-

John Hallacy talks with Chip Barnett about how fiscal and monetary policy is affecting the municipal bond market. He discusses recent data releases, supply forecasts and the midterm elections and the future of ESG in public finance. (20 minutes)

September 27 -

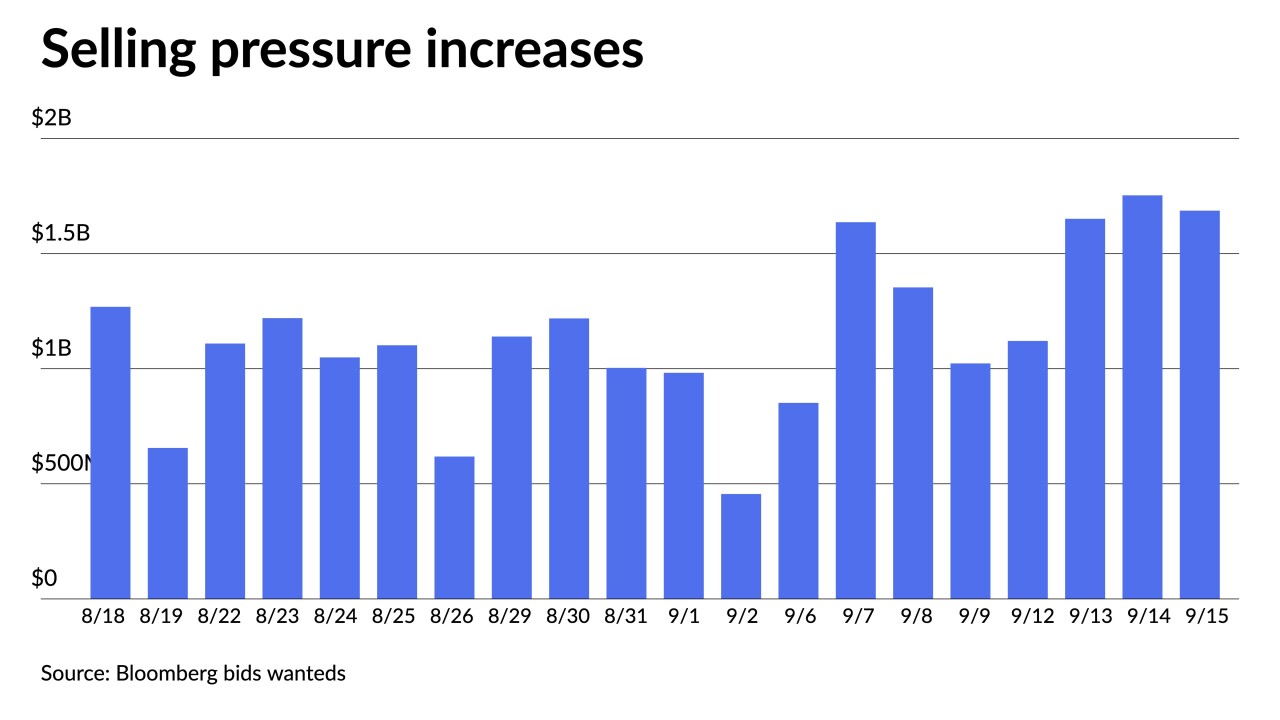

Municipals saw more cheapening on the short end Friday as selling pressure persisted all week.

September 16 -

Many market players have revised their supply projections downward since rising interest rates have slowed down refunding and taxable volumes and general market volatility has stopped some issuers from participating.

August 31 -

Higher education borrowing led by century bond deals helped offset the dive in refundings brought on by rising interest rates.

August 16 -

Spreads on underwriting municipal bonds dipped to below $4 per $1,000 on issues in the first half of 2022 due to heavy competition and a shrinking volume of deals — the lowest figures reported in two decades.

August 15 -

Total volume in the first half of the year was at $209.718 billion in 5,153 deals, down 11.2% from the $235.836 billion in 6,793 over the same period in 2021, according to Refinitiv data.

August 15 -

Environmental facilities and public facilities saw the largest contraction in issuance.

August 15 -

New-issue volume grows to $10.7 billion led by a $2.7 billion taxable Massachusetts ESG deal, $1.35 billion of Oklahoma natural gas taxables, $1.25 billion from the Regents of the University of California and $1.1 billion from New York City.

August 12 -

Total July volume was $25.598 billion in 520 deals versus $37.573 billion in 1,013 issues a year earlier, according to Refinitiv data.

July 29 -

The top two bond insurers — Assured Guaranty and Build America Mutual — accounted for $17.132 billion of deals in the first two quarters.

July 21