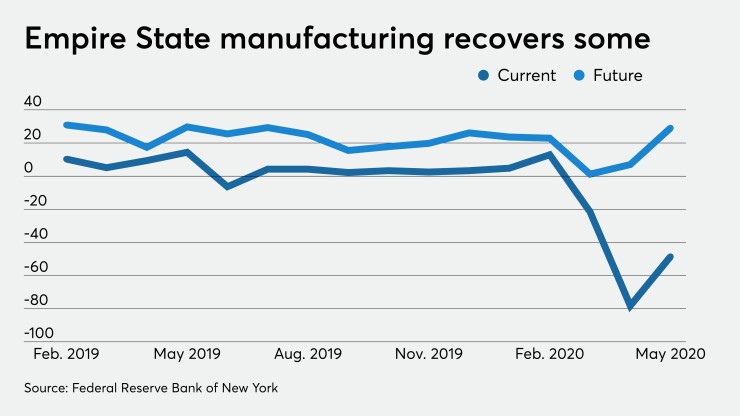

With the coronavirus pandemic just now allowing some parts of the economy to reopen, data revealed a painful picture, despite the Empire State Manufacturing Survey results not being as bad as expected, and the future outlook suggesting improvement ahead.

Business activity “continued to deteriorate significantly in New York State” in May, but not as much as economists expected, and the index for future conditions improved, according to the Empire State Manufacturing Survey, released Friday by the Federal Reserve Bank of New York.

The general business conditions index rose to negative 48.5 in May from negative 78.2 in April, its lowest reading ever.

Economists surveyed by IFR Markets expected the index would be negative 65.0.

“The measures of current activity and demand in the Empire State manufacturing survey were all deeply negative in May,” said Roiana Reid, U.S. economist at Berenberg Capital Markets. “The deterioration in current manufacturing conditions is consistent with the 1.4 million decline in manufacturing employment since February, accounting for 6% of the overall job loss in the economy.”

The new orders index improved to negative 42.4 from negative 66.3, while the shipments index narrowed to negative 39.0 from negative 68.1, and unfilled orders fell to negative 20.3 from negative 16.8, the Fed said.

The delivery time index contracteded to negative 4.1 from positive 11.0, while the inventories index rose to negative 3.4 from negative 9.7 in the prior survey. The prices paid index slid to 4.1 from 5.8, while the prices received index gained to negative 7.4 from negative 8.4. The number of employees index rose to negative 6.1 from negative 55.3, while the average employee workweek index improved to negative 21.6 from negative 61.6, the Fed reported.

Looking six months into the future, the general business conditions index moved to 29.1 from 7.0 last month. The new orders index rose to 35.0 from 11.7, while the shipments index increased to 33.3 from 13.1, and unfilled orders dipped to zero from 0.6, the Fed said. The delivery time index dropped to negative 4.7 from negative 2.6, while the inventories index rose to 0.7 from negative 3.9.

The prices paid index gained to 20.3 from 14.9, while the prices received index rose to 2.0 from 0.6. The number of employees index doubled to 10.4 from 5.2, while the average employee workweek index slipped to 8.1 from 8.4, the Fed reported. The capital expenditures index increased to negative 8.1 from negative 11.0. The technology spending index rose to negative 8.1 from negative 11.0.

Retail sales drop

Retail sales tumbled a record 16.4% in April, after dropping 8.3% in March, the Commerce Department reported on Friday.

Economists surveyed by IFR expected sales would fall 11.6%.

“Many retailers are referring this to the lost year in retail. Sadly, they may be correct,” said Diane Swonk, chief economist at Grant Thornton. “It will take years, not months, for some industries to recoup what they lost to COVID-19, a reality that Congress needs to acknowledge if members hope to recoup the losses from COVID-19 in any reasonable time frame.”

Excluding autos, sales fell 17.2% in the month, after an 8.3% drop in March. Economists expected an 8.6% fall.

Industrial production plunges

Industrial production dropped 11.2% in April, its largest monthly drop in the index's 101-year history, the Federal Reserve reported.

Economists surveyed by IFR expected the number to be at negative 11.5%.

Manufacturing output fell a record 13.7%, with all major industries lower in the month.

Capacity utilization dropped to 64.9% from an upwardly revised 73.2% in March.

Economists expected 64.0% capacity use.

“Wall Street is closing out the week on a terrible note as trade concerns grow, and horrid data encouraged investors to head for the sidelines,” Edward Moya, senior market analyst at OANDA said. “Risk aversion is a three-headed monster today with renewed trade tensions between the world’s two largest economies, record low readings for both U.S. retail sales and industrial production, and partisan politics likely delaying the next tranche of stimulus.”

Consumer Sentiment

The University of Michigan's preliminary May consumer sentiment index gained to 73.7 from 71.8 in April.

The current conditions index rose to 83.0 from 74.3 last month, while the expectations index slipped to 67.7 from 70.1 last month.

Economists surveyed by IFR expected consumer sentiment to fall to 68.5.

Business inventories

Business inventories dipped 0.2% in March, after a 0.5% decline in February, Commerce said, while sales dropped 5.3% in March after a 0.5% decline in February.

Economists expected a 0.3% decline in inventories.