The New York Metropolitan Transportation Authority

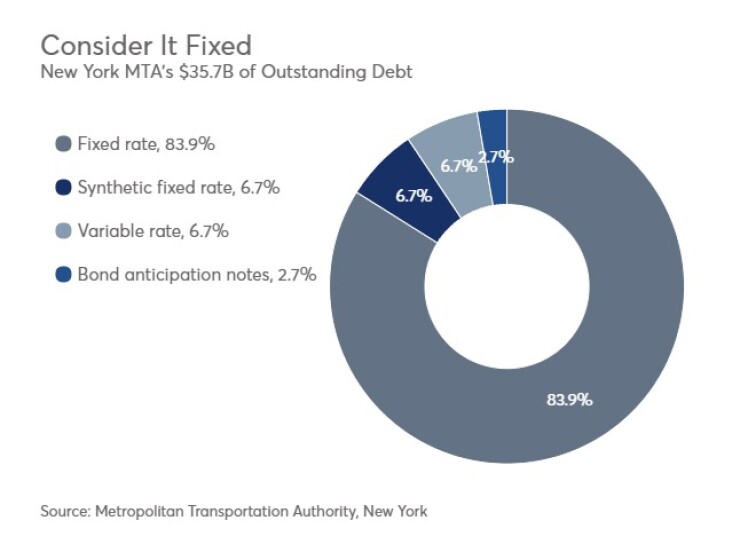

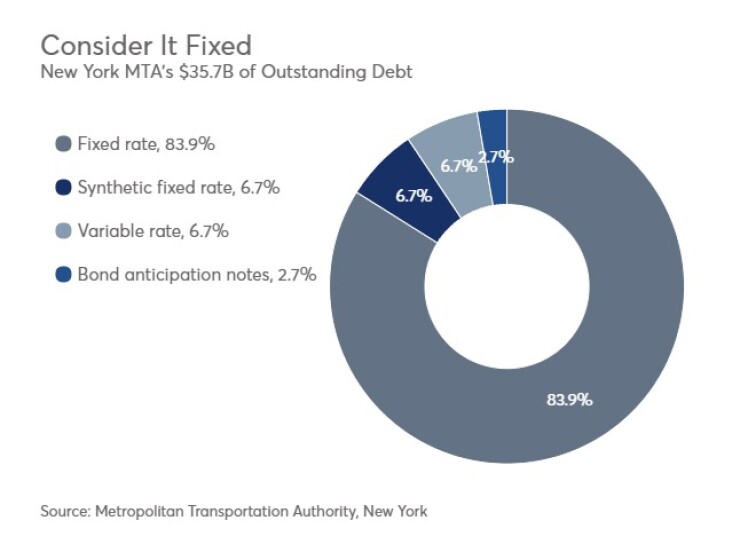

The authority, one of the largest municipal issuers, had $35.7 billion of debt as of Dec. 31, deputy finance director Olga Chernat told members of the board's finance committee on Monday.

Roughly 84% of the MTA's debt, or just under $30 billion, is in fixed-rate bonds, according to Chernat.

Synthetic fixed-rate debt and variable debt each account for $2.4 billion, or 6.7%, she said. The authority also issued $948 million of bond anticipation notes.

"This actually should position us well in the market, where we expect interest rates to increase," said Chernat. "We can add more to the variable rate at that point."

The MTA's core portfolio consists of four credits – its workhorse transportation revenue bonds, dedicated tax fund bonds, and Triborough Bridge and Tunnel Authority senior and subordinate debt.

TRBs account for 60% of the issuance, followed by TBTA senior and dedicated tax fund bonds at 19.5% and 16%, respectively. TBTA subordinate accounts for 4.5%.

Chernat said that the $1.25 billion net increase in debt outstanding was "a little misleading," because it included the $1.06 billion of Hudson Rail Yards trust obligation bonds issued in September.

"That's not part of our core portfolio," she said.

MTA officials saw the deal as an opportunity to benefit from development along the Hudson rail yards – site of a new station on the No. 7 subway line – and low interest rates.

MTA bond transactions totaled $7.8 billion last year, according to Chernat. Nearly $3 billion of refunding bonds achieved present-value savings of $561 million or 16.6% of par refunded, she added. The authority's $2.3 billion in new-money borrowing consisted of $797 million in fixed-rate bonds, $1.4 billion in bond anticipation notes and a $146 million Railroad Rehabilitation & Improvement Financing loan withdrawal.

The MTA also issued $1.95 billion of long-term fixed-rate bonds to retire BANs and remarketed $484.2 million of tendered obligations.

The authority's bond-financed capital investments totaled $2.43 billion, said Chernat.

Benefits to the BAN issuance financing strategy, said Chernat, include low-cost, short-term financing; transparency into assets financed with long-term bonds; and a better match of assets and debt-related liability.

The authority's BAN transactions typically range from $500 million to $700 million, sold competitively through the Grant Street bidding platform. The MTA awards bids based on lowest true-interest cost offered.

In February, said Chernat, the MTA will issue $900 million in transportation revenue BANs and $350 million in dedicated tax fund bonds. Nixon Peabody LLP and D. Seaton and Associates will be co-bond counsel for both transactions.