-

The University of Chicago embarked on the Illinois Finance Authority's largest financing ever to transform its capital structure and fund major projects.

November 20 -

"This year, with the tax-exemption clearly threatened, primary calendars should (although, of course, might not) be larger, putting a $500 billion full-year supply total in range, with $451 billion already in the books through 46 weeks," said MMA's Matt Fabian.

November 19 -

Extending tax cuts from TCJA is viewed as fiscally problematic.

November 19 -

The decision is expected to be appealed to the Georgia Supreme Court and the ruling could have implications for the muni bond industry.

November 19 -

The low-rated, Phoenix-based university turned to a public debt sale after refinancing maturing outstanding bonds with bridge loans.

November 19 -

The group of five banks deny long-standing charges from a Minnesota-based whistleblower that they conspired to artificially inflate the rates on variable-rate demand bonds.

November 19 -

The board is seeking one municipal advisor, one broker-dealer and two public representatives to join the board for FY 2026.

November 19 -

Now a Fox Business host, Duffy while in Congress sat on the Financial Services, Budget and Joint Economic committees.

November 19 -

The projects funded by the deal align with the city of Alexandria's goal to reduce community-wide greenhouse gas emissions 50% by 2030.

November 19 -

The deal, which marks the city's largest special facilities revenue bond issuance, will help finance a terminal project at George Bush Intercontinental Airport.

November 19 -

The wealthy city is borrowing $124.2 million through its finance authority. The bonds are backed by lease payments the city will pay from its general fund.

November 18 -

The cost of replacing the airport's train system has blown past its budget by $1.45 billion to $3.5 billion.

November 18 -

Houston is set to price Tuesday $1 billion of United Airlines Terminal Improvement Projects AMT revenue bonds while the Public Finance Authority will bring $125 million of non-rated Million Air Three General Aviation Facilities Project revenue bonds.

November 18 -

The agencies cited the authority's strong performance and position.

November 18 -

The $4.5 billion of New York Transportation Development Corp. bonds sold for the P3 won the Northeast category of The Bond Buyer's 2024 Deal of the Year awards.

November 18 -

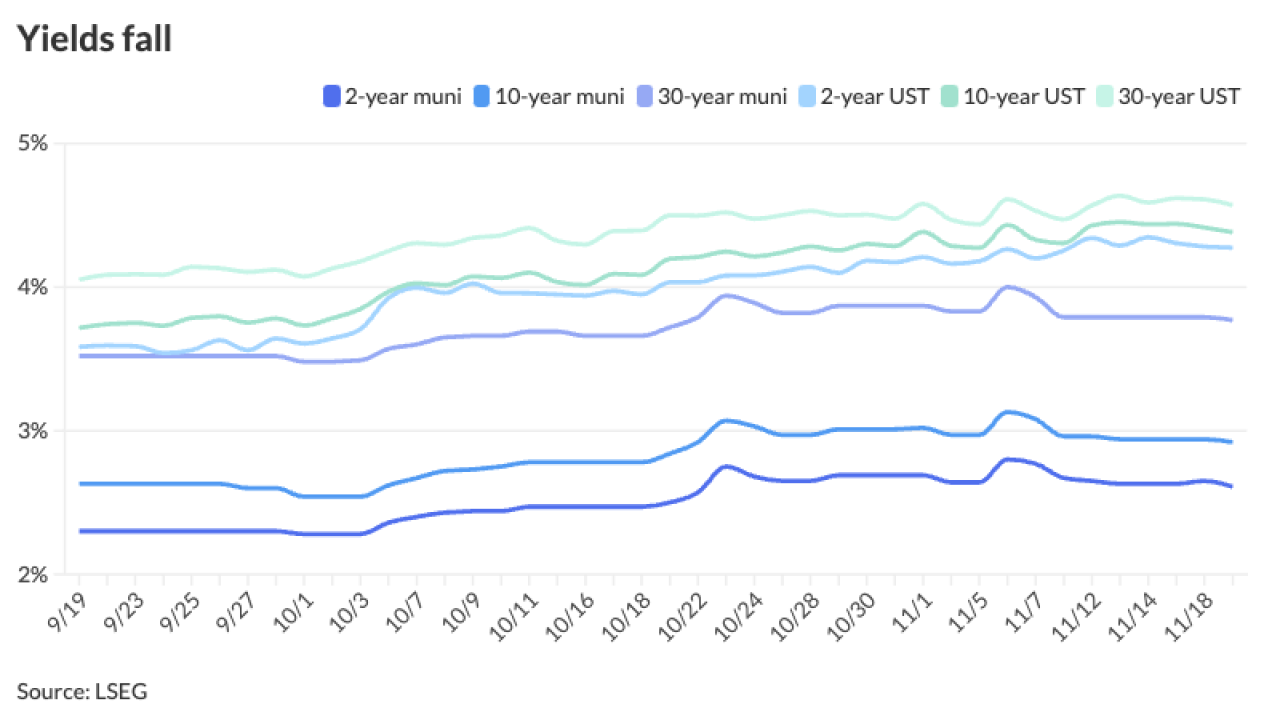

As headline risk swirls around the Fed and the transition to the Trump administration, municipals have largely stayed in their own lane. November finds the municipal market "in far better technical shape, with an attractive backdrop through at least year-end," J.P. Morgan's Peter DeGroot said.

November 15 -

The outlook change to negative comes in the wake of voter approval on Nov. 5 of a ballot measure requiring certain public safety spending by the city.

November 15 -

The Aloha State received three rating affirmations as it prepares to sell $750 million of taxable general obligation bonds.

November 15 -

Donald Trump discussed various items related to the Fed and its independence and stated he would not nominate Jerome Powell for another term as chair. Gennadiy Goldberg, head of U.S. rates strategy at TD Securities, discusses what a Trump presidency may mean for the Fed.

-

A bond-financed rehab of the downtown sports arena is receiving pushback.

November 15