-

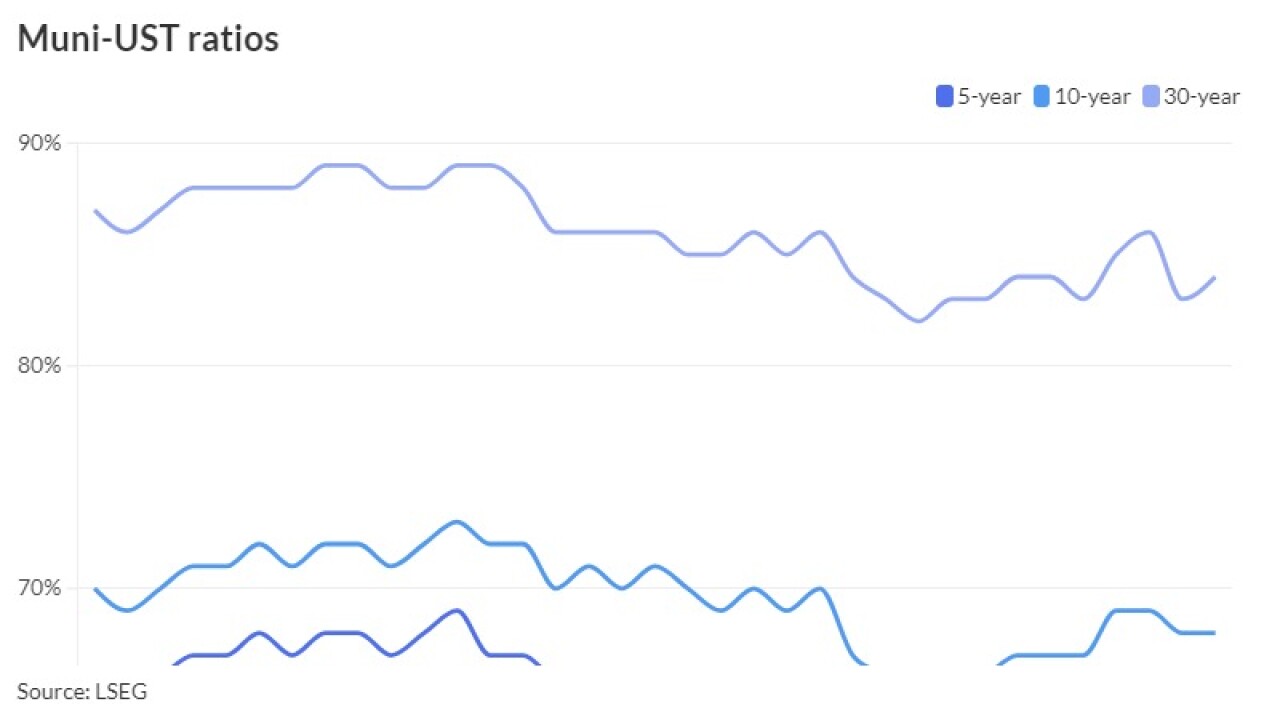

"Coming off rich muni-Treasury ratios, the market has swiftly repriced," said 16Rock Asset Management's James Pruskowski. "With now cheaper benchmark yields and wider credit spreads, fresh capital is flowing in, and a strong bottoming opportunity looks to be emerging."

October 23 -

As technology options grow, firms are looking for ways to streamline and scale workflows.

October 22 -

Despite this week's underperformance, exempt investment-grade munis continue to outperform taxable sectors.

October 18 -

Craig Brothers, partner, portfolio manager and co-head of fixed income strategy for Bel Air Investments, joins Bond Buyer senior reporter Keeley Webster and discusses why his firm, primarily invested in California debt, has veered away from California GOs and public works revenue bonds in favor of agency, school district and local government debt.

October 17 -

The muni market enters the last quarter of 2024 in "excellent shape," said GW&K Investment Management partners John Fox, Brian Moreland, Kara South and Martin Tourigny.

October 16 -

Supply ramps up this week to an estimated $13.361 billion, with several billion-dollar pricings on tap.

October 15 -

Florida will use its own cash, not from a refunding bond, to buy up to $500 million of bonds tendered.

October 15 -

Municipal triple-A yield curves played catch up to USTs Friday to close out a week of more mixed economic data that has economists constantly reevaluating their Federal Reserve policy expectations with little consensus.

October 11 -

Municipal bond insurers wrapped $28.921 billion in the first three quarters 2024, a 26.8% increase from the $22.814 billion insured in the first three quarters of 2023, according to LSEG data.

October 11 -

Wells Fargo Head of Municipal Markets Strategy Vikram Rai said on Monday that Illinois' bonds are underappreciated as he released a report on the state.

October 8