-

"Bearish Treasury moves have kept some pressure on the muni market and prevented an attempt to rally during the summer season when large redemptions trump issuance," BofA Global Research said in a report.

August 18 -

While it's still relatively early to tell how much — if at all — the muni market will be impacted, Kara South, portfolio manager at GW&K Investment Management, said downgrades of certain municipal bonds are likely to follow.

August 2 -

Matthew Gastall and Daryl Helsing of Morgan Stanley delve into how municipals are performing versus other asset classes, where taxable munis fit and how they see the market performing heading into the summer reinvest. Jessica Lerner hosts. (36 minutes)

June 13 -

The bill passed through the committee on a 21 to 17 vote, over fierce Democratic opposition.

March 9 -

Ellis Phifer, managing director and senior strategist in the fixed income research department at Raymond James, talks with Chip Barnett about the state of the bond markets. (Taped Feb. 16; 15 minutes)

March 7 -

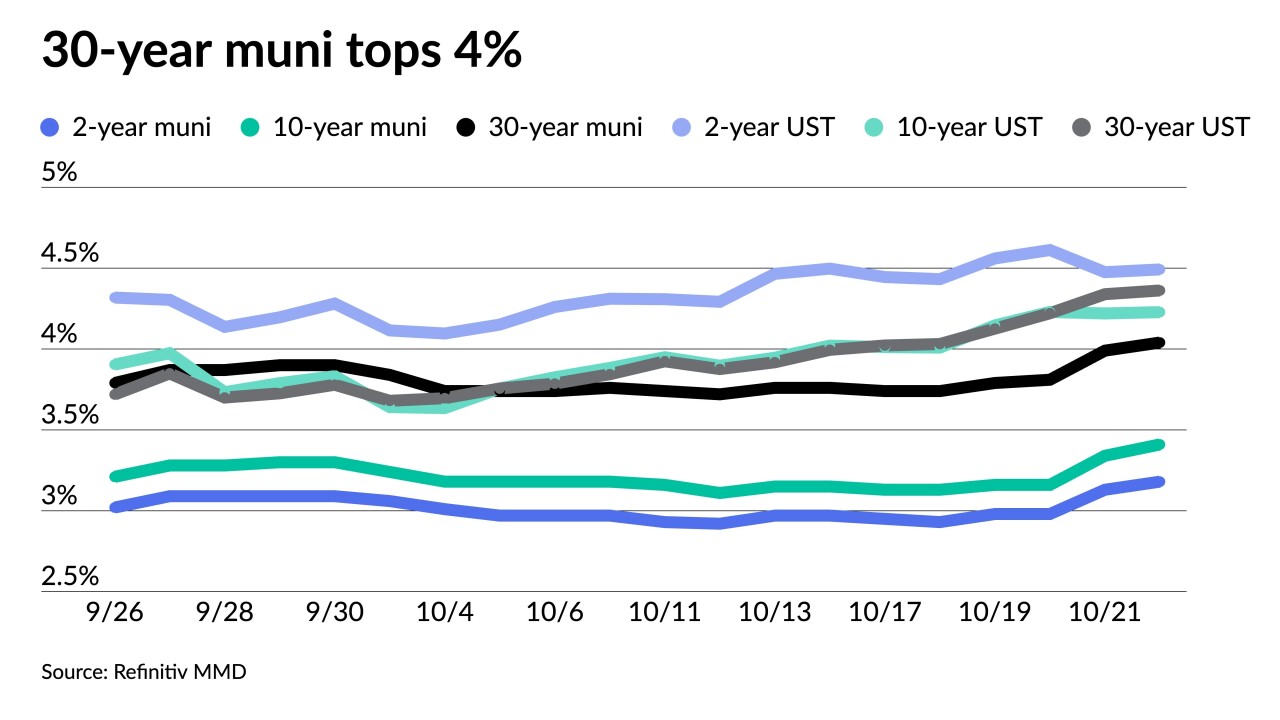

The 10- and 30-year Treasuries haven't reached these levels since November.

March 2 -

BVAL marketed its bond valuation methods as sophisticated but sometimes based the valuation on a single broker quote, the SEC said.

January 23 -

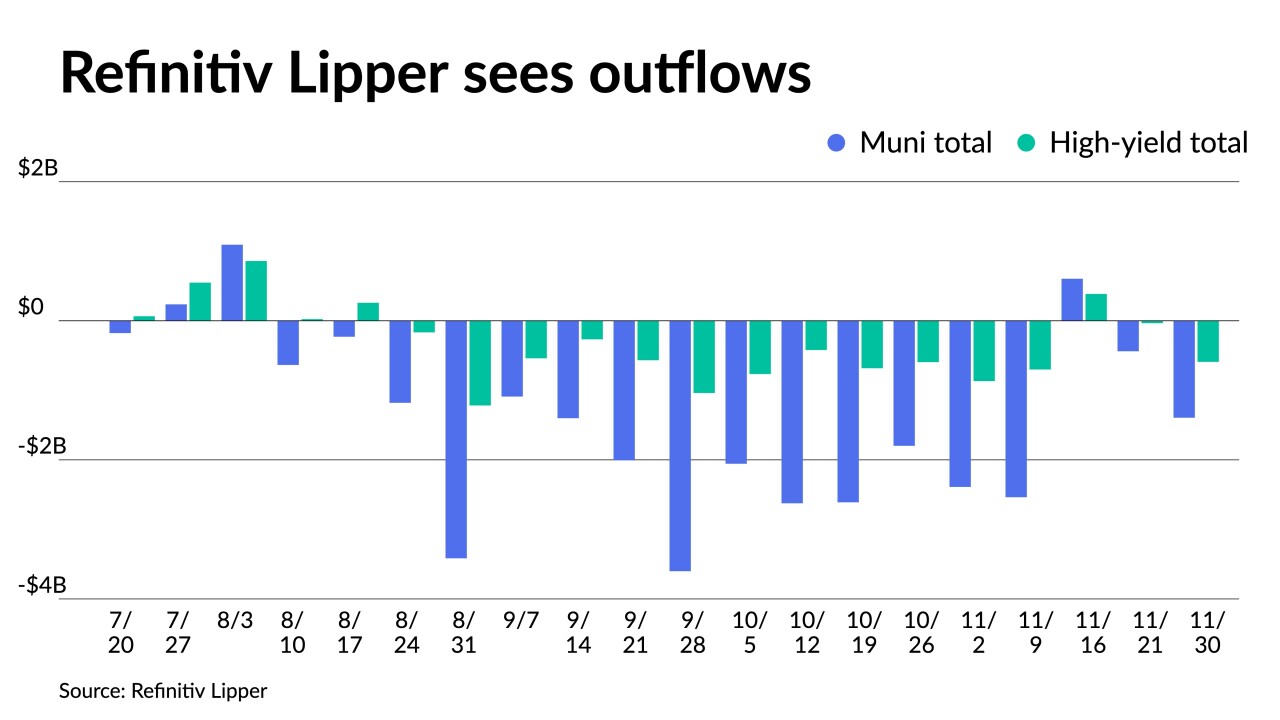

Munis saw the best performance in November in decades, with the asset class ending in the positive by 4.68%. The MSRB reported that trading volume reached another record in November, with 1.29 million municipal trades.

December 1 -

Refinitiv Lipper reported $2.537 billion of outflows from municipal bond mutual funds for the week ending Wednesday after $2.389 billion the week prior.

November 10 -

"Municipal market performance has improved, but the bumpy road continues as investors remain uncertain about the interest rate environment," said Nuveen's Head of Municipals John Miller.

October 24 -

New-issue volume grows to $10.7 billion led by a $2.7 billion taxable Massachusetts ESG deal, $1.35 billion of Oklahoma natural gas taxables, $1.25 billion from the Regents of the University of California and $1.1 billion from New York City.

August 12 -

John Luke Tyner, fixed income analyst at Aptus Capital Advisors, discusses yield curve inversion with Bond Buyer Managing Editor Gary Siegel. Tyner looks at recession possibilities and how the Federal Reserve’s actions will impact the economy, the yield curve and recession. (23 minutes)

August 2 -

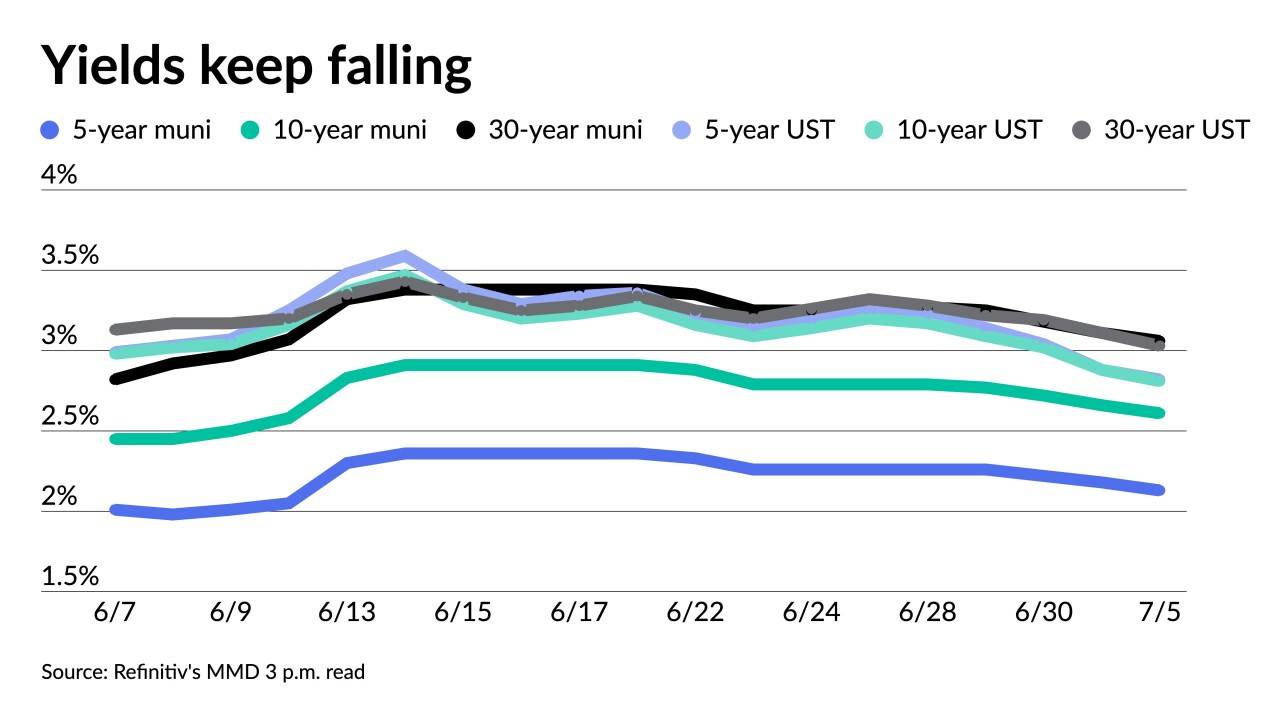

As investors shift the focus from inflation to recession concerns, fixed income markets, including munis, may regain some of the year's losses.

July 5 -

A bearish market sentiment and elevated muni to UST ratios often represent a buy signal. Taxable equivalent yields are compelling for buy-and-hold investors, analysts say.

June 27 -

The rapid swing to lower yields over the past week has led to a sunnier outlook for the summer reinvestment season, but uncertainties on the economic front, rate volatility, and supply questions hang overhead.

May 27 -

Investors pulled $7.270 billion from muni bond mutual funds in the week ending May 11, per ICI data, while exchange-traded funds saw $1.756 billion of inflows, the fourth week of record inflows.

May 18 -

Next week's supply is slated to be $10.166 billion, $8.982 billion of negotiated deals and $1.184 billion of competitive loans. A larger primary calendar is led by two billion-dollar airport deals.

April 1 -

The Investment Company Institute on Wednesday reported $2.728 billion of outflows in the week ending March 23, down from $3.615 billion of outflows in the previous week.

March 30 -

Next month’s Easter holiday in the U.S. is poised to create cash-flow headaches for the Federal Reserve and investors in Treasury debt.

March 14 -

DASNY leads the calendar with $2.3 billion of exempt personal income tax bonds and $662.32 million of taxables. Potential volume is slated to be $5.11 billion, with $4.392 billion of negotiated deals and $718.1 million of competitive loans.

March 11