-

Recovery seen next year, but rates stay low.

June 10 -

Many expect this recession, just officially announced Monday, could already be done.

June 9 -

With interest rates on hold until the picture is clearer, the Summary of Economic Projections should take center stage.

June 8 -

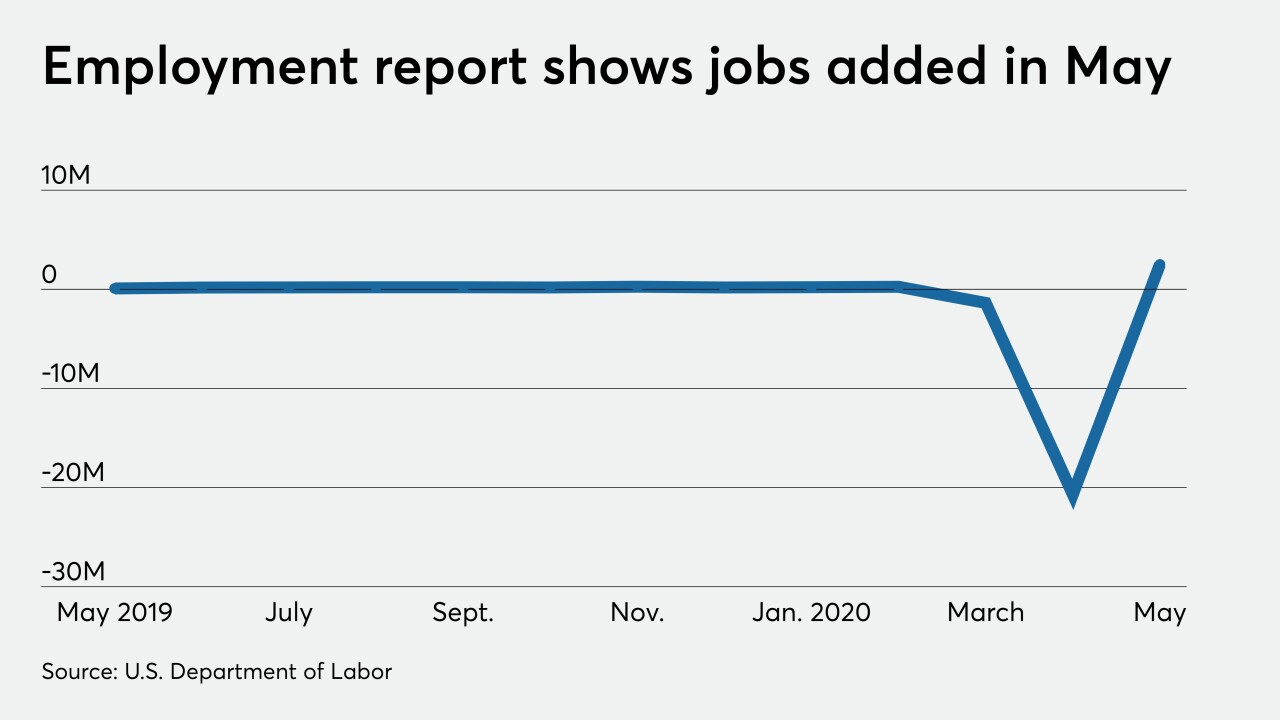

Jobs added and the unemployment rate well below expectations suggest April may have been the bottom.

June 5 -

Fear of a second wave of illnesses will keep economy muted.

June 4 -

The ADP employment report was better than expected, but the real test will be Friday's employment report.

June 3 -

While the headline number improved, key components tell different story.

June 1 -

Consumer spending plunged while the Chicago Business Barometer fell in May.

May 29 -

Economy still hurting as reopening in early stages.

May 28 -

The coronvirus pandemic led to economic declines and contacts are unsure how quick recovery will be.

May 27 -

Although up from the worst levels, indicators are not signalling recovery.

May 26 -

Numbers in the fall will offer clearer picture of where economy is.

May 21 -

With rates near zero, analysts will turn to minutes of the latest FOMC minutes for signs of upcoming economic support.

May 19 -

The Federal Reserve chair says it may take a while, but the U.S. economy will get back where it was before the coronavirus pandemic.

May 18 -

The economy continues to take a beating, but the Empire State Manufacturing Survey suggests better times are expected in six months.

May 15 -

Jobless claims went down for the sixth week in a row and the figure is now below 3 million for the first time since the week of March 14.

May 14 -

Fed chair warns recovery may not be quick or easy.

May 13 -

Inflation, low before the coronavirus shut the economy, drops further.

May 12 -

Atlanta Fed president said the Fed is keeping "all tools on the table" and could discuss negative rates.

May 11 -

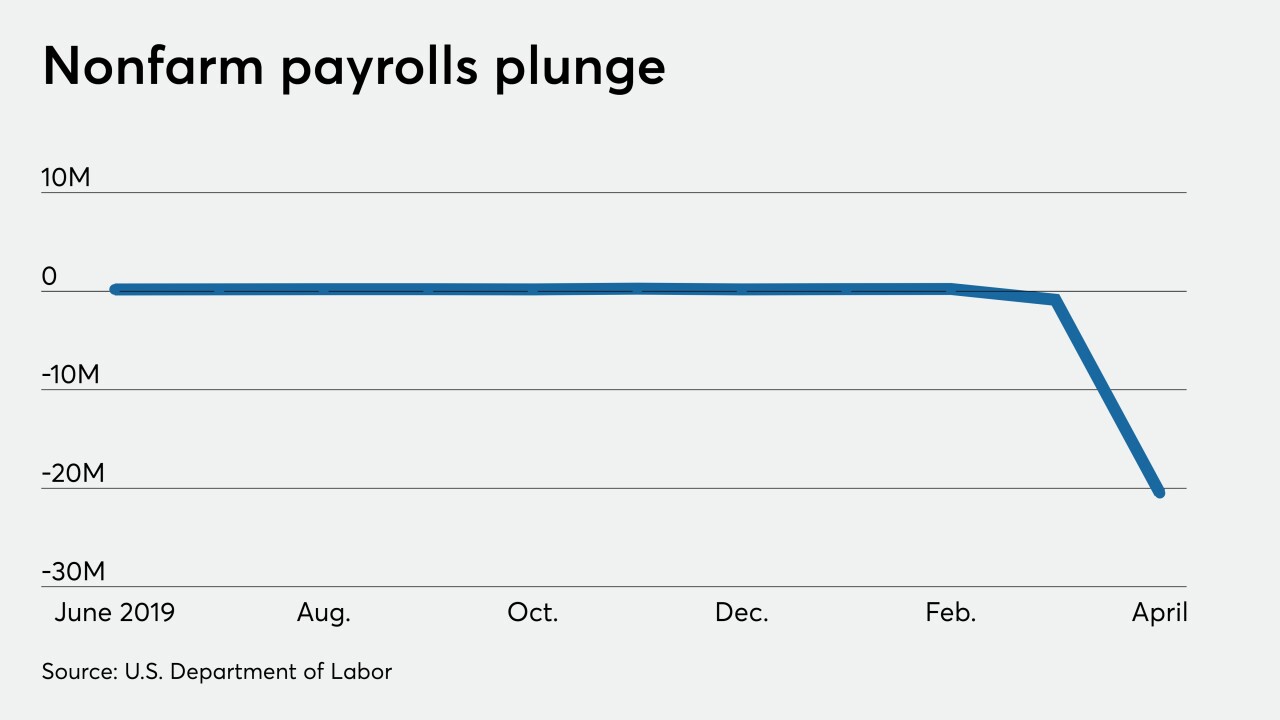

While the employment report showed record job losses and a spike in unemployment, economists pointed to some positives.

May 8