-

John Luke Tyner, fixed income analyst at Aptus Capital Advisors, discusses yield curve inversion with Bond Buyer Managing Editor Gary Siegel. Tyner looks at recession possibilities and how the Federal Reserve’s actions will impact the economy, the yield curve and recession. (23 minutes)

August 2 -

As investors shift the focus from inflation to recession concerns, fixed income markets, including munis, may regain some of the year's losses.

July 5 -

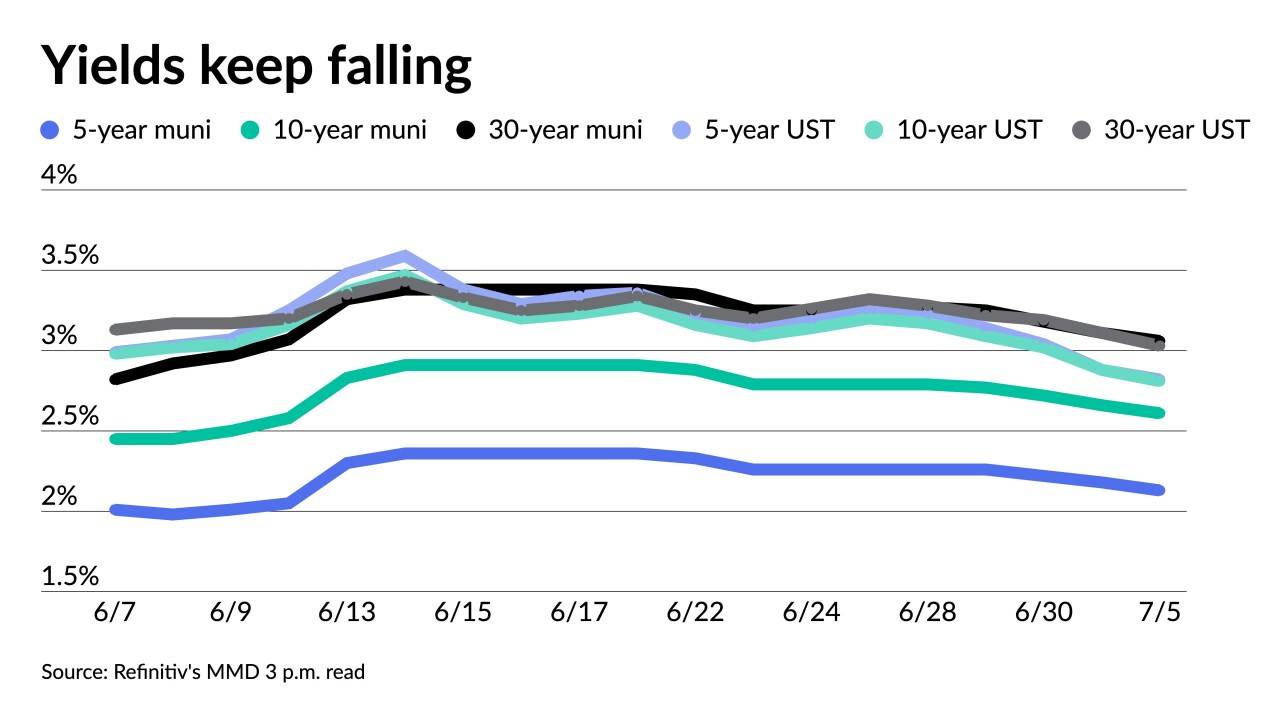

A bearish market sentiment and elevated muni to UST ratios often represent a buy signal. Taxable equivalent yields are compelling for buy-and-hold investors, analysts say.

June 27 -

The rapid swing to lower yields over the past week has led to a sunnier outlook for the summer reinvestment season, but uncertainties on the economic front, rate volatility, and supply questions hang overhead.

May 27 -

Investors pulled $7.270 billion from muni bond mutual funds in the week ending May 11, per ICI data, while exchange-traded funds saw $1.756 billion of inflows, the fourth week of record inflows.

May 18 -

Next week's supply is slated to be $10.166 billion, $8.982 billion of negotiated deals and $1.184 billion of competitive loans. A larger primary calendar is led by two billion-dollar airport deals.

April 1 -

The Investment Company Institute on Wednesday reported $2.728 billion of outflows in the week ending March 23, down from $3.615 billion of outflows in the previous week.

March 30 -

Next month’s Easter holiday in the U.S. is poised to create cash-flow headaches for the Federal Reserve and investors in Treasury debt.

March 14 -

DASNY leads the calendar with $2.3 billion of exempt personal income tax bonds and $662.32 million of taxables. Potential volume is slated to be $5.11 billion, with $4.392 billion of negotiated deals and $718.1 million of competitive loans.

March 11 -

Market volatility has risen significantly, particularly in the last several weeks, with daily Treasury yield swings of 10 basis points or more becoming the norm with municipals struggling to stabilize.

March 4