-

How the pandemic is accelerating trends in financial advice and changing the way Americans manage their money.

-

There’s so much spare cash sloshing around U.S. funding markets that investors are choosing to park almost half a trillion dollars at the central bank — earning absolutely nothing.

May 28 -

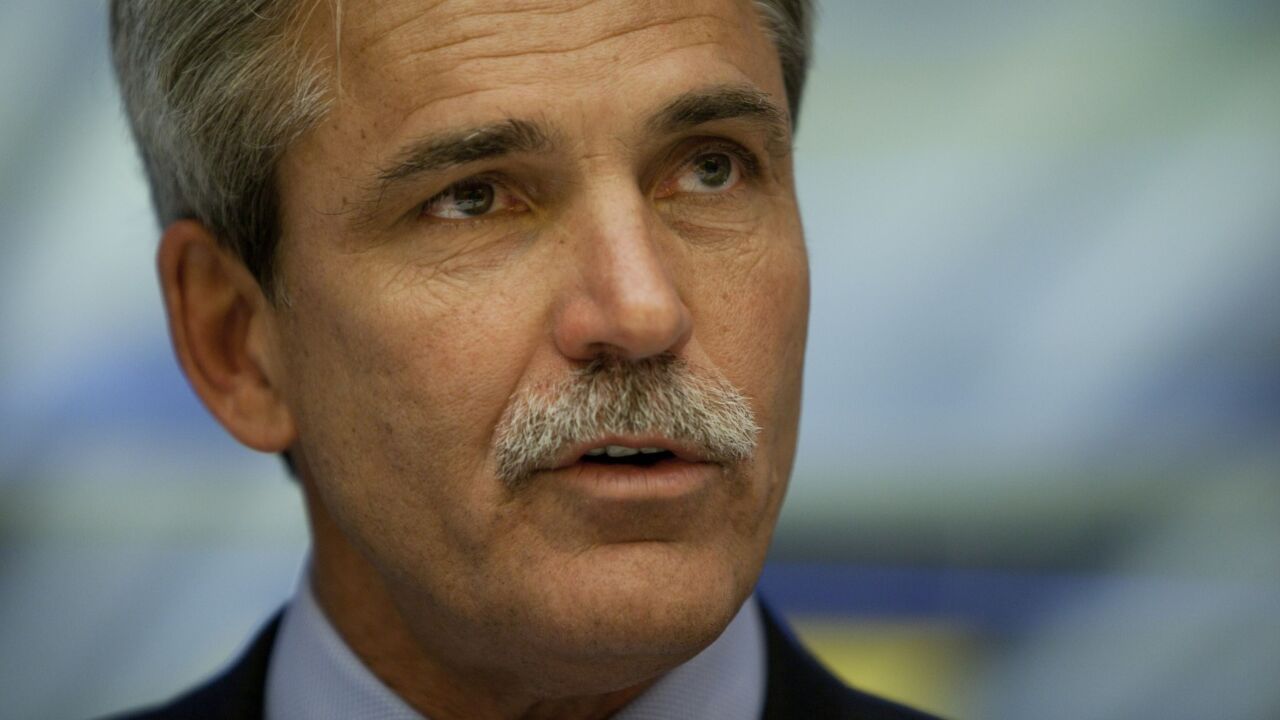

About 500 of Raymond James' workforce will be cut because of a decline in earnings due to low interest rates and the pandemic-induced economic downturn.

September 16 -

The housing and transportation sectors had the biggest declines in municipal bond volume.

August 24 -

Members of the economic research department of the Federal Reserve Bank of San Francisco take a look at the relationship between the effective lower bound interest rates and inflation.

August 10 -

Recovery seen next year, but rates stay low.

June 10 -

Spoiler alert: Not much. What makes a May Friday a relative oddity is that it was just the first time in 2020 the 30-year UST ended the day unchanged, the second longest span of continuous yield activity since the U.S. government began benchmarking maturities in the late 1970s.

June 10 Wing-O-Metrics LLC

Wing-O-Metrics LLC -

Federal Open Market Committee members have been adamant that negative rates would be a last resort.

June 2 -

The Fed says it has more ammunition; experts define what those bullets are.

May 22 -

Fed chair warns recovery may not be quick or easy.

May 13 -

Inflation, low before the coronavirus shut the economy, drops further.

May 12 -

Atlanta Fed president said the Fed is keeping "all tools on the table" and could discuss negative rates.

May 11 -

Economists also expect the Fed's balance sheet to more than $10 trillion as policymakers look to lift the country from a recession brought on by the coronavirus pandemic.

April 24 -

It feels like we have stepped into a new virtual reality in the municipal market. Things are not what they appear to be any more.

March 5John Hallacy Consulting LLC -

Vallejo, California, benefited from last week's record-low municipal market rates when it finally sold its water revenue bond refunding.

March 4 -

Investors should be aware that a lower coupon rate could become illiquid if interest rates rise, the Municipal Securities Rulemaking Board said.

February 5 -

Despite tax-exempts being expensive, strong technicals are likely to extend into February.

January 29 -

The Securities Industry and Financial Markets Association survey indicates low interest rates will keep the environment for issuing debt favorable.

January 15 -

After what one analyst called the muni market's "most eventful" decade, investors are expected to be greeted by continued heavy volume in 2020.

January 3 -

Looking back on the last decade makes one realize that we have come a long way.

January 2John Hallacy Consulting LLC