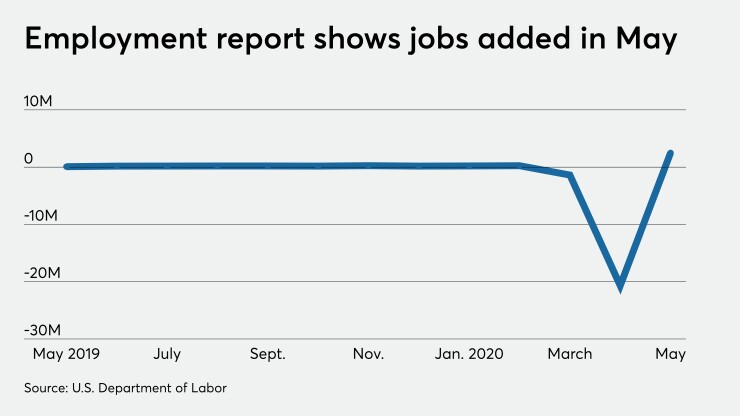

Friday's employment report , which showed jobs were added and the unemployment rate fell, offered optimism the economy will bounce sooner than originally thought.

Nonfarm payrolls rose 2.509 million in May after falling 20.687 million a month earlier. The unemployment rate declined to 13.3% in May from 14.7% in April, the U.S. Bureau of Labor Statistics reported on Friday.

Economists polled by IFR expected a loss of 8.250 million jobs and an unemployment rate of 19.7%.

Scott Colbert, executive vice president and chief economist at Commerce Trust Co., believes that “this will be the quickest recession." Although the downturn was larger than the 18-month long Great Recession, and maybe even “twice as bad" if you just look at the gross domestic product, he believes this crisis will end sooner.

“The average recession lasts 11 months but this one will last maybe four months,” Colbert said before the employment report was released.

And the recovery may be in progress. “A better than expected nonfarm payroll report suggests the economic recovery already began in May,” said Edward Moya, senior market analyst at OANDA. “It is not often you get the headline number and all the components help paint a positive picture of the economy.”

Average hourly earnings dropped to $29.75 from $30.04, Moya noted, most likely a reflection of lower paying jobs coming back.

Wall Street had been optimistic recently, as states started reopening. “This report resolves at least some of the dissonance between economic indicators and recent activity on Wall Street, which has remained optimistic despite reports of tragically high unemployment,” said Beth Akers, Manhattan Institute Senior Fellow and former Council of Economic Advisors economist. “Economic activity remains far below pre-crisis levels, due in large part to continued restrictions aimed at preventing further spread of the coronavirus, but this news suggests the potential for activity to resume more quickly than many had anticipated.”

Brian Coulton, chief economist at Fitch Ratings, pointed to the increase in certain sectors as reinforcing his view that April likely marked the trough in U.S. economic activity.

“The sharp pick-up in leisure and hospitality jobs and in construction and retail employment speaks to the impact of the easing in lockdowns in May and to the huge share of unemployed in April who were reported to be on ‘temporary’ lay-off,” he said. “But it’s also clear that the relationship between weekly initial unemployment claims and the labor force survey measure of unemployment is even weaker than we initially thought.”

Tony Bedikian, head of global markets at Citizens Bank, said, “Barring a second surge of COVID-19, the overall U.S. economy may have turned a corner, as evidenced by the surprise job gains today, even though it still remains to be seen exactly what the new normal will look like.”

Bryce Doty, senior VP and senior portfolio manager at Sit Fixed Income, added "investors are feeling better about the state of the economy and financial markets."

The belief is the worst is past, “and I believe that is true,” Doty said. “Right before economic activity is about to turn is when there appears to be the largest disconnect between the terrible daily economic reality and the almost euphoric optimism of the equity market. Especially when this natural phenomenon is being fueled by trillions of dollars injected into the economy and financial markets.”

Lawrence Yun, chief economist for the National Association of Realtors, said while the housing sector may see a V-shaped recovery, the broader economy will not be.

“The double-digit unemployment rate may persist till the end of the year,” Yun said. “Still, the latest jobs data is showing much better recovery potential.”