-

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell one basis point to 4.25% in the week ended Feb 10 from 4.26% in the previous week.

February 9 -

Tucked into the Illinois Senate's "Grand Bargain" budget legislation is a bill to authorize a new type of local government bond that would benefit Chicago and other home rule communities.

February 7 -

New language designed to protect investors appeared in the offering documents of a recent municipal bond deal.

February 7 -

Private placement bond deals helped push volume to record levels in 2016, even as some observers remain concerned about transparency and value in the deals.

February 6 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices was steady at 4.26% from the previous week.

February 2 -

Retail municipal investors who prefer discount bonds are becoming more aware of the tax implications of the de minimis rule as interest rates rise.

February 2 -

Fitch Ratings issued a report to criticize Moodys Investors Services recent assessment of Chicago Public Schools.

February 1 -

In the week ended Jan.26, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose seven basis points to 4.26% from 4.19% in the previous week. The BB40 Index is based on the price of 40 long-term bonds.

January 26 - Texas

President Trumps broadsides against Mexican immigrants and trade have not triggered rating agency action on border credits, which, in several cases, have seen upgrades.

January 25 -

Most of the oil states have gone into recession, S&P Global Ratings said in a new report.

January 24 -

New York MTA retired $945 million of debt from its core portfolio last year through normal amortization, said deputy finance director Olga Chernat.

January 24 -

Muni professionals predictions about the economy, volume, demand, and credit spreads panned out, but they were taken off guard by the political roller coaster that roiled the tax-exempt market in 2016.

January 20 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, decreased one basis point to 4.19% from 4.20% from the previous week.

January 19 -

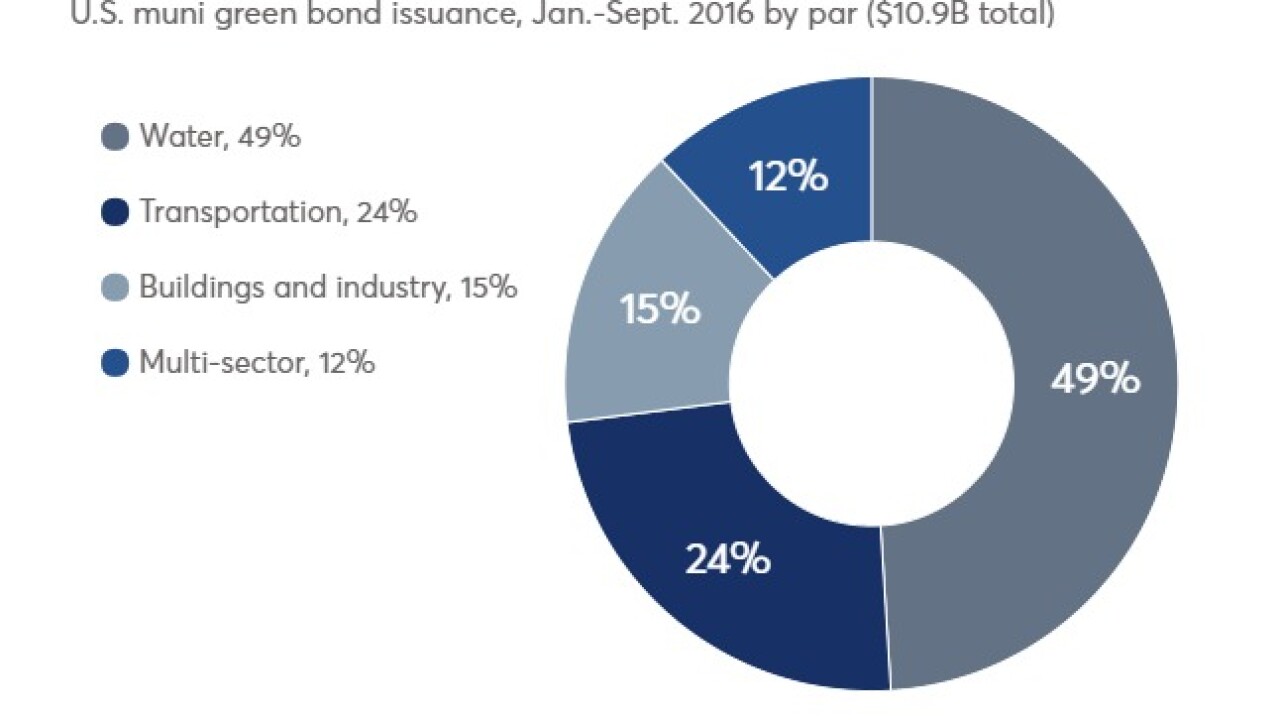

Green bonds are a tool more issuers use to finance various means of purifying drinking water and buffering against rising seas.

January 17 -

A cybersecurity scare at a public power utility in Vermont has some municipal market participants thinking about how an attack could affect the nation's utility bond issuers.

January 13 -

In the week ended Jan.12, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index fell five basis points to 4.20% from 4.25% in the previous week. The BB40 Index is based on the price of 40 long-term bonds.

January 12 - Kentucky

Kentuckys credit outlook was revised to negative ahead of an upcoming bond deal, a change S&P Global Ratings said was triggered by the states unfunded pension obligations.

January 12 -

So-called intervention bankruptcy combining federal and state resources could help governments manage municipal insolvency, said a Manhattan Institute report.

January 12 -

Analysts affirmed the stable outlook for the healthcare sector, while acknowledging that repeal of the Affordable Care Act could change the landscape.

January 11 -

The recently enacted National Defense Authorization Act is a credit positive for privatized military housing project bonds, Moodys Investors Service said in a comment released on Friday.

January 6