CHICAGO – Fitch Ratings in a report Wednesday criticized Moody's Investors Services' recent assessment of Chicago Public Schools' new credit structure and the legal options available to ease its distress.

The report titled "Fitch Disagrees With Moody's Legal Analysis On Chicago Public Schools" was published to counter arguments laid out by Moody's in special credit profile reports published Jan. 12 about the city and CPS.

Fitch's public dissection of another rating agency's opinions was described as "highly unusual" by several market participants.

"This is uncharted. Very rarely except on panels at conferences would you have this sort of open debate or defensiveness," said Howard Cure, director of municipal research at Evercore Wealth Management, LLC. Cure worked for Moody's until 1994.

Moody's has not been asked to rate new deals by either issuer, but maintains junk ratings on their older debt.

Some suggested that Fitch's motive for publicly calling out a peer rating agency may stem from market questions received after Moody's released its commentary.

Fitch said that wasn't the case.

"We read it and we didn't feel all the information was correct and felt it would helpful to the market if we posed our reasons as to why we disagreed," said the report's co-author, Amy Laskey, a Fitch managing director.

"Our goal is to clearly articulate an opinion, and often that means openly disagreeing with other market participants. We may publish those comments if there is strong investor interest, or if we feel our view is meaningfully different from another," said Daniel Noonan, Fitch's global head of corporate communications.

Fitch outlines its disagreement with Moody's on several aspects of its legal assessment of CPS' new capital improvement tax-backed bonds. The district used the new property tax levy for the first time on a $730 million sale in December.

The deal garnered an A rating from Fitch based on analysts' confidence in its bankruptcy-remote structure.

CPS asked only Fitch and Kroll Bond Rating Agency to review the bonds. Kroll assigned its BBB rating in line with its GO ratings of BBB and BBB-minus.

Fitch rates CPS GO debt B-plus, with a stable outlook. The other two rating agencies also rate CPS GOs at junk.

Fitch countered Moody's suggestion that triggering the ad valorem tax pledge used on most of its $6 billion of debt offered one option for CPS to free up revenue for operations.

Fitch quoted Moody's report suggesting that the district could elect to use unrestricted general state aid for operations instead of debt service on its alternate bonds issued under the Illinois Local Government Debt Reform Act.

Under the state's alternate revenue structure, an ad valorem tax levy is imposed to repay bonds but it is typically abated as the "alternate" revenues are tapped. About $373 million in CPS state aid will go to such bond repayments this year.

"We believe that the most likely scenario for CPS is that the district will levy for debt service on GO alternate revenue bonds in order to free up state aid for operations," Moody's wrote. "The district could elect to use unrestricted GSA for operations instead of debt service."

"Unless by 'elect' Moody's is referring to a successful ballot referendum, a plain reading of the act indicates this is not the case," Fitch countered, arguing that the act "clearly" indicates that CPS must apply available alternate revenues to debt service.

"As there is no option in the law to apply alternate revenues to operations, Fitch believes any attempt to do it would draw a successful challenge in litigation opposing an attempt to levy taxes while alternate revenues were available for debt service," Fitch wrote in the report, co-authored by Laskey and lead CPS analyst Arlene Bohner.

Fitch also countered Moody's position on various features of the district's capital improvement tax structure. Moody's had written that features like a "lockbox" on revenues helped "lessen but do not eliminate the risk of bondholder impairment in a future bankruptcy."

"Unlike Moody's, Fitch does not give rating uplift for the presence of a third-party lockbox structure absent other legal considerations," its report said.

A lockbox is a security device that loses its effectiveness in bankruptcy, Fitch said, because a consensual lien on revenues generally does not continue unless the bonds are secured by pledged special revenues or they qualify as bonds secured by a statutory lien.

"In a Chapter 9 bankruptcy, Fitch does not believe such a structure would insulate ordinary pledged revenues from an automatic stay," analysts wrote. "Fitch also does not agree that the CIT bonds are secured by a statutory lien."

Fitch's belief that the bonds would be protected in Chapter 9 stems from opinions that they meet the bankruptcy code's designation of "pledged special revenues" which offers some insulation from impairment.

The belief stems from structural features such as the fact that the bonds are payable solely from segregated CIT revenues that can be used only for capital projects or CIT bond repayment and not for operations.

"We give credit to special revenue status only if, in our view, the overall legal framework renders remote a successful challenge to the status of the debt as secured by special revenues," Fitch wrote.

In its January report, Moody's had written that it viewed the new structure "to be at least as strong as, if not modestly stronger than, CPS's GO bonds."

State law would have to change to allow the school district to file for bankruptcy.

Moody's spokesman David Jacobson had no direct response to the Fitch report, saying his agency's Jan. 12 speaks for itself.

Cure said Moody's opinion "carries weight with the market."

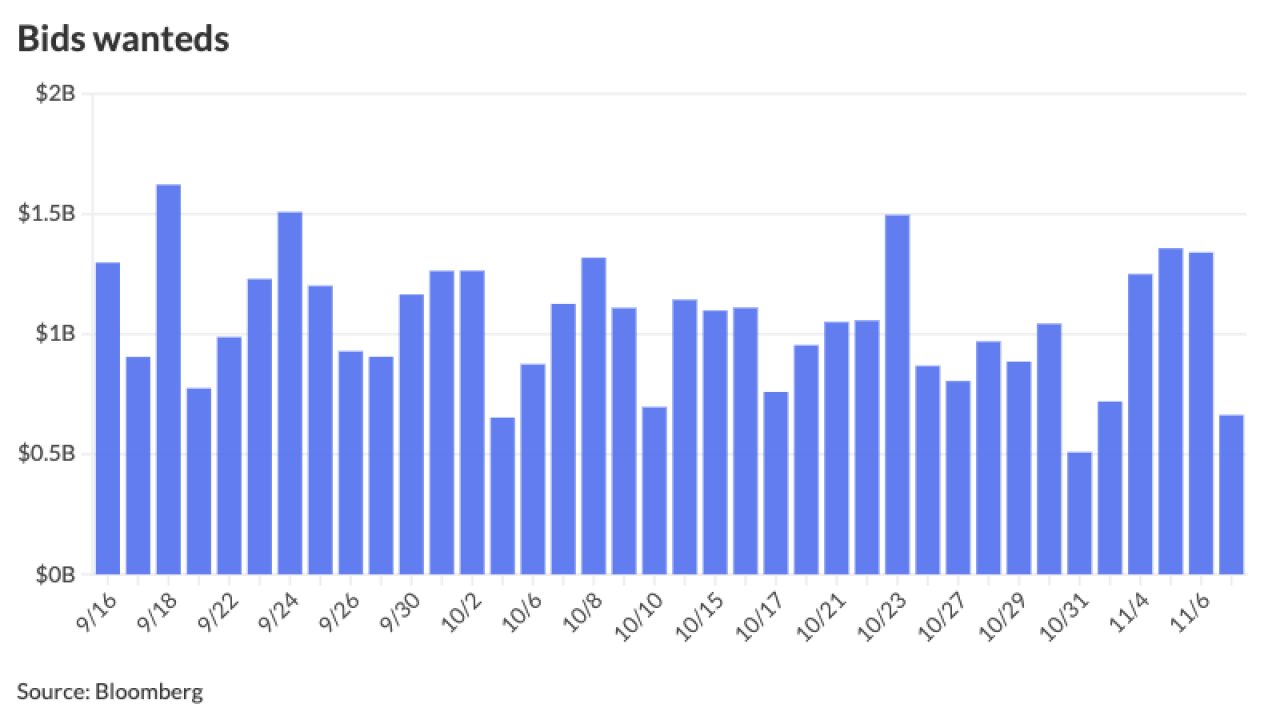

He noted that the city of Chicago's recent GO deal priced at junk levels, even though Moody's is the only rating agency to rate Chicago at junk. CPS' 30-year CIT bond – despite the Fitch A rating and BBB from Kroll – landed 309 basis points over the Municipal Market Data's top-rated benchmark, 243 basis points over the single A benchmark, and 207 basis points over the BBB benchmark.

Moody's January reports were released ahead of Chicago's $1.16 billion GO sale and followed the city's disclosure that it had asked Moody's to withdraw all of its city ratings in December. Moody's declined to withdraw.