-

Disasters like wildfires, floods and hurricanes "are striking harder and more often."

March 5 -

Illinois will sell $725 million of junior sales tax revenue bonds in a competitive deal pricing Tuesday. The Build Illinois bonds will fund capital projects.

March 5 -

The top five bond financings totaled more than $6 billion.

March 5 -

Short-end U.S. Treasuries rallied mid-morning, while UST yields were little changed out long, but ended the day weaker across most of the curve with the greatest losses out long. Munis were steady throughout the day.

March 4 -

The city's Independent Budget Office projects New York's operating surplus as a percentage of tax revenue will fall to 4.8% at the end of the fiscal year.

March 4 -

The New York City Transitional Finance Authority plans to make an impact on the municipal market this month with $1.8 billion of bond sales.

March 4 -

S&P Global Ratings primarily cited a "precipitous decline" in unrestricted cash to explain its triple-notch downgrade of the system.

March 4 -

The IRS has issued a preliminary determination that educational and general revenue bonds issued in 2018 by the University of Rhode Island are taxable due to alleged noncompliance with requirements of Section 149(g).

March 4 -

Belvia Gray, Public Finance Leader at Baker Tilly, talks about the firm's efforts and focus on bringing the industry together on cyber security threats, succession planning and more.

March 4 -

Texas, Oklahoma, and other Southwest states would jump on the bitcoin bandwagon amid a nationwide surge in bills to invest public money in cryptocurrencies.

March 4 -

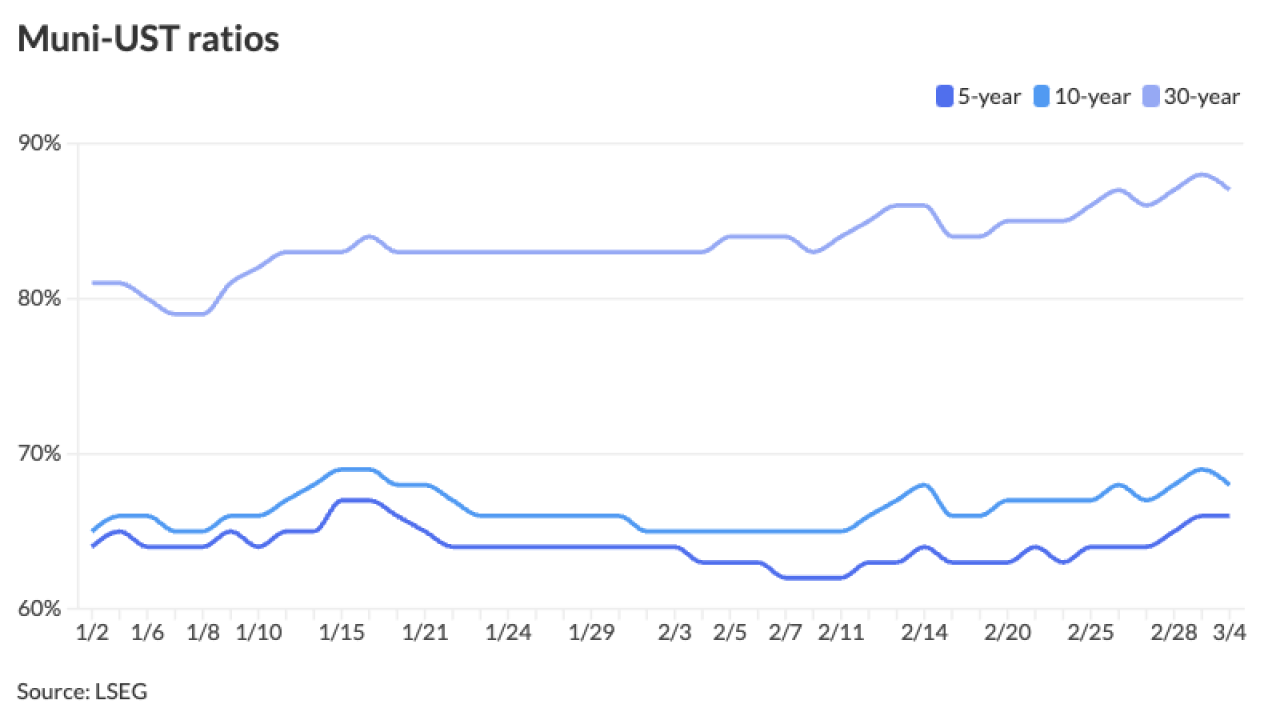

"Apathy and caution" were the theme of the past week, said Birch Creek strategists.

March 3 -

Wisconsin will be in the market Wednesday with $253.9 million of general obligation bonds, with some proceeds funding the Blatnik Bridge replacement project.

March 3 -

Pamela Frederick and Adam Barsky will share their views on the importance of the tax-exemption, how it benefits state and local governments, taxpayers, and U.S. retail investors -- and keeps the country competitive on a global scale.

-

The governor aims to secure federal funding with latest executive order in aftermath of Los Angeles fires.

March 3 -

The Trump administration wants to shed federal office space, and bonds backed by those leases are feeling the heat.

March 3 -

It was 2024's biggest national conduit. You may not have heard of it. New Hampshire's National Finance Authority has become a big issuer with a low profile.

March 3 -

The $2.5 billion Brightline West and $849 million Hawaii deals stood out among the rash of issuances last month alongside the ongoing tax exemption debate.

March 3 -

New York City leads the negotiated calendar with $1.4 billion of GOs, followed by the Regents of the University of California with $1.2 billion of general revenue bonds.

February 28 -

Bond trustee UMB Trust has engaged Lighthouse Management Group to serve as the receiver.

February 28 -

February's volume was at $33.725 billion in 622 issues, up 1.6% from $33.191 billion in 614 issues in February 2024, according to LSEG data.

February 28