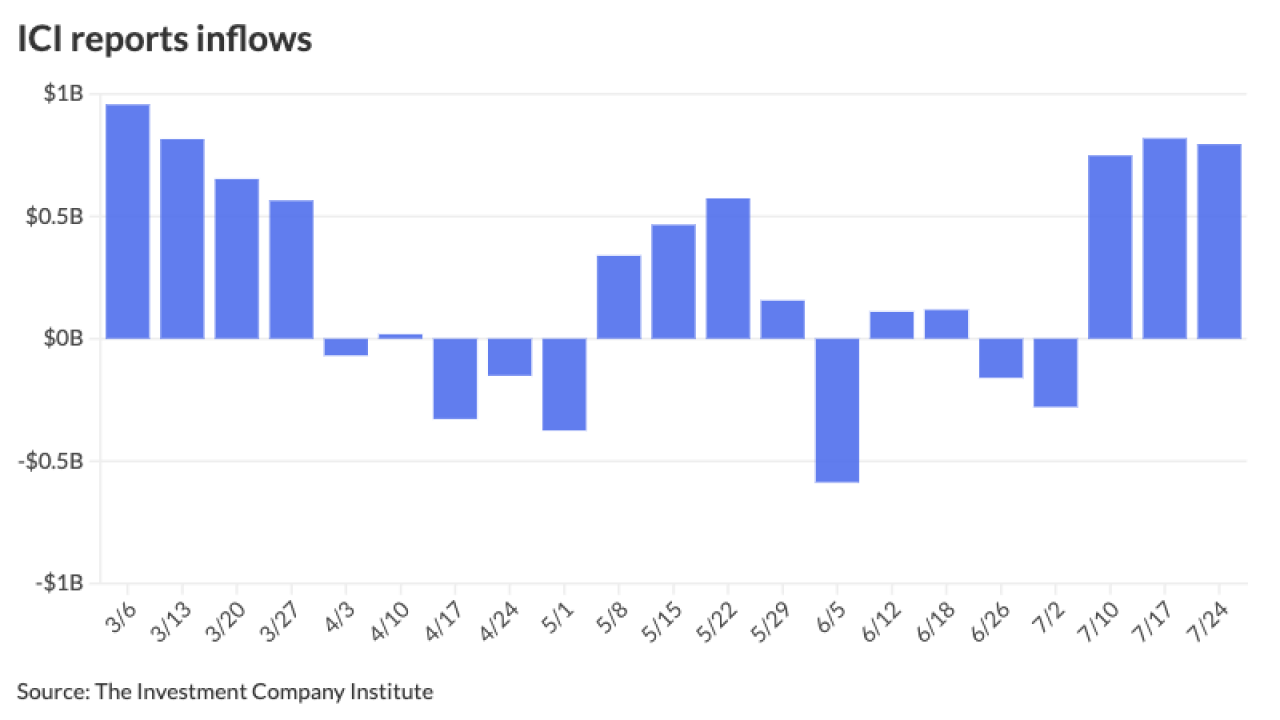

Municipal bond mutual funds saw inflows as investors added $1.112 billion to funds after $892.2 million of inflows the week prior, according to LSEG Lipper.

August 1 -

Oconee County using bond proceeds for a sewer that will benefit only some residents may violate the state constitution.

August 1 -

Regulators indicated they may prefer the use of Financial Instrument Global Identifiers for securities.

August 1 -

The city's pensions funds for police officers, fire fighters, teachers, civil employees and school personnel, with a combined $274 billion in assets, returned 10% in the year through June, beating their 7% target, according to a news release Thursday from city Comptroller Brad Lander.

August 1 -

The proceeds will be used to finance replacement of the Calcasieu River Bridge.

August 1 -

"The Fed remains data dependent as always, but it now appears that the 'more good data' bar is not as high as it was before, particularly with labor market developments becoming more important," said Michael Gregory, deputy chief economist at BMO Economics.

July 31 -

California Gov. Gavin Newsom fast-tracked the first $3.3 billion of a bond measure approved by voters in March.

July 31 -

Successful roll-outs are countered by regulations and red tape.

July 31 -

The mayor and controller debated the causes for the rating outlook revision to negative from stable ahead of a July city bond sale.

July 31 -

Riedl First Securities Company of Kansas has been fined $15,000 by FINRA for charging unfair prices, violating MSRB Rule G-30 on fair pricing and MSRB Rule G-27 on supervision.

July 31 -

Issuance was lumpy in July, with three weeks of $10 billion issuance sandwiched between lower issuance due to the Fourth of July holiday at the start of the month and the FOMC meeting the last week.

July 31 -

Fitch upgraded Chicago's issuer default rating and GO debt rating to A-minus from BBB-plus and the city's sales tax securitization bonds to AAA from AA-plus.

July 31